Can one expect a reversal of the crypto market soon and a continued rise?

By the end of the week, the cryptocurrency market keeps facing a bearish influence as all top 10 coins are in the red zone.

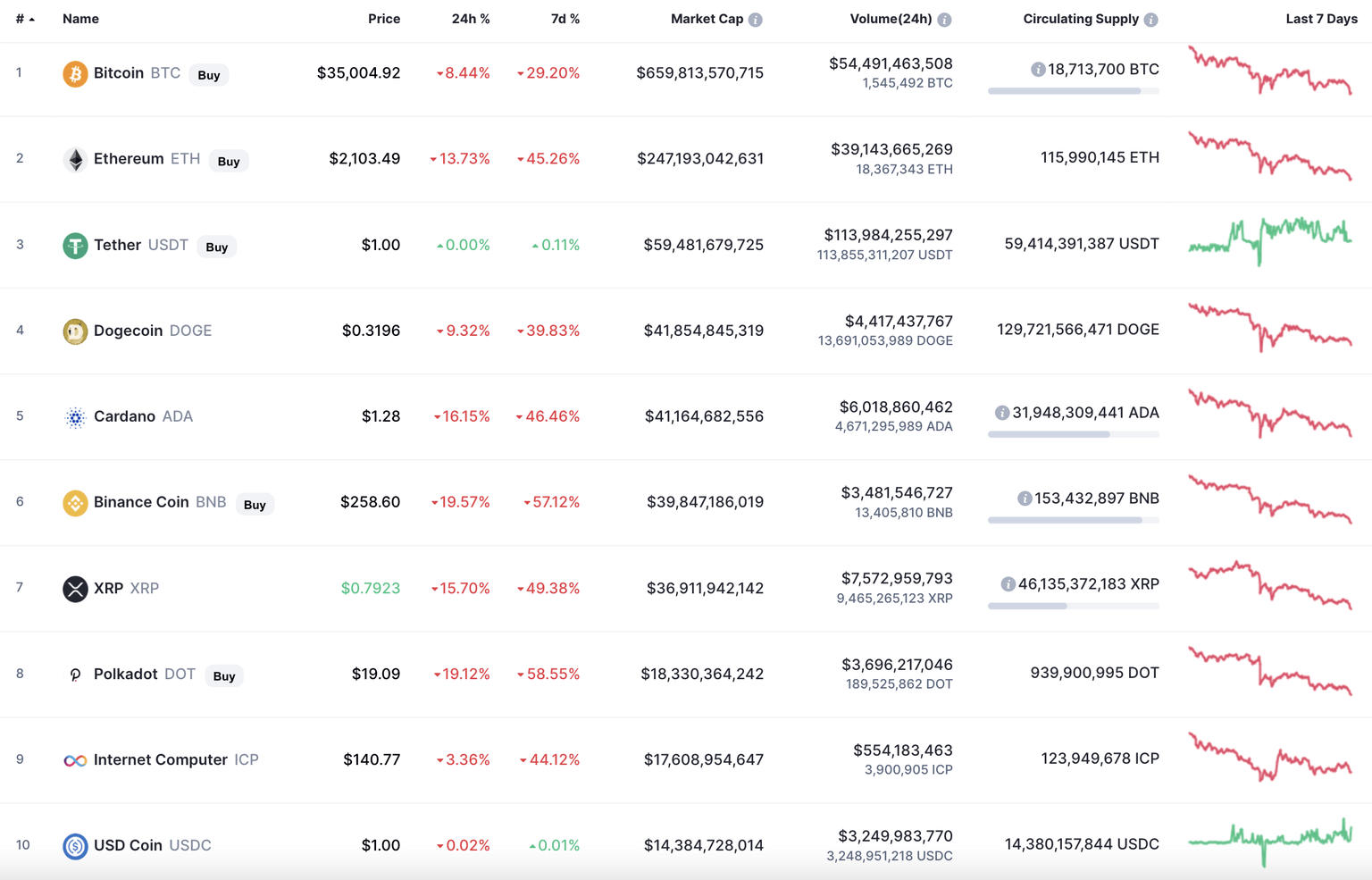

Top coins by CoinMarketCap

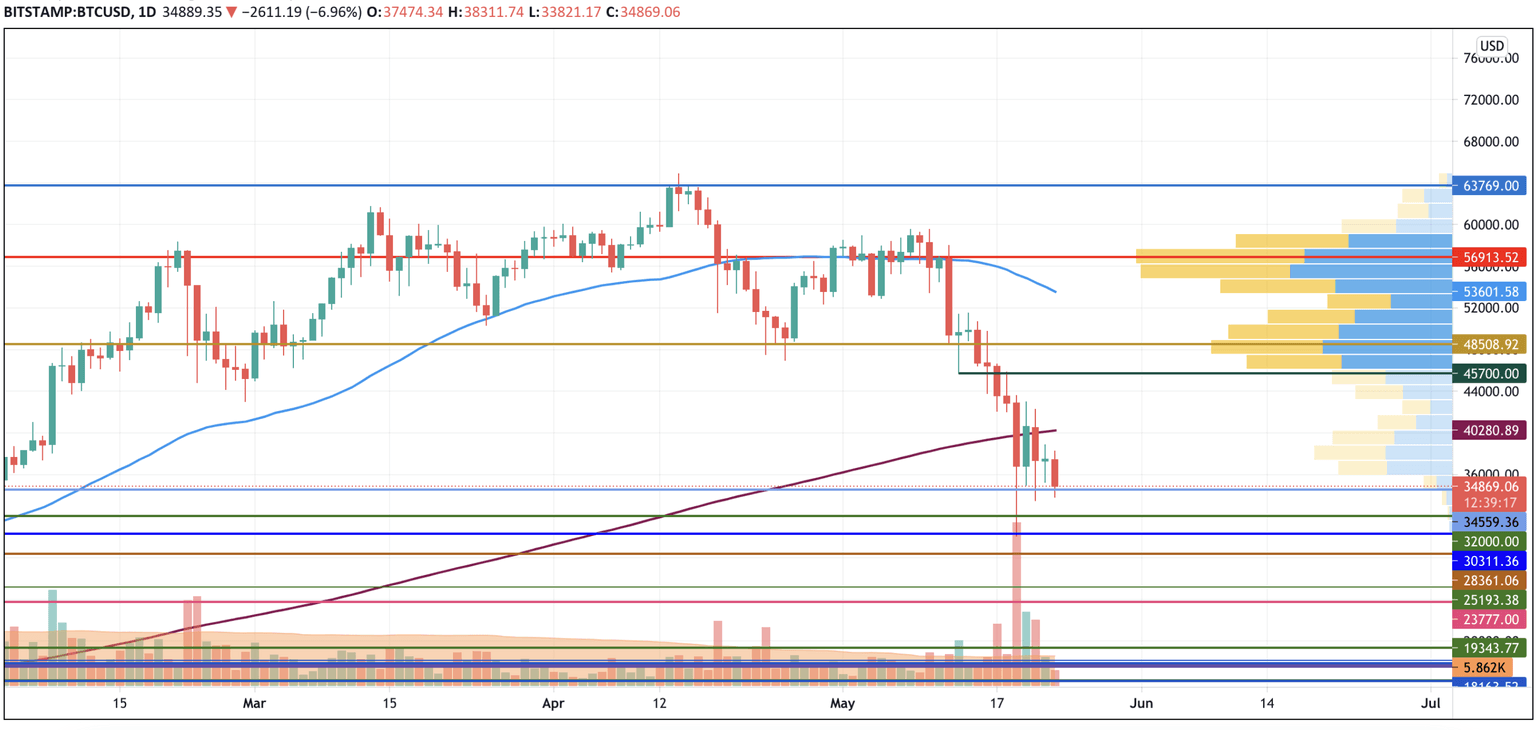

BTC/USD

Bitcoin (BTC) has lost the least with a price drop of 8.59% over the last day.

BTC/USD chart by TradingView

Bitcoin (BTC) could not keep trading above $40,000, having confirmed a mid-term bearish trend. However, the selling trading volume is going down, which means that a bounceback to the area around $45,000 might still happen.

