Cardano price could revisit $1 as ADA threats multiply

- Cardano price faces two crucial hurdles at $1.20 and $1.24, suggesting further upside is unlikely.

- Investors can expect ADA to retrace roughly 15% and revisit the $1 psychological barrier.

- A four-hour candlestick close above $1.24 will invalidate the short-term bearish thesis.

Cardano price has breached its consolidation range but is struggling to head higher. The presence of a resistance confluence makes this run-up an arduous task for bulls.

Cardano price breaks free but for the worse

Cardano price traded between the $1.12 and $1 barrier for roughly two weeks, signaling a consolidation. On February 5, ADA breached through this sideways movement and produced a swing high above $1.12, flipping into a support floor.

Cardano price faces two critical hurdles as it trades above $1.12 - the weekly resistance barrier at $1.20 and the 50-day Simple Moving Average (SMA) at $1.24. Hence, the chances of an upswing are considerably less.

Therefore, investors can expect Cardano price to face rejection at either of the two barriers and retrace lower. A failure to breach the 50-day SMA at $1.24 could lead to a 15% downswing to the daily support level at $1. This barrier served as a support platform for the run-up in mid-2021 that pushed ADA to $3. Hence, this stable support floor is where the downside could be limited.

ADA/USDT 4-hour chart

Supporting this downward movement for Cardano price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that the immediate support level for ADA is non-existent and that a stable one is present at $1.03, further adding credence to the short-term bearish thesis. Therefore, investors can expect ADA to find a firm footing around this barrier where roughly 448,830 addresses that purchased 7.78 billion ADA are “In the Money.”

ADA GIOM

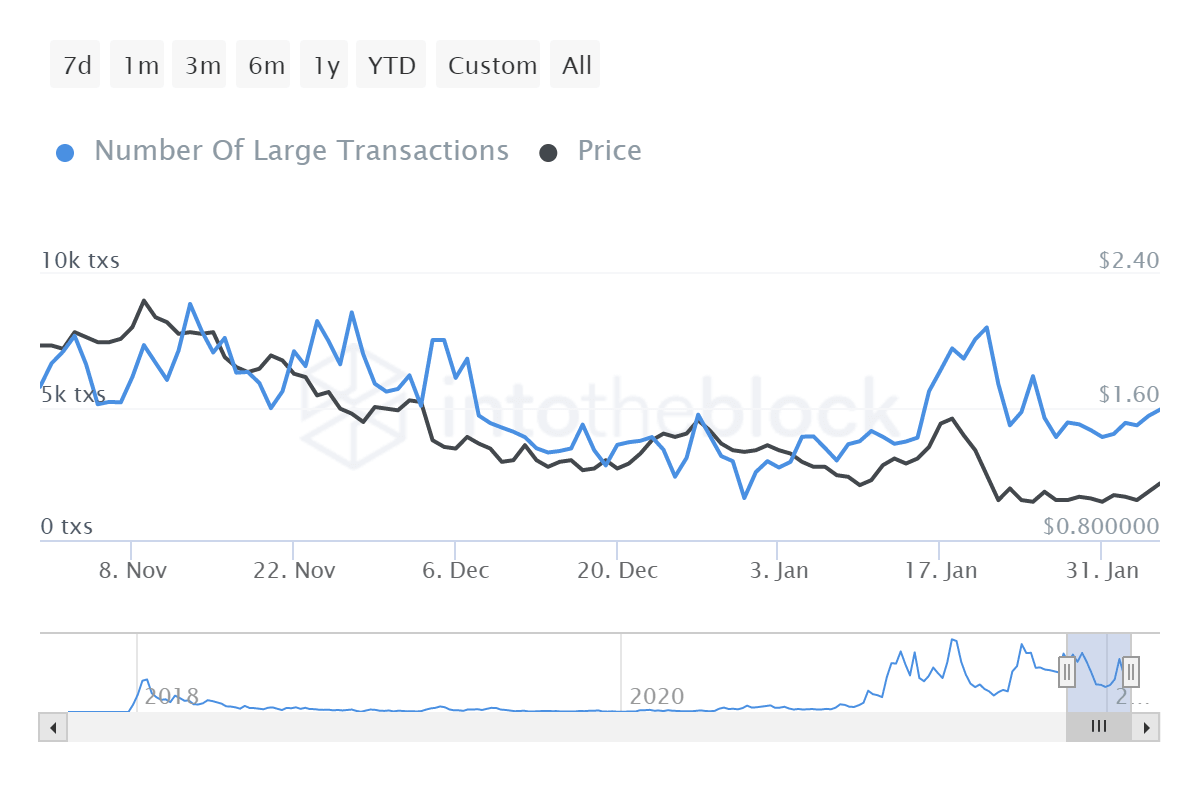

Another reason why a bullish thesis Cardano price is unlikely is due to the decline in the number of large transactions from 5,100 to 4,900. This 3.9% drop, which serves as a proxy of their

investment thesis, indicates that they are not interested in ADA at the current levels.

ADA large transactions

All in all, Cardano price seems ready for a quick leg down to $1, a crucial psychological level. This bearish outlook can be side-stepped if ADA bulls can produce a four-hour candlestick close above $1.24.

Doing so will allow Cardano price to have a free reign up to $1.45 or a 17% upswing. The upside seems to be limited at $1.45, which is a confluence of the weekly resistance barrier and the 100-day SMA.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.