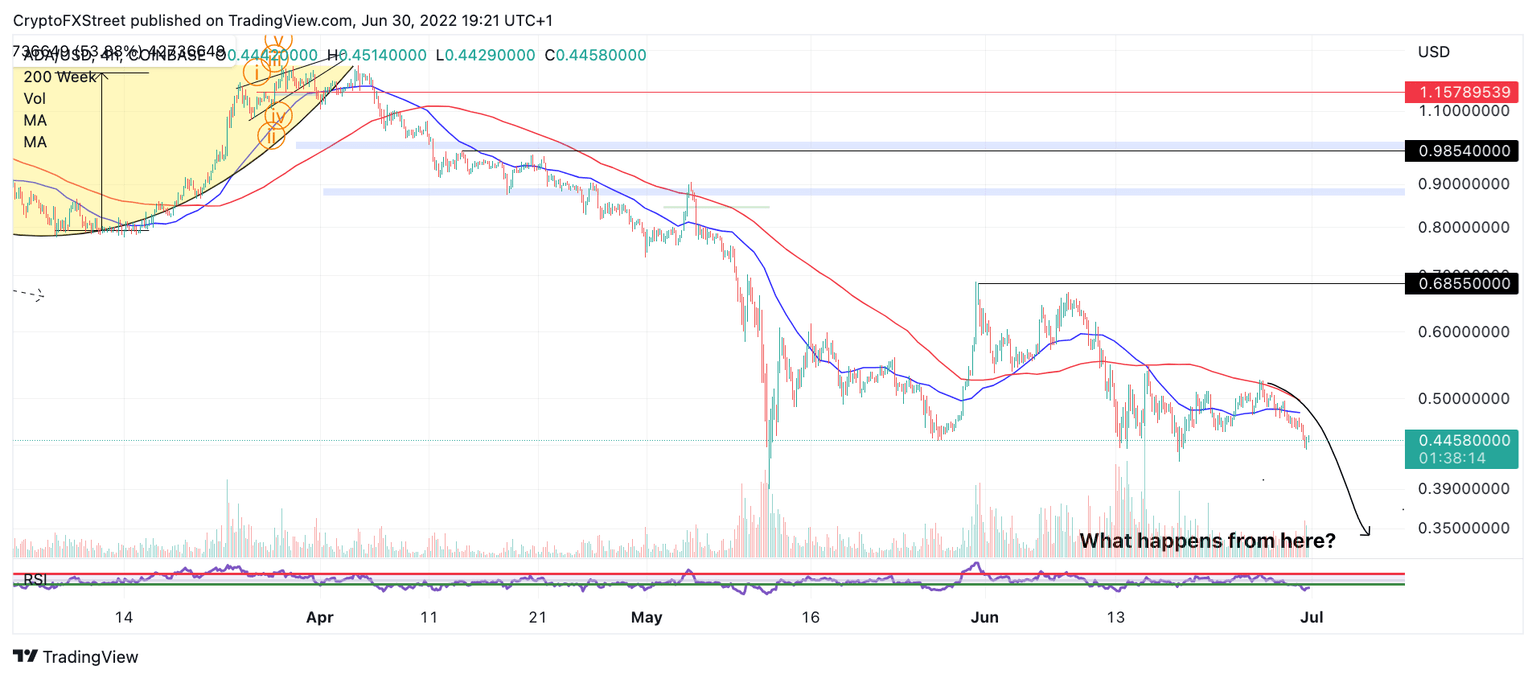

Cardano price has fallen beneath $0.45, here’s what to expect in July

- Cardano price has breached through the 8- and 21-day moving averages.

- ADA price falls in free-fall fashion printing consecutive bearish candlesticks on the four-hour chart.

- Invalidation of the bearish downtrend is a breach above the 21-day moving average currently positioned at $0.50.

Cardano price shows no evidence to believe in a trend reversal. Expect calamity.

Cardano price to sweep the lows

Cardano’s ADA price shows the continuation of the bearish trend is likely underway. Since June 25, what first appeared to be a simple consolidation within two coiling simple moving averages, quickly turned into a bearish blitzkrieg as traders came out to suppress the Cardano price. The ongoing downtrend could become increasingly powerful as the bears aim to besiege the liquidity levels under the June 18 swing low at $0.42. A breach of this low could be devastating for bulls in the market as the Cardano price could plummet an additional 50% into the $0.20 price level.

Cardano price currently trades at $0.44. The self-proclaimed Ethereum killer does not show a bullish reversal signal as of yet. The consecutive free-fall candlesticks on the four-hour chart indicate the bear's strength and confidence in the market. Their satisfaction will only be met by large liquidations, presumably under critical swing lows at $0.42 and the May 12 swing low at $0.39.

ADA/USDT 4-Hour Chart

An early Invalidation signal of the bearish downtrend could occur if the bulls can reconquer the 21-day simple moving average currently positioned at $0.50. If the bulls can re-hurdle this level, they may be able to rally as high as $1.20, resulting in a 170% increase from the current Cardano price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.