Chainlink Price Prediction: LINK prepares for quick 40% breakout

- Chainlink price is grappling with the 50% Fibonacci retracement level at $2.22.

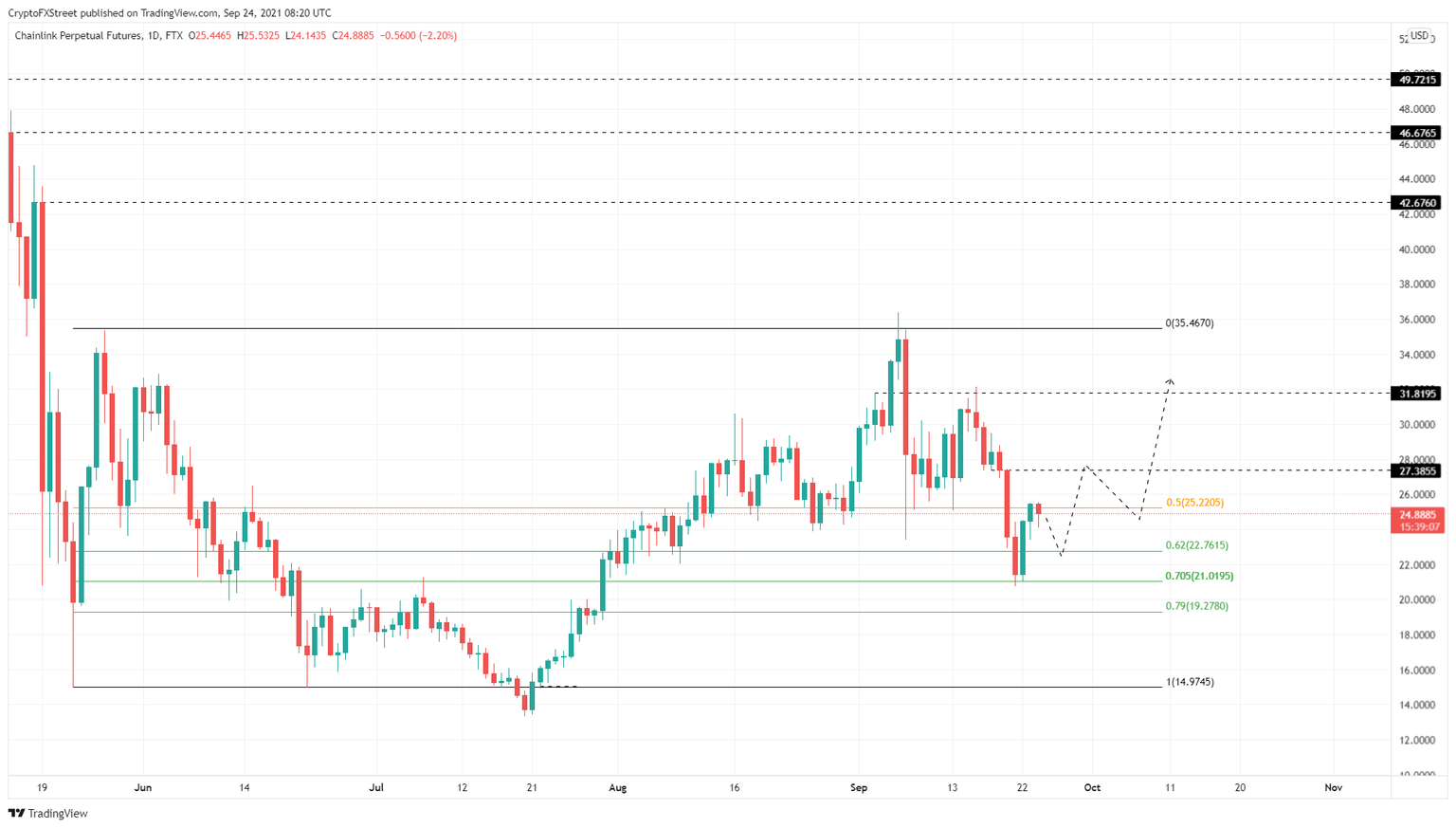

- A decisive close above this barrier is likely to trigger a 30% climb to $31.82.

- If LINK fails to hold above $19.28, it will invalidate the bullish thesis.

-637336005550289133_XtraLarge.jpg)

Chainlink price is currently retesting the midpoint of the trading range as it tries to recover from the crash witnessed in the third week of September. A successful flip of this barrier will allow LINK to venture higher and recover the losses over the past week.

Chainlink price ponders a journey higher

Chainlink price rose 21% over the past 48 hours and encountered the 50% Fibonacci retracement level at $25.22. Although the buyers are struggling to push through this barrier, the future remains mildly optimistic.

A decisive close above $25.22 will indicate a resurgence of bulls and propel it to the next supply level at $27.39. While this is a temporary blockade, the market makers will likely push LINK to collect liquidity resting above the September 16 highs at $31.82.

However, investors need to note that this uptrend might first encounter a pullback to the 62% Fibonacci retracement level at $22.76.

This ascent to $31.82 would constitute a 40% climb from $22.76.

LINK/USDT 1-day chart

On the other hand, if Chainlink price fails to bounce off the 62% Fibonacci retracement level at $22.76, it will reveal a chink in the bulls’ armor. Such a development will likely push LINK to $21.02, a second chance to restart the uptrend. A breakdown below this level will create a lower low, invalidating the bullish thesis.

This move might trigger a further correction to the range low at $14.97 if the selling pressure persists.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.