Chainlink Price Forecast: LINK holds firm as reserves hit 16-month low

- Chainlink price steadies near $13.70 on Tuesday, finding support around the key level.

- On-chain data signals bullish sentiment, as LINK exchange reserves fall to their lowest level since August 2024.

- Growing ecosystem adoption, including new integrations across multiple platforms and chains, continues to reinforce LINK’s upward outlook.

Chainlink (LINK) began the week on a stable footing, trading around $13.70 at the time of writing on Tuesday, holding above a key support zone. Growing ecosystem activity from declining exchange reserves to a wave of new integrations continues to strengthen the network’s fundamental outlook, signalling a rally in the upcoming days.

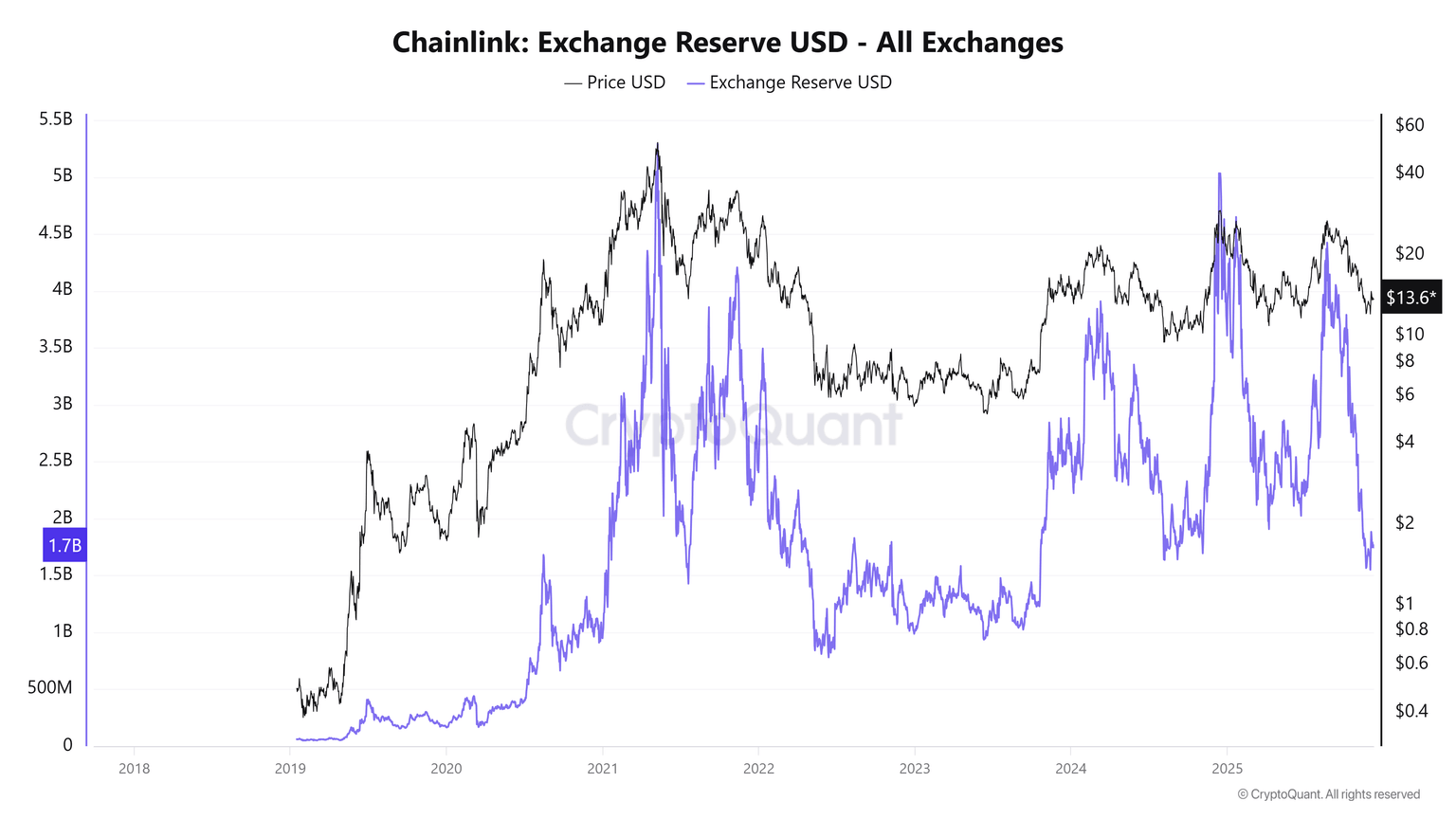

Chainlink exchange reserve drops to 1.7 billion LINK

CryptoQuant data indicate that the Chainlink Exchange Reserve - All Exchanges chart below shows the reserve has dropped to 1.55 billion on December 1, the lowest level since August 2024, and has recovered slightly to around 1.7 billion on Tuesday.

