Can Avalanche’s friend.tech-inspired StarsArena push AVAX price to $12?

- AVAX price currently hovers around $10 with an upside potential.

- The launch of StarsArena, a crypto-based social media application similar to friend.tech, has investors flooding in.

- This frenzy could be a strong tailwind that propels the altcoin higher.

Avalanche (AVAX) price has the potential to climb higher amid the launch of StarsArena, a social media application on the Avalanche blockchain. This move could trigger a buying spree from incoming users, kickstarting a rally for the underlying token.

StarsArena becomes Avalanche ecosystem’s favorite social media application

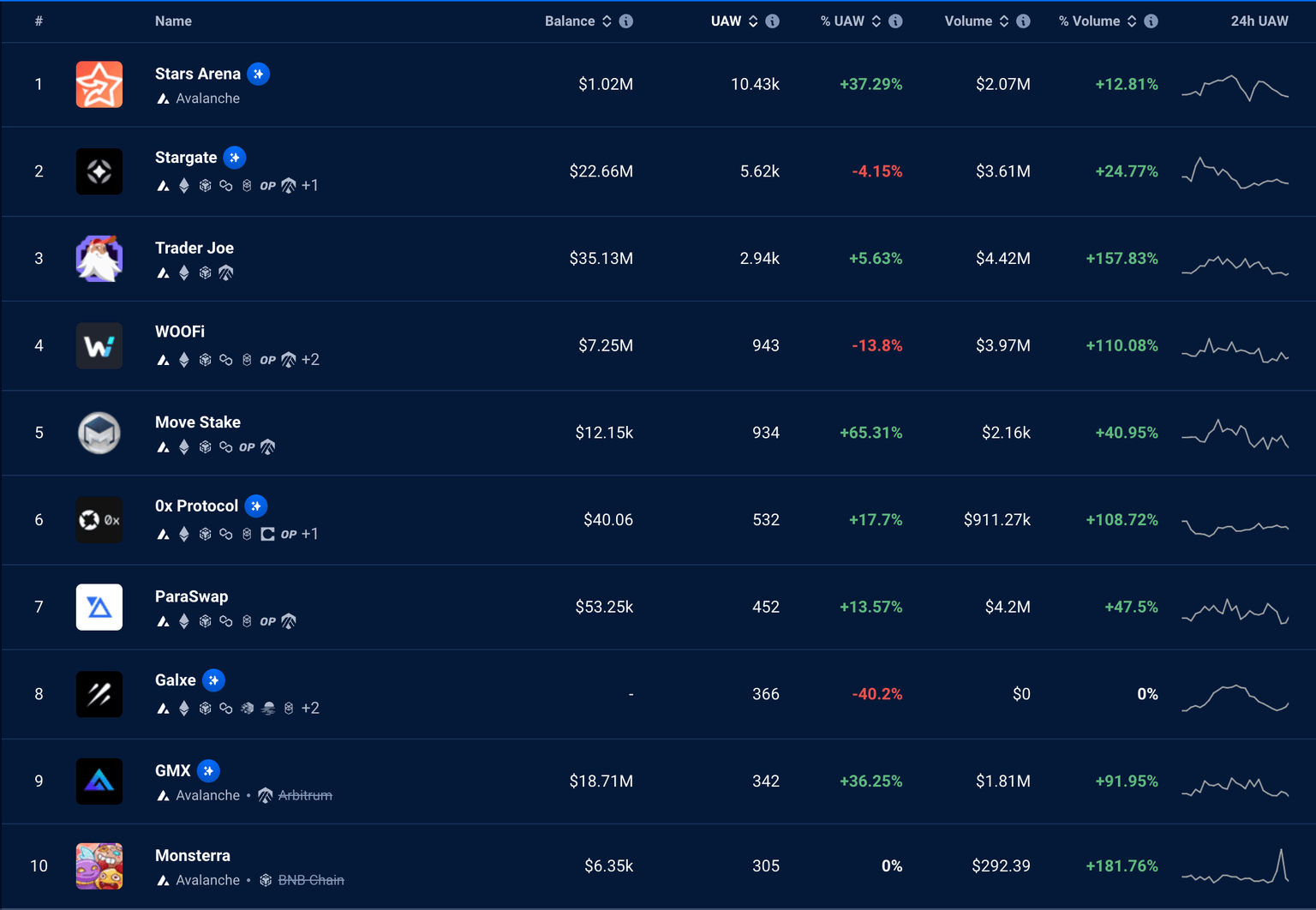

StarsArena, a social media application built on the Avalanche ecosystem, has attracted more than 10,000 users in less than two weeks. In the last 48 hours, the volume grew from $353,000 to $2.1 million, while the number of transactions spiked from nearly 68,000 to 248,000.

