Cardano Price Prediction: ADA to offer 28% profits

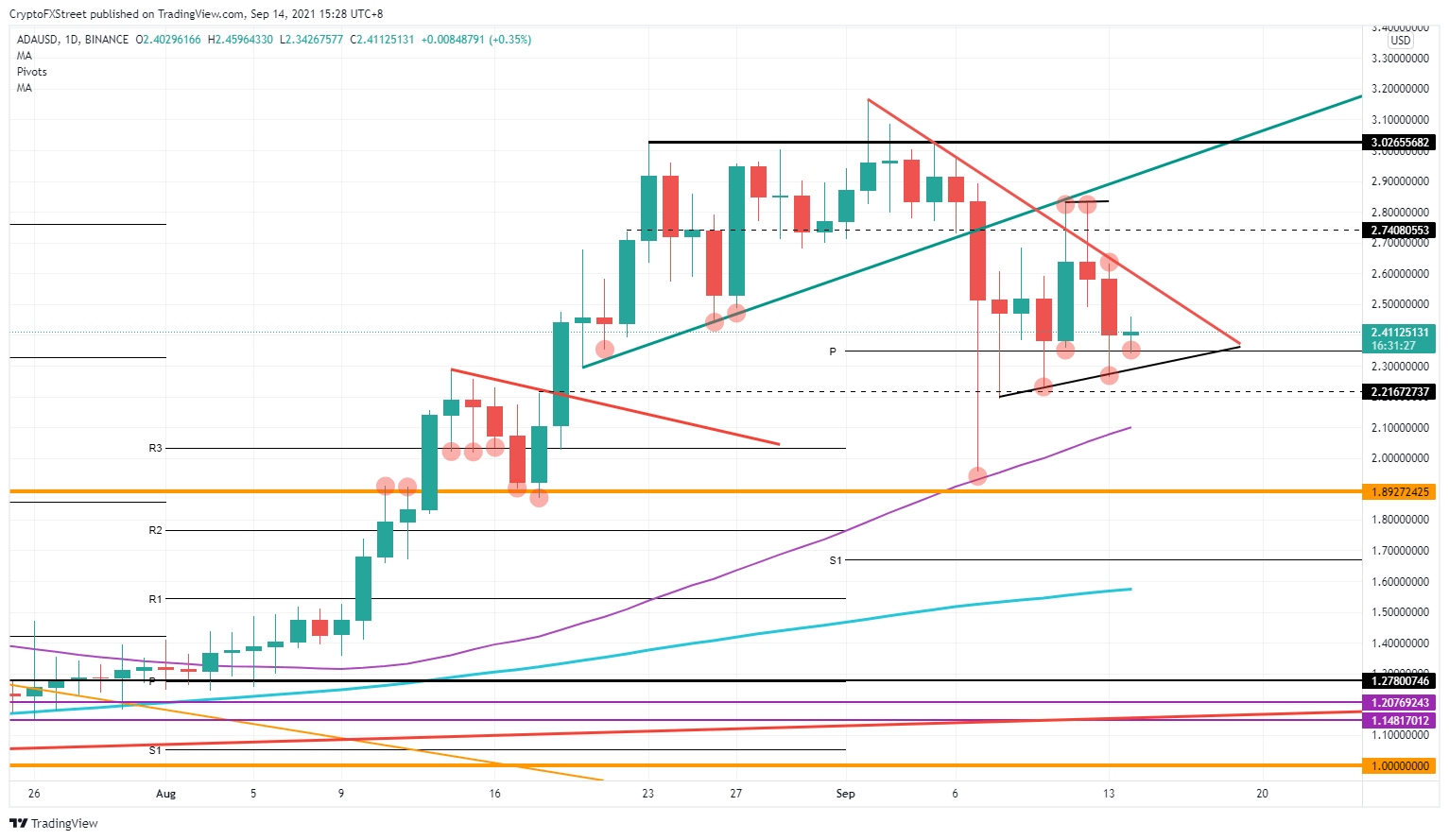

- Cardano price action is caught in a pennant.

- ADA prices are getting squeezed from both sides.

- Expect an upwards breakout of the pennant.

Cardano (ADA) price action has been consolidating in a pennant for a week now, and it looks to break to the upside with a potential 28% gain for buyers, back up towards $3.02.

Cardano price building momentum for a break to the upside

The pennant started its build on September 8 with a confirmed test on the downside on September 10 and September 13. Buyers each time stepped in and made higher lows. On the downside in the pennant, the red descending trend line is still in play, originating from September 2. With three solid retests along the way, it can count as a double element: one as part of the pennant and the second on its own as a descending trend line. Buyers already tried to break out of the pennant above the red descending trend line but failed with a double top formation and gains being pared on the next day.

Cardano price has since consolidated with lower highs, further respecting the red descending trend line and thus squeezing buyers and sellers toward each other. It is a heavily fought battle, but judging from the monthly pivot at $2.35, it looks like buyers are ready for the pop higher.

ADA/USD daily chart

ADA price around the monthly pivot looks to be a key element in the mix with the pennant. Judging from its behavior, the pivot level acted as a launching platform for the buyers to run prices higher up. This will have hurt short-term sellers for sure by having them lick their wounds, not ready to enter any time soon. This will cause a fade in sellers' action and hand momentum to buyers. A push higher to break the red descending trend line is next. Once from there, it is a quick jump to $3.02 for a retest of that level.

In case sellers overhaul price action, expect a break of the black ascending trend line in the pennant and look for a dip toward $1.89.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.