The LINK reserve at the exchange has hit a 16-month low, indicating lower selling pressure from investors and a reduced supply available for trading.

Apart from reducing selling pressure, a drop in reserves also signals an increase in coin scarcity, an occurrence typically associated with bullish market movements.

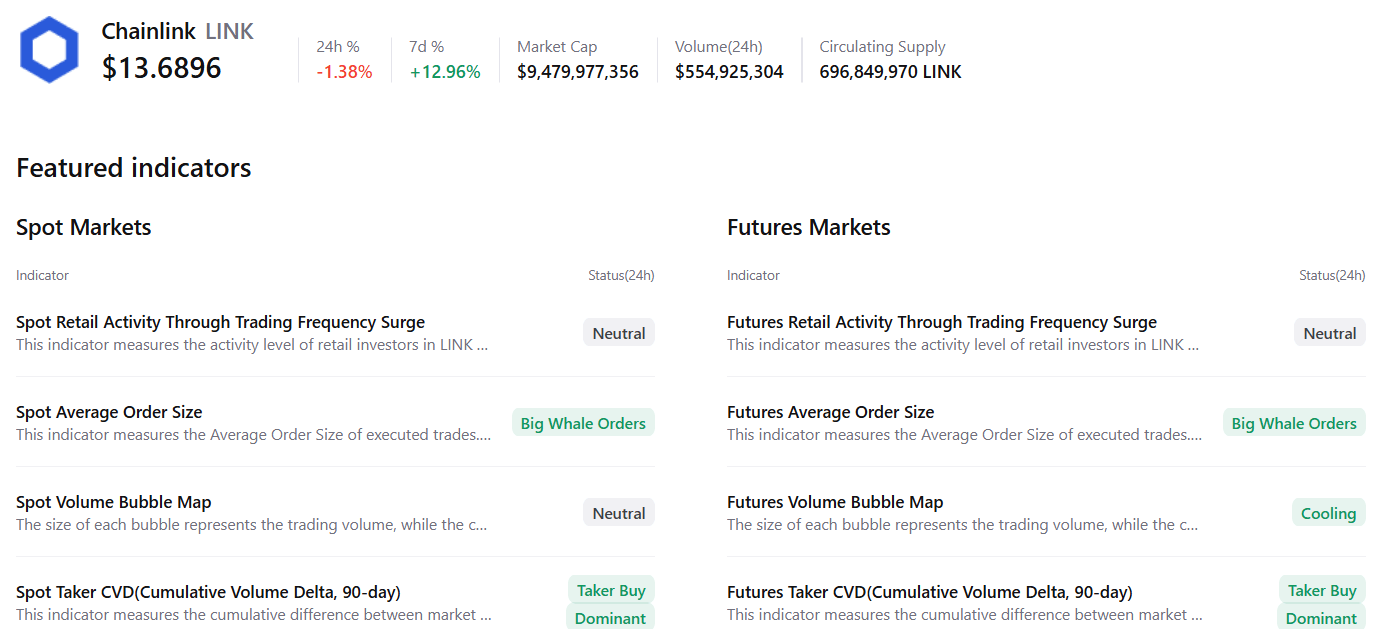

Moreover, CryptoQuant’s summary data also supports the bullish outlook, as Chainlink’s spot and futures markets show large whale orders, cooling conditions, and buy dominance. These factors signal a potential rally in the upcoming days.

