Chainlink bulls put up a fight at $21.60 to push LINK up by 30%

- Chainlink price is on the rebound after the correction on Monday.

- Bulls are positioning themselves for upside as they buy in at $22.

- Upside looks capped with a technical element in play.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price has been trading on a positive note today, after the correction it faced yesterday. As a segment of that, markets and cryptocurrencies faced headwinds on growing worries about a spillover effect in case the Chinese equity Evergrande defaults. Riskier assets, like cryptocurrencies, were cut out of the portfolios with a correction in price action.

Chainlink price could pair yesterday's losses by the end of this week

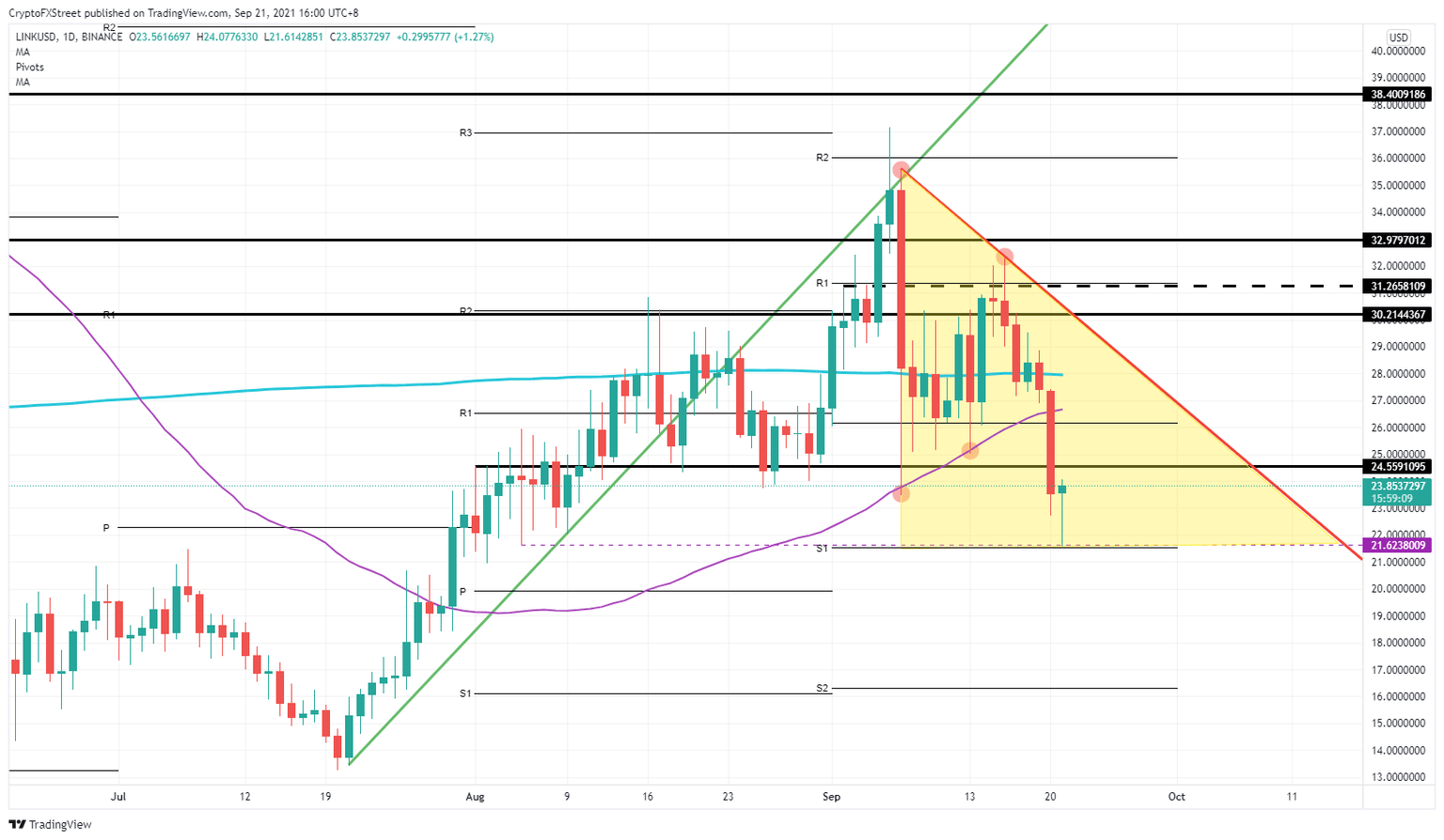

Chainlink price got picked up this morning on buy-the-dip momentum. After the price drop in LINK yesterday, bulls found a good and technical entry at the monthly S1 pivot near $21.60. Not only did the S1 pivot do its work, but it got help from a supporting low originating from August 5. WIth LINK price action not being that low since August, buyers saw the correction as a buying opportunity at a discount.

LINK prices have been soaring throughout the day. Tailwinds are helping with global stocks and riskier assets on the backfoot and with green results across the board. It will be important to see how bulls face the first hurdle at $24.55. Although this level holds no firm importance, it acted as a line in the sand on how price action has behaved and worked as a supportive element throughout the summer.

LINK/USD daily chart

Expect bulls to stay in favor as long as tailwinds prevail. Looking at the broader trading plan, LINK price is forming a bearish triangle. Any further upside potential could be limited by the red descending triangle. However, that descending trend line is still due for another retest as for now, but only one test is not enough to confirm its importance. Bulls thus have a chance here to reign in more power and break out of this bearish indicator.

If market sentiment should fall back into correction, expect a bounce off $24.55 and a retest back toward $21.63 for a retest of the monthly S1 support level.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.