In addition, most of the liquidity is focused at that level.

Bitcoin is trading at $35,363 at press time.

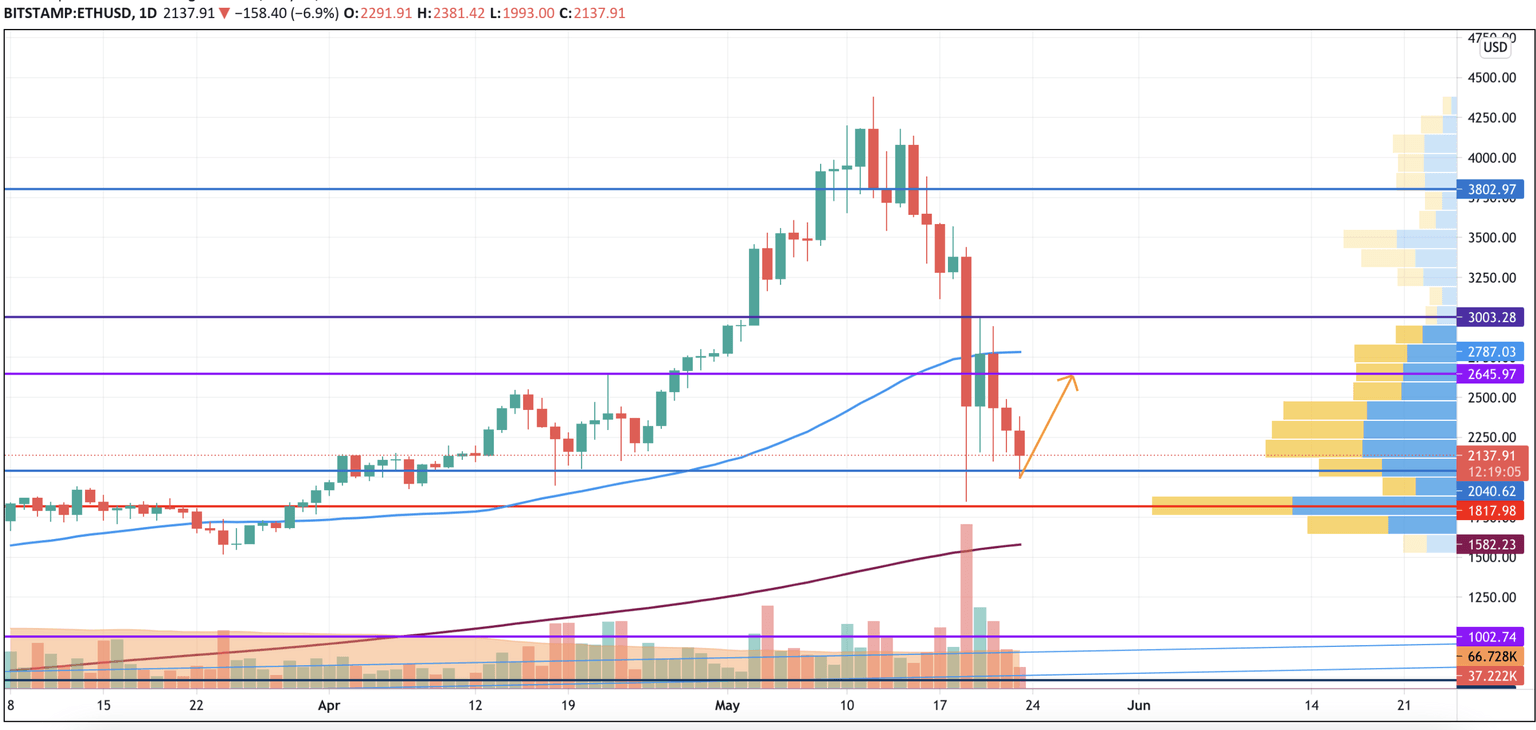

ETH/USD

Ethereum (ETH) is more of a loser than Bitcoin (BTC) as the chief altcoin has lost 11% of its price share.