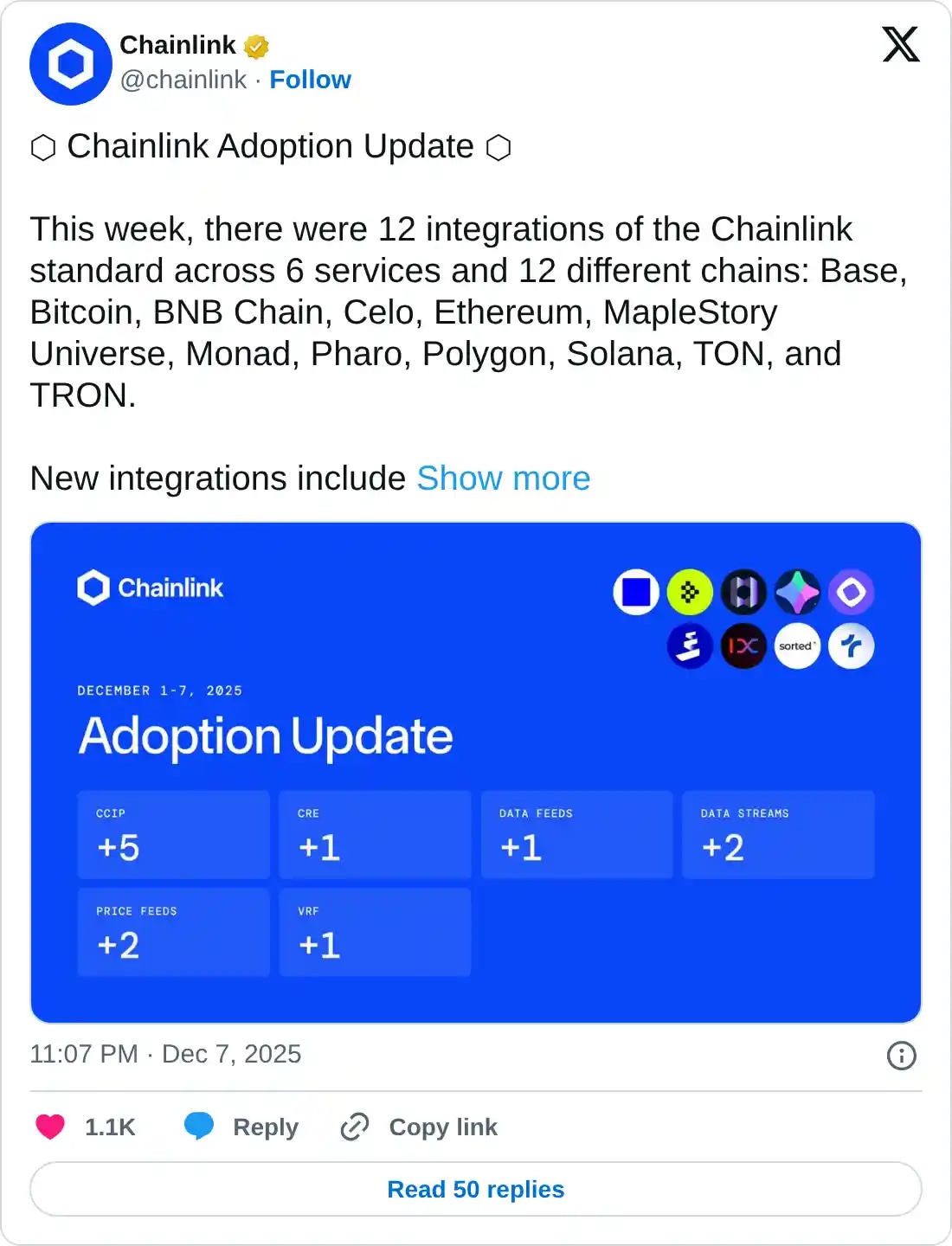

Chainlink’s growing adoption

Codatta, an AI-focused layer, announced on Tuesday that it is using Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to transfer XNY across Base and BNB Chain securely.

Earlier on Monday, Stable, the StableChain powered by USDT and backed by Bitfinex and PayPal Ventures, announced its adoption of Chainlink CCIP to enable cross-chain LBTC transfers, further highlighting the growing integration of CCIP across leading platforms.

Apart from this, Chainlink saw strong ecosystem growth this week, with 12 new integrations across six services spanning 12 different chains, including Base, Bitcoin, BNB Chain, Celo, Ethereum, Polygon, Solana, TON and TRON.

These growing developments and partnerships underscore Chainlink’s enhanced real-world utility, increased institutional credibility, and broader adoption, which support a bullish outlook for its native token in the long term.

