Cardano price might observe a 10% rally as ADA whale volumes hit a 12-month high

- Cardano price is currently trading at $0.358 following the broader market cues.

- ADA whales' transaction volume rose to $16 billion over the week, which is a positive sign for the altcoin.

- Retail investors have refrained from selling in the past few weeks, giving ADA a chance to recover.

Cardano price, since mid-April, has been on a downtrend, just as Bitcoin, Ethereum and many other cryptocurrencies have been. Thus most of the altcoin's recovery is dependent on broader market cues. However, ADA might have an additional factor in play in the form of its whales.

Cardano price could be on the path of recovery

Cardano price trading at $0.358 hit a monthly low but is still far away from the March lows of $0.304. The altcoin's high correlation with Bitcoin has kept it from falling excessively, but ADA seems to have found support from its investor base as well.

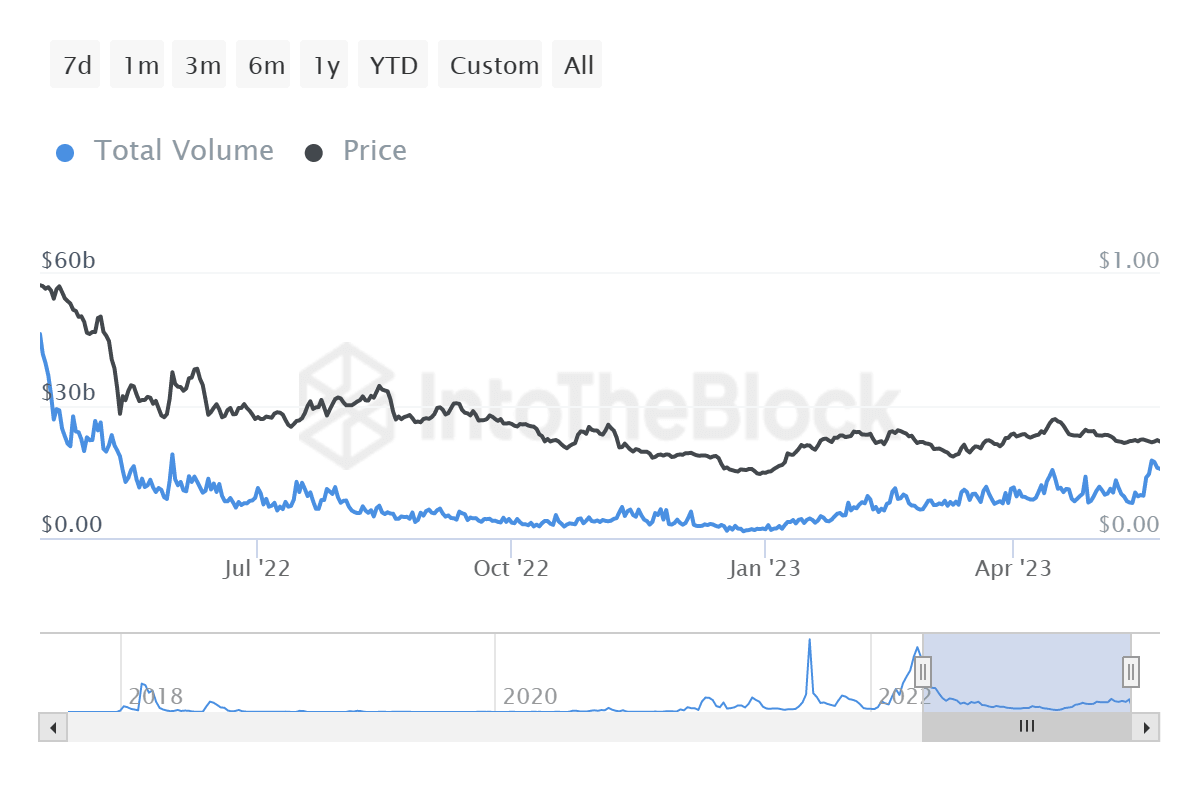

Over the week, Cardano whales have been highly active, with their transaction volume reaching a yearly high of $16 billion. The last time transactions worth more than $100,000 were this high was back in June 2022.

Although their activity has been on the rise since Q1 and throughout April, the sudden rise might act as a bullish sign for the altcoin.

Cardano whale transaction volume

This is because a lack of activity on the network tends to leave the price action of the cryptocurrency dependent on external factors. And since Cardano is not observing any major developmental event taking place at the moment, its potential of a quicker recovery is mostly hinged on its investors.

Awaiting profits, these ADA holders, too, have refrained from selling, as observed in the balance held by mid-term holders. Holding more than 51% of the entire circulating supply, these investors have not noted a dip in their balance, suggesting selling has been minimal.

Cardano held by investors

Thus a bullish outlook from retail and whale addresses could support Cardano price recovery. In order to lock in profits, ADA needs to rally 10% and flip the critical resistance marked by the 200-day Exponential Moving Average (EMA) at $0.395 into a support floor.

This would allow the token to eventually breach the historically tested barrier at $0.42 and head on toward 2023 highs of $0.450.

ADA/USD 1-day chart

However, a bearish turn in the broader market cues could mean trouble for the third-generation cryptocurrency, leaving Cardano price vulnerable to a crash to March lows at $0.304.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.