ETH/USD chart by TradingView

Ethereum (ETH) might show a similar price action as Bitcoin (BTC) after it has successfully bounced off the support zone. If buyers can keep ETH trading at $2,100, there are chances that the mirror level at $2,600 can be attained by the end of the upcoming week.

Ethereum is trading at $2,136 at press time.

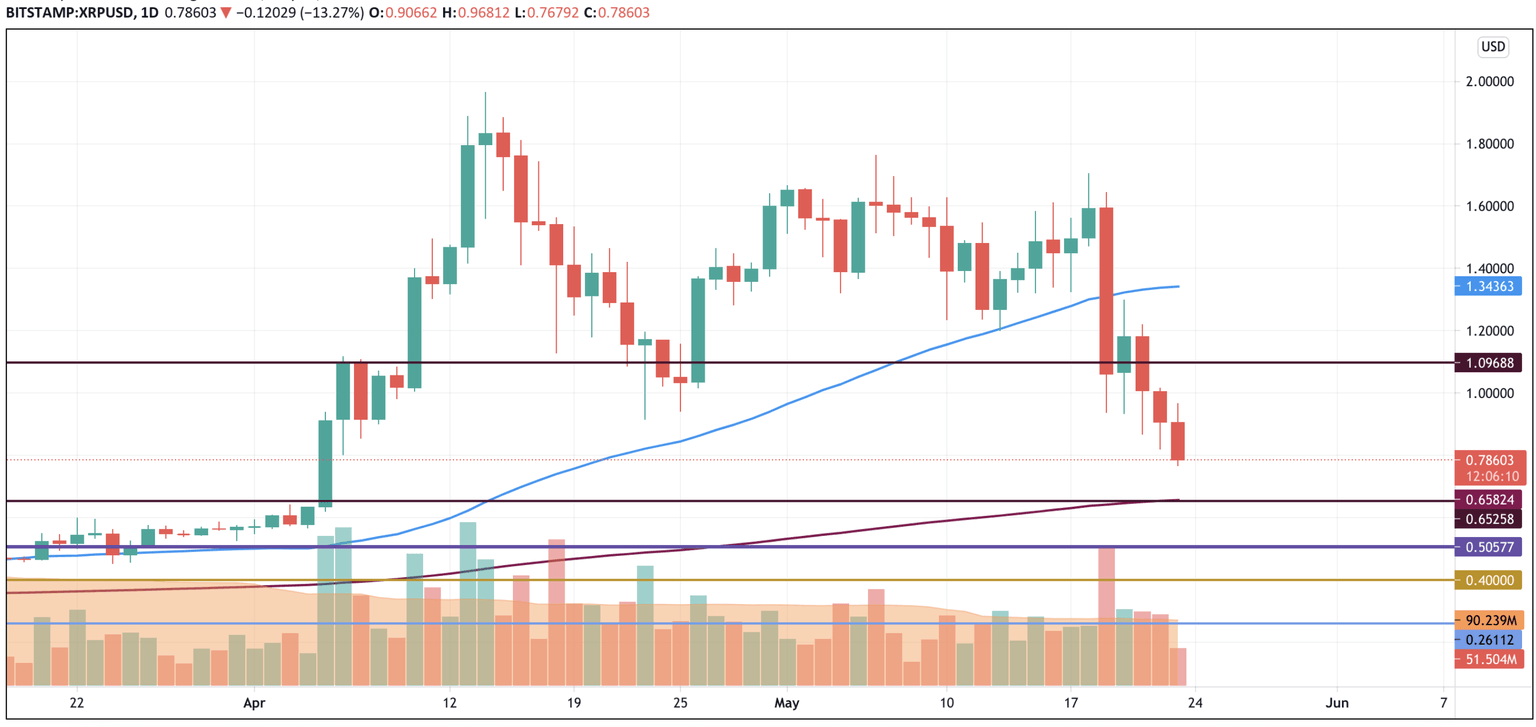

XRP/USD

XRP is not an exception to the rule, and the price of the altcoin has gone down by 15%.

XRP/USD chart by TradingView

According to the daily chart, XRP might not have finished its fall. The altcoin is moving to the MA 200 that refers to the support at $0.65. There are chances that a bounceback may happen from that level.