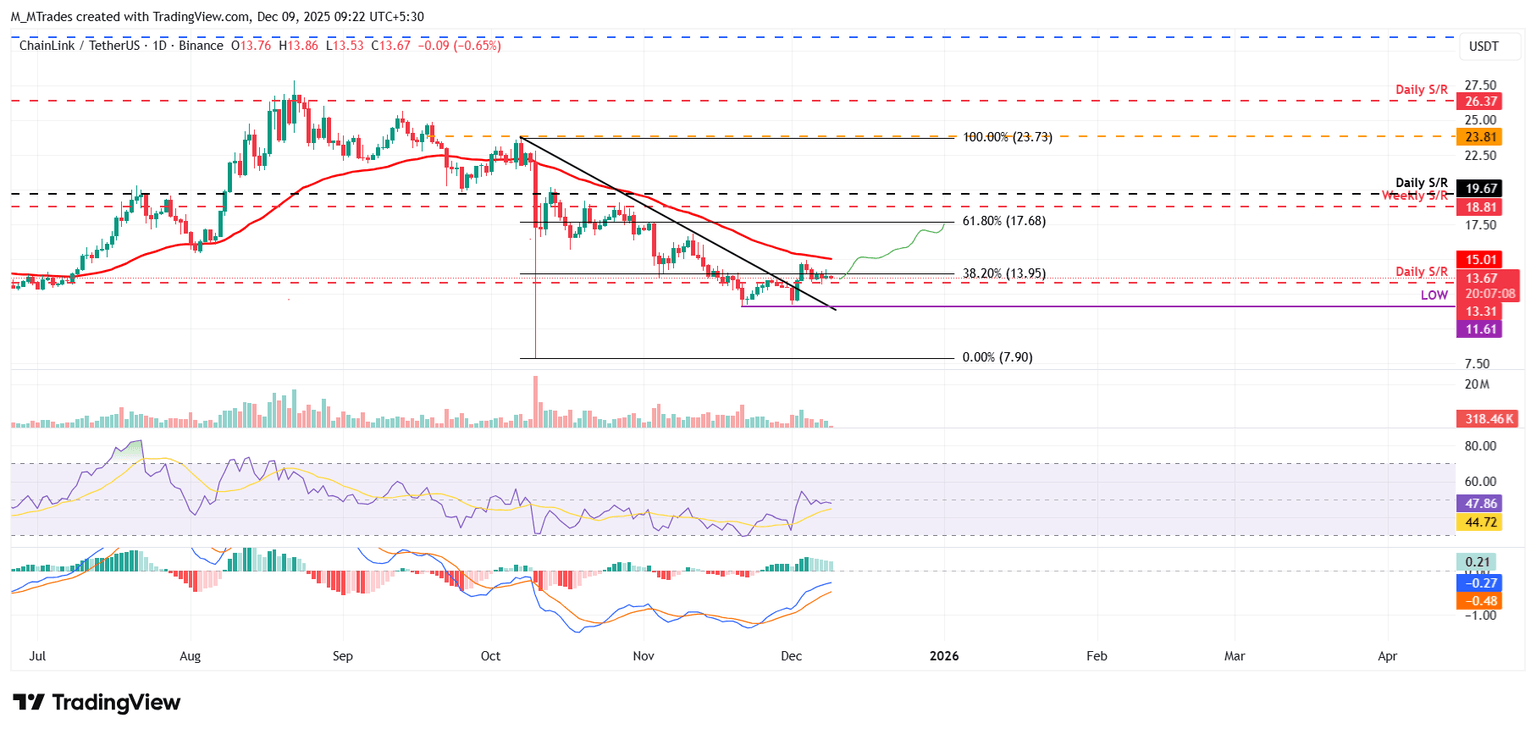

Chainlink Price Forecast: LINK finds support around key level

Chainlink price broke above the descending trendline (drawn by connecting multiple highs since early October) on December 2 and rallied nearly 9% the next day. However, LINK faced correction and found support around the daily level at $13.31. At the time of writing on Tuesday, LINK hovers slightly above this support level, trading around $13.67.

If LINK continues its upward trend, it could extend the rally toward the 50-day Exponential Moving Average (EMA) at $15.01. A successful close above this level could extend gains toward the next key resistance at $17.68.

The Relative Strength Index (RSI) on the daily chart is 47, near the neutral 50 level, suggesting fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which still holds, supporting the bullish thesis.

However, if LINK faces a correction, it could extend the decline toward the daily support at $13.31.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.