Chainlink Price Forecast: LINK has to hold above this key point to avoid 10% dip

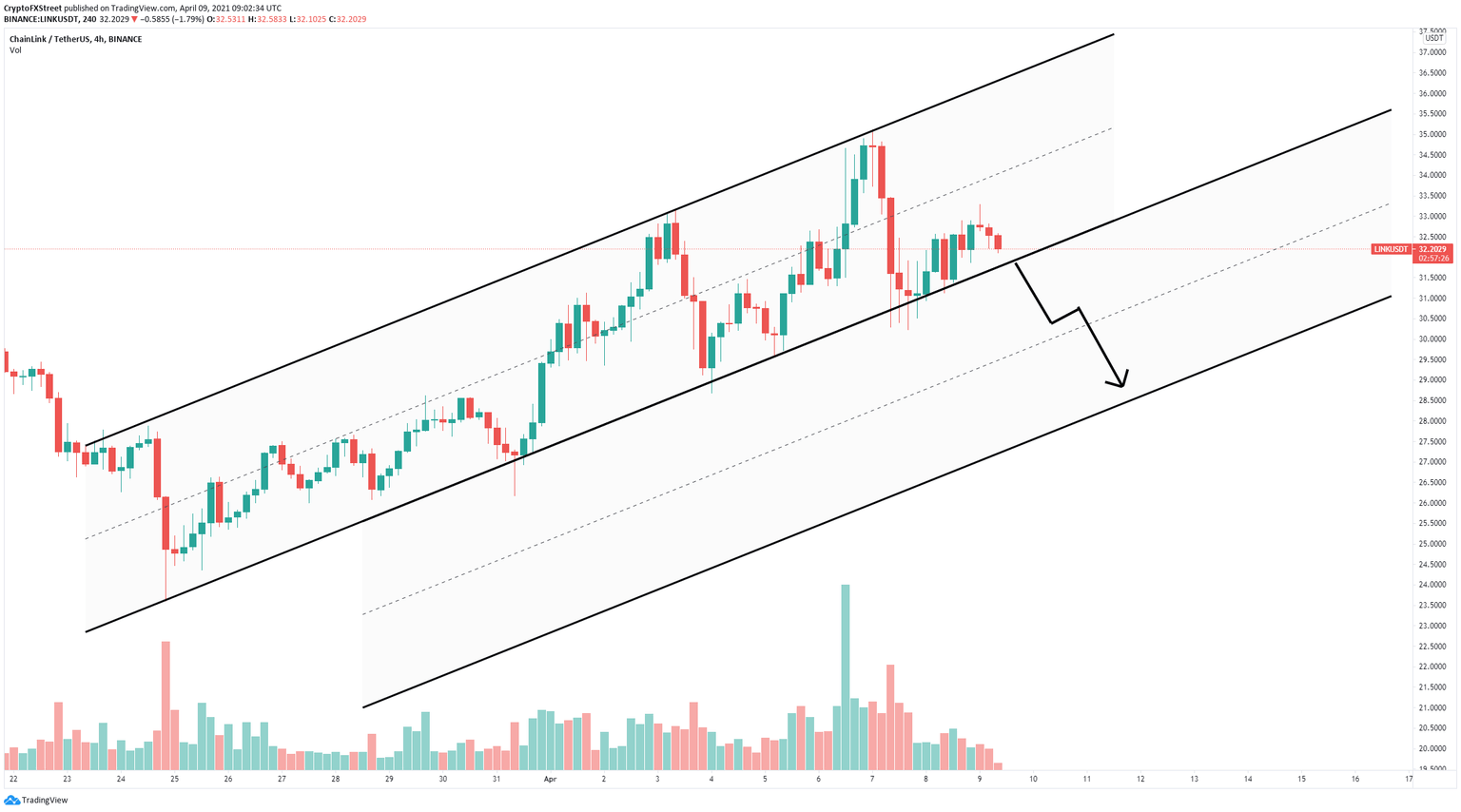

- Chainlink price is contained inside an ascending parallel channel on the 4-hour chart.

- The digital asset is at risk of a 10% breakdown if bulls cannot hold a key support level.

- LINK bulls are hopeful as there is weak resistance ahead of the current price.

-637336005550289133_XtraLarge.jpg)

Chainlink has been trading inside an uptrend for the past two weeks but could be on the verge of a significant 10% correction. Nonetheless, LINK bulls remain in control over the short term.

Chainlink price must defend key support level

On the 4-hour chart, Chainlink has formed an ascending parallel channel that can be drawn connecting the higher highs and higher lows with two parallel trend lines. The lower boundary of the channel is set at $32 at the time of writing.

LINK/USD 4-hour chart

A breakdown below $32 will quickly push the Chainlink price down to $30.5 and toward $28.8 eventually. This price target is calculated by measuring the height of the parallel channel. However, bulls remain in control over the short term as long as they can hold this critical support level.

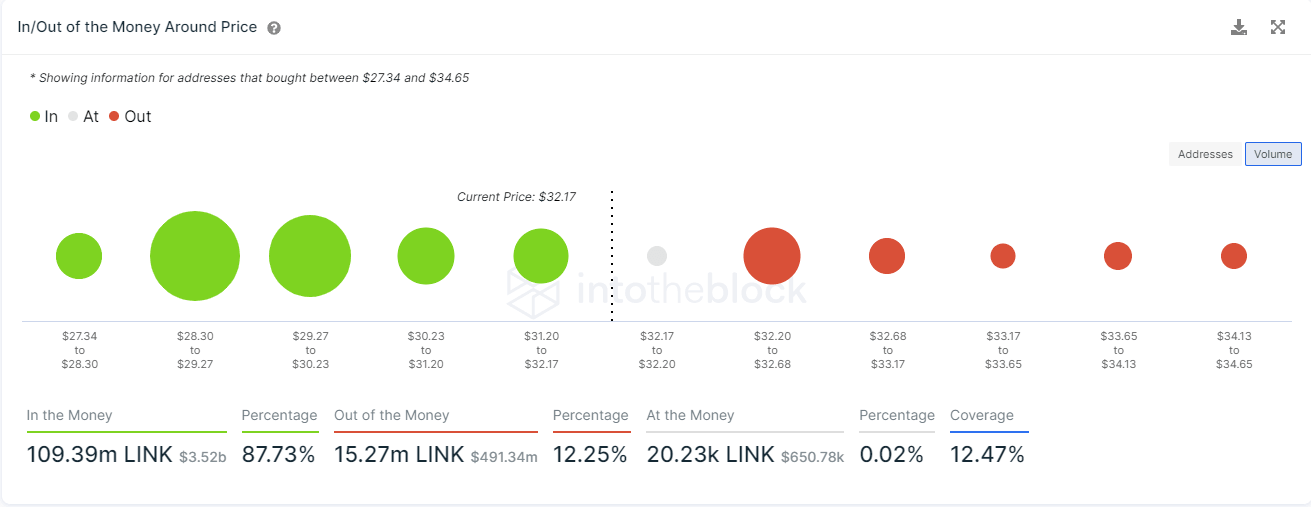

LINK IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows only one significant resistance level between $32.20 and $32.68 where 2,890 addresses purchased 12 million LINK. A breakout above this area should quickly drive the Chainlink price toward the middle trend line of the pattern at $34.4 and $36.4 in the longer term.

The IOMAP model adds credence to the bearish price targets above as it shows a large concentration of buyers between $28.3 and $30.2, which coincide with both targets. This area will absorb a lot of selling pressure, which is why a correction will most likely not go any deeper.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.