XRP is trading at $0.795 at press time.

LTC/USD

Litecoin (LTC) has fallen the most today as the price drop has accounted for 16.80%.

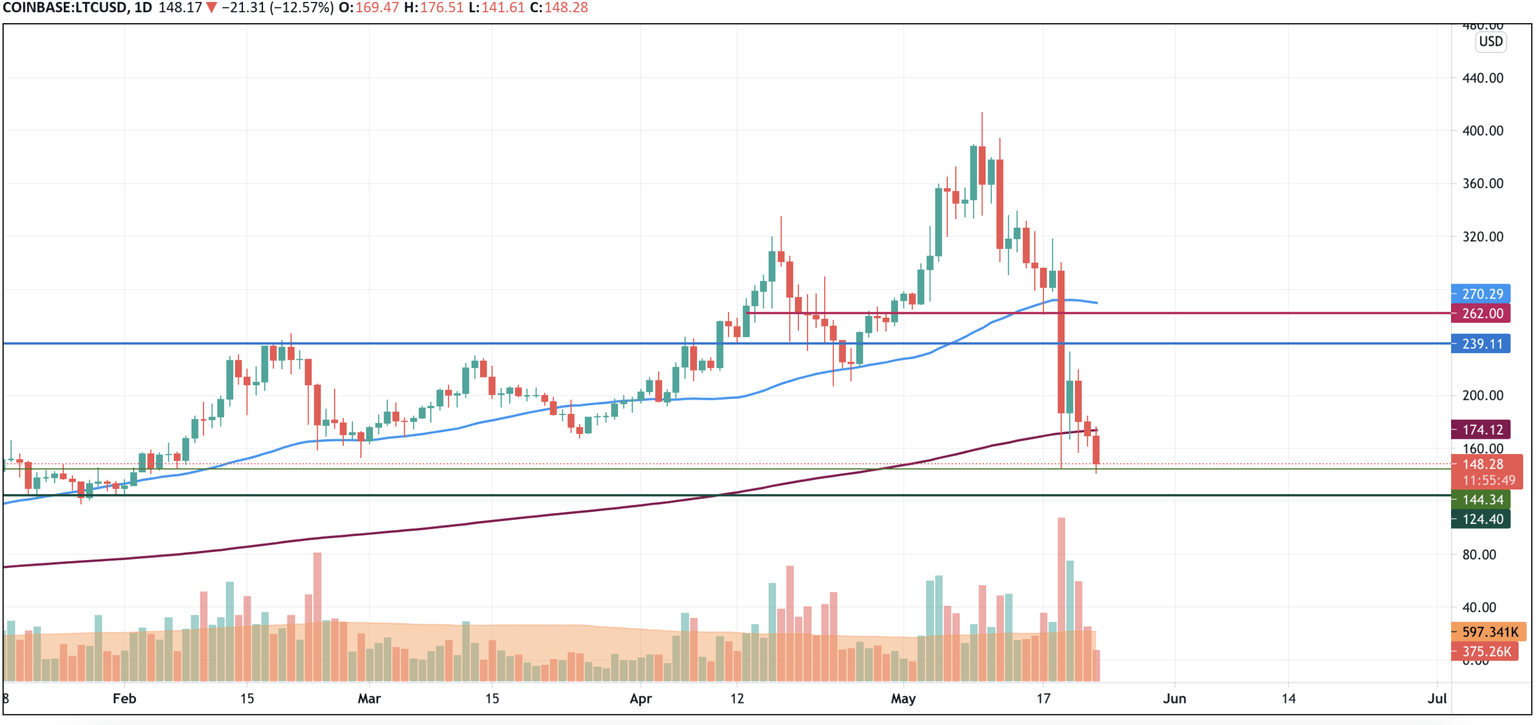

LTC/USD chart by TradingView

After a false breakout of the $148 zone, the rate of the "digital silver" has come back to the support zone and seems ready to break out. If that happens, the next area where buyers might again seize the initiative is the $124 mark.

Litecoin is trading at $146.62 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.