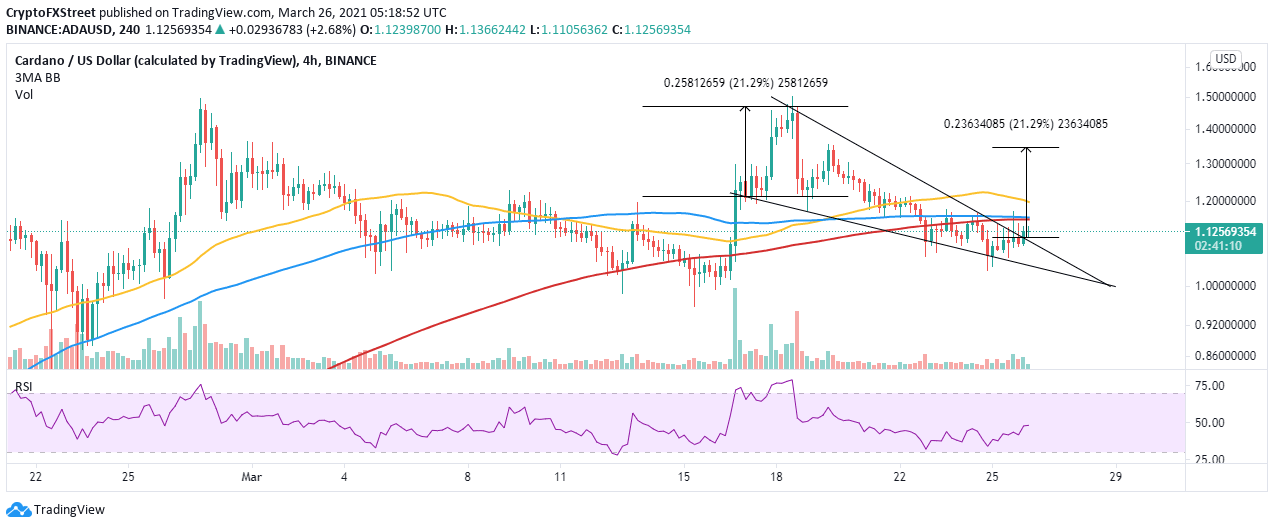

Cardano Price Prediction: ADA prepares for 21% upswing

- Cardano has broken out of a falling wedge pattern, eyeing gains to $1.35.

- The RSI validates ADA’s uptrend after bouncing off the oversold region.

- Recovery is likely to be a painstaking exercise, according to the resistance seen in the IOMAP.

Cardano has flipped bullish after a persistent downtrend over the last week. Support was embraced slightly above $1, whereby bulls took control of the trend. At the time of writing, ADA is trading at $1.12 following a breakout above a key technical pattern.

Cardano lifts toward $1.35

Cardano’s downtrend led to the formation of a falling wedge pattern. This is a continuation pattern that forms after significant upward price action. The freefall from the resistance leads to a consolidation period, as bulls prepare to take control. A breakout is usually anticipated when the price slices through the upper trendline.

Falling wedges have precise targets measured from the highest to lowest points of the pattern. Cardano gains are expected to spike to $1.35, presenting a 21% liftoff from the breakout point.

ADA/USD 4-hour chart

The Relative Strength Index (RSI) reinforced the uptrend after recovering from the oversold region. Cardano’s momentum to $1.35 is bound to continue if the RSI closes the gap toward the overbought area.

Looking at the other side of the picture

The In/Out of the Money Around Price (IOMAP) on-chain model by IntoTheBlock suggests that Cardano will settle for consolidation before breaking out further. This is due to an immense resistance highlighted between $1.12 and $1.16. Here, around 144,000 addresses previously bought approximately 3.9 billion ADA.

Cardano IOMAP chart

The model brings to light a relatively strong support level, running from $1.09 to $1.12. Here, roughly 97,500 addresses previously bundled up nearly 3 billion ADA. If this support remains intact, Cardano will settle for a sideways trading action before completing the upswing to $1.35.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637523372659875709.png&w=1536&q=95)