Can the fast growth of Bitcoin (BTC) affect the rise of Ethereum (ETH) or XRP?

Despite the correction of some coins from the top 10 list, the bullish trend continued on the cryptocurrency market.

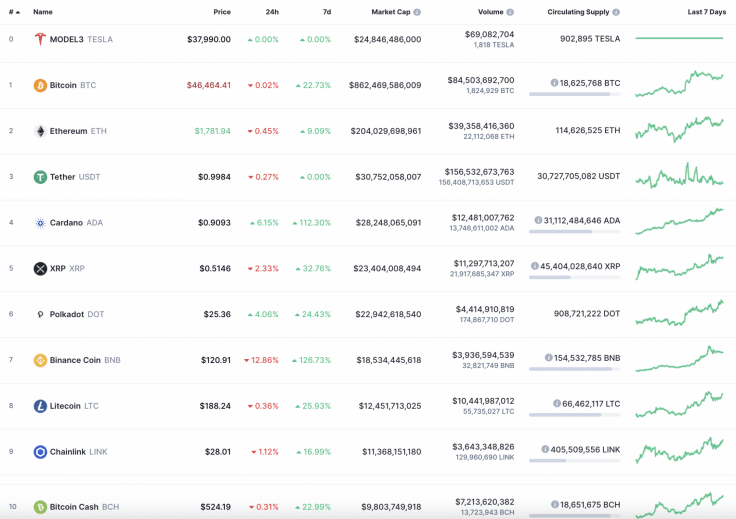

Top 10 coins by CoinMarketCap

BTC/USD

Yesterday, the bears pushed the Bitcoin (BTC) price back below the support of $45,200, which limited the pullback from the all-time high. The decline has stopped around $44,000. Trading volumes decreased and the pair consolidated in a short-term consolidation.

BTC/USD chart by TradingView

Attempts to restore the price are still taking place at small volumes, so today it is possible that the decline will continue below the two-hour EMA55. If the moving average is able to stop the pullback, then buyers might get to the mark of $50,000.

Bitcoin is trading at $47,480 at press time.

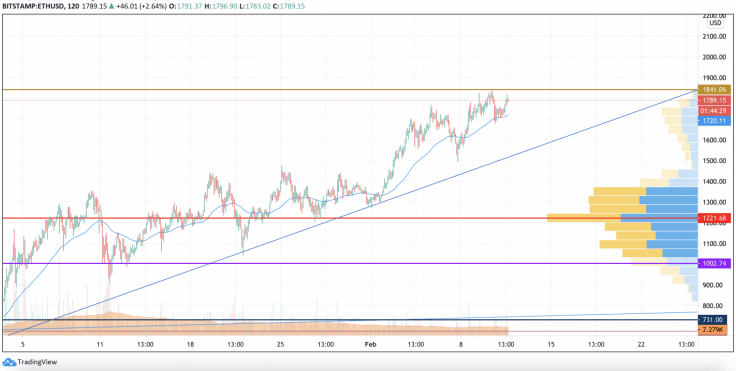

ETH/USD

Yesterday morning, buyers managed to renew the all-time high to $1,839 before the price pulled back to the support of $1,700.

ETH/USD chart by TradingView

A rather strong bearish momentum was able to pierce the two-hour moving average, but by this morning, the pair has held above this level of average prices. If during the day EMA55 limits the onslaught of sellers, the pair will return to the resistance zone around $1,850.

Ethereum is trading at $1,792 at press time.

XRP/USD

Yesterday morning, buyers broke through the psychological resistance at the level of $0.50 and tested the level of $0.543.

XRP/USD chart by TradingView

The sellers' reaction was a rather strong bearish impulse, which forced a test of the upper border of the sideways corridor of $0.45. This level worked as a support and the price bounced to the area of $0.50, trying to gain a foothold above it in consolidation.

Now trading volumes have decreased and price volatility has decreased. One believes that today the XRP price will consolidate above the $0.50 level.

XRP is trading at $0.5267 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.