Can Bitcoin (BTC) outperform altcoins in the short term?

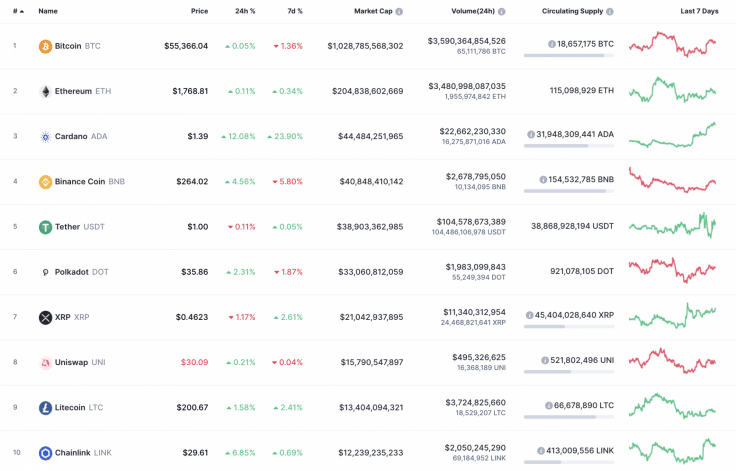

Most of the coins have recovered after a recent sharp drop of the market. XRP is the only loser from the list, falling by 1.17%.

Top 10 coins by CoinMarketCap

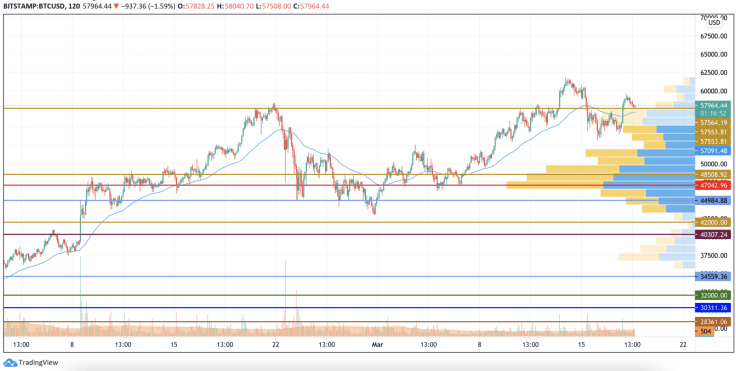

BTC/USD

Yesterday, buyers tried to restore the pair to the resistance of $58,000. In the first half of the day, they could not break above $56,400. Late in the evening, bulls formed a powerful impulse, which allowed the Bitcoin (BTC) price to overcome the resistance of $58,000 and gain a foothold in the area of $59,000.

BTC/USD chart by TradingView

A rollback is possible this morning. If the price holds above $58,000, then the recovery will continue to the area of $60,000.

If bears push through $58,000, then the pair might return to the area of average prices ($56,400).

Bitcoin is trading at $57,840 at press time.

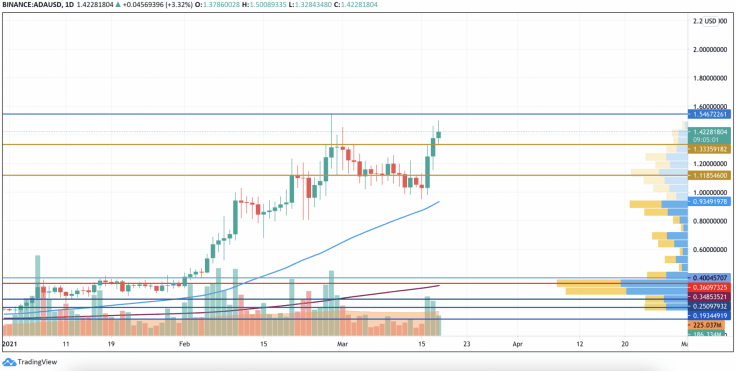

ADA/USD

Cardano (ADA) is the biggest gainer today. The rate of the altcoin has increased by 14.24% since yesterday.

ADA/USD chart by TradingView

Despite the sharp growth, the rise may continue as the coin has accumulated enough power. In this case, possible bearish pressure may accumulate in the area of $1.54.

Cardano is trading at $1.43 at press time.

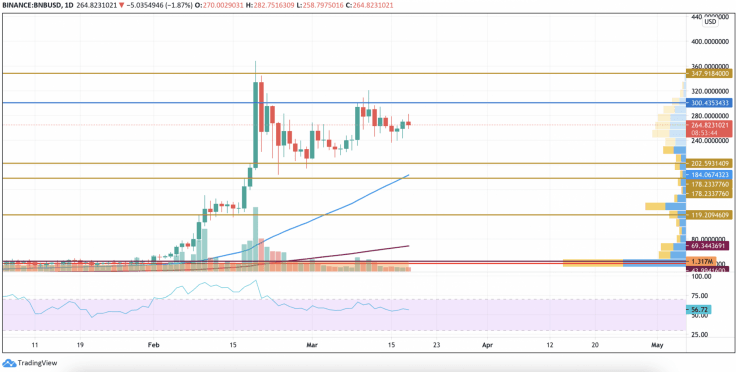

BNB/USD

Binance Coin (BNB) is the second biggest gainer today as the rate of the native exchange coin has gone up by 5%.

BNB/USD chart by TradingView

After a false breakout of the $300 mark, the altcoin is about to restest it within the next few days. Thus, the value of the RSI indicator has not reached the overbought zone, which means that a rise is more likely than a drop.

BNB is trading at $264.90 at press time.

LTC/USD

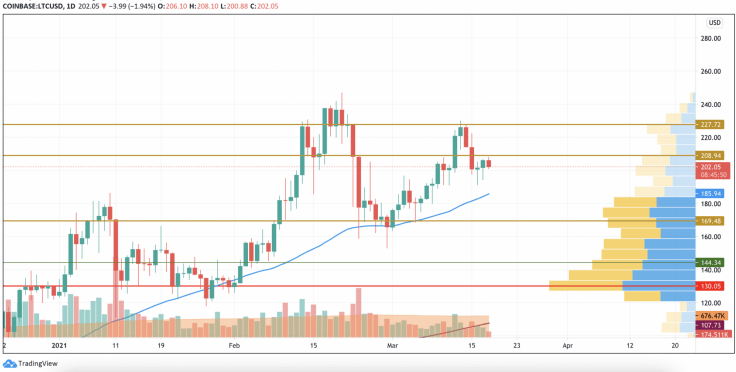

The rate of Litecoin (LTC) has not shown such enormous growth as Cardano (ADA). The price of "digital silver" has risen by 1.88% over the past 24 hours.

LTC/USD chart by TradingView

On the daily chart, Litecoin (LTC) is slightly approaching the first resistance at $208. From the technical point of view, LTC can break it and rise to the area around $227 where sellers might seize the initiative in the short-term perspective.

Litecoin is trading at $202 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.