Chainlink price could hit a brick wall on fears over Ukraine-Russia peace talks

- Chainlink price looks promising on the charts, but two warning lights are flashing.

- LINK price could soon hit a very bearish wall of resistance and might see a push back to lower levels.

- Headwinds are emerging as more tail risk is being priced in again, possibly triggering a selloff towards $15.00

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price is still increasing, although most markets have been put on the back foot a bit in a slight change of sentiment overnight. Global markets took a step back as investors realised no real breakthrough had been made in the peace process, and after EU inflation numbers were seen running out of control. Whereas on Tuesday markets perceived that tail risks were diminishing, they now seem only to have got bigger and are weighing more on price action.

Chainlink price is on the cusp of a setback

Chainlink price has had a nice spring rally thus far with investors, depending on where they entered, looking at 14% to 33% of gains. So far so good, because investors are set to be in for a bumpy ride as markets get nervous about tail risks that are quickly filling the gap after a breakthrough in negotiations was communicated from both Ukrainian and Russian negotiators. Yet until a solid deal materialises, and with the rising risk of inflation, supply constraints, the considerable risk is that Russia will not uphold its promise and the war could become a significant tail risk again.

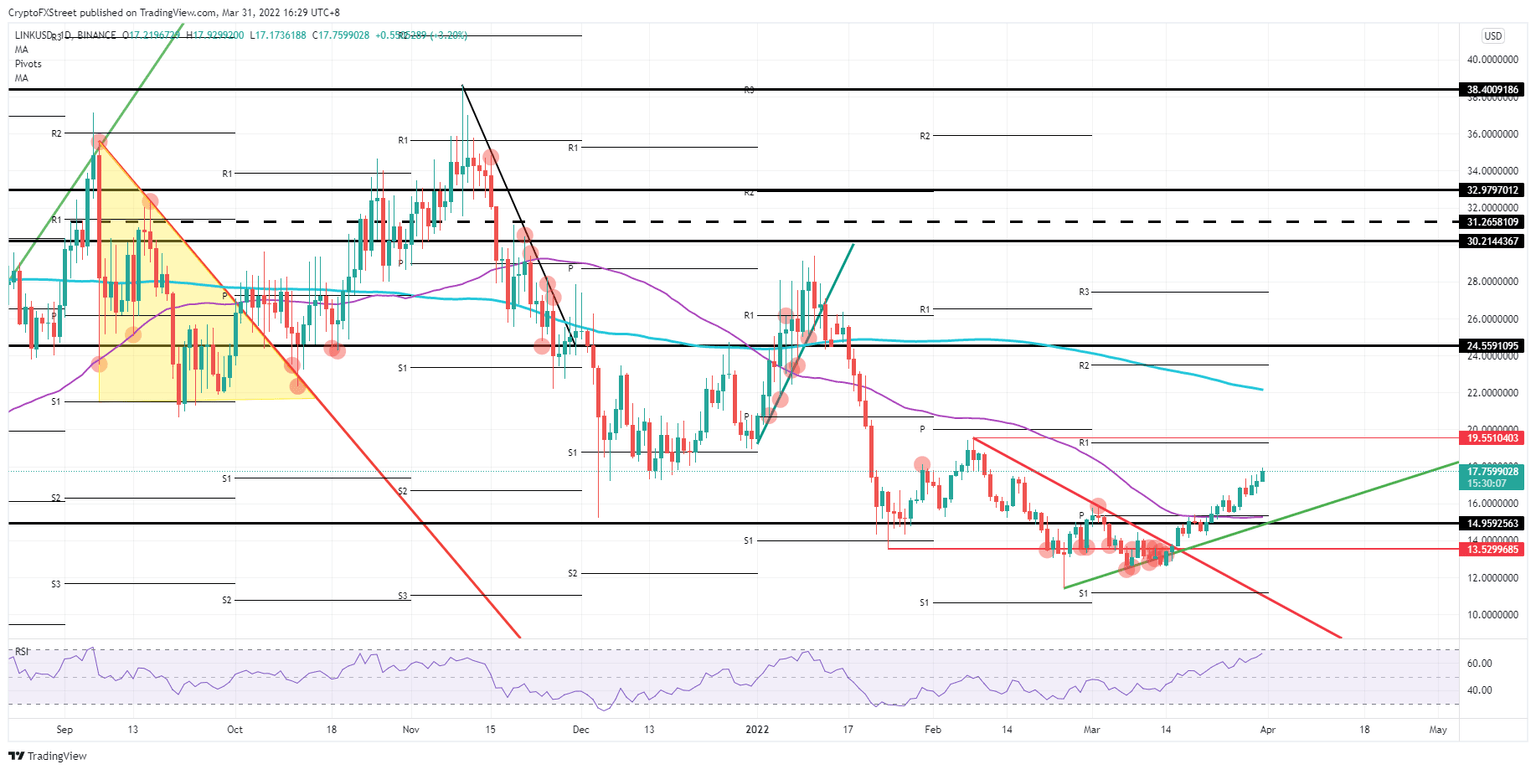

LINK price, is currently still surfing on the upturn in market mood, but it could quickly see quite a lot of those tailwinds turn into headwinds if a domino effect triggers a massive turnaround. The question is if LINK price will be able to hit $19.55 before the Relative Strength Index (RSI) breaks into the overbought area. Expect price action to fall back to $14.95 where the monthly pivot, a historical level and the green ascending trendline all lie just a few cents away from each other. Should those headwinds prove that severe, expect another leg lower towards $11.46, just above the monthly S1.

LINK/USD daily chart

The signals mentioned above could be ignored if the Nasdaq this evening can close out with a profit above +1% again, making up the loss from yesterday which came from profit-taking on a buy-the-rumour-sell-the-fact trade setup. Investors will look further into the summer projections and see that risk assets still hold solid gains with LINK than seeing more broad buying along the way in the rally towards $19.55, just above the monthly R1. Should bulls be able to close above, that opens the door to a jump to $22.00 with the 200-day Simple Moving Average just above.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.