In terms of the Unique Active Wallets, StarsArena has become the top decentralized application (dapp), overtaking the likes of Stargate, Trader Joe and others, whose volumes hover in tens of millions of dollars.

DappRadar

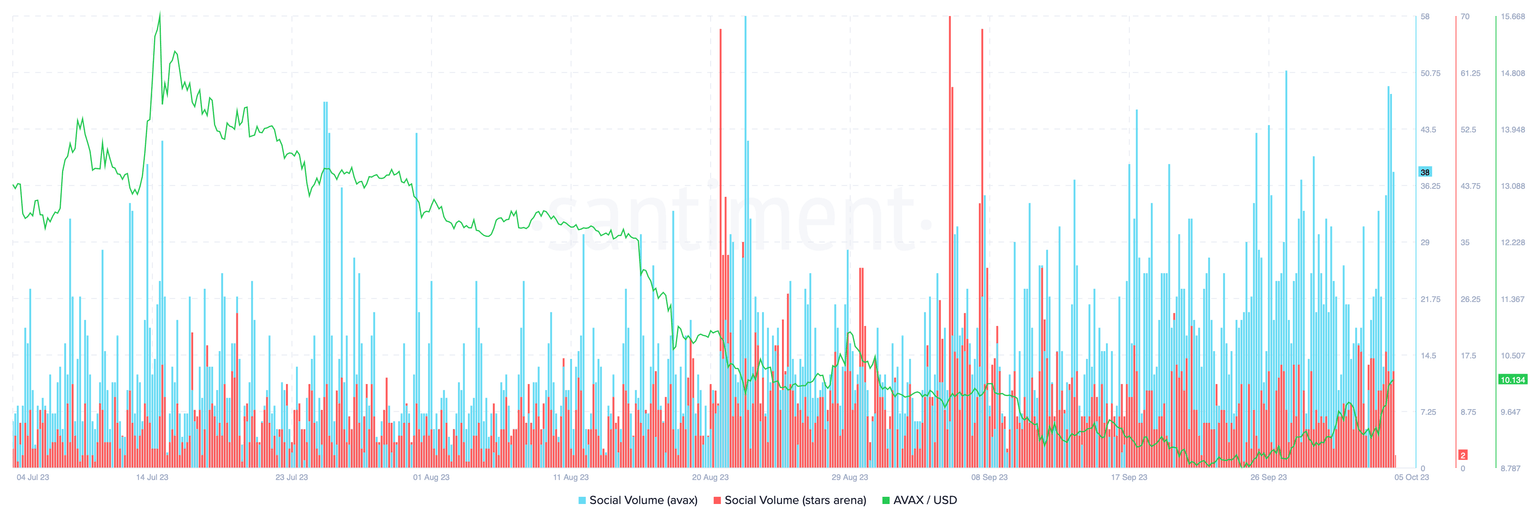

The StarsArena social volume shows upticks in late August and early September. In August and September, the social volume spikes of AVAX coincided with that of StarsArena. Still, at the time of writing, AVAX’s social volume is higher than the social media application, which denotes a shift in the narrative.

AVAX social volume

Since the application uses AVAX as the native token, traders are likely front-running the hype by buying AVAX.

Rightfully so, the on-chain volume of AVAX has hit 209 million, well above its 30-day average of 131 million.

AVAX on-chain volume

Read more: 99% of AVAX holders are in loss ahead of nearly $100 million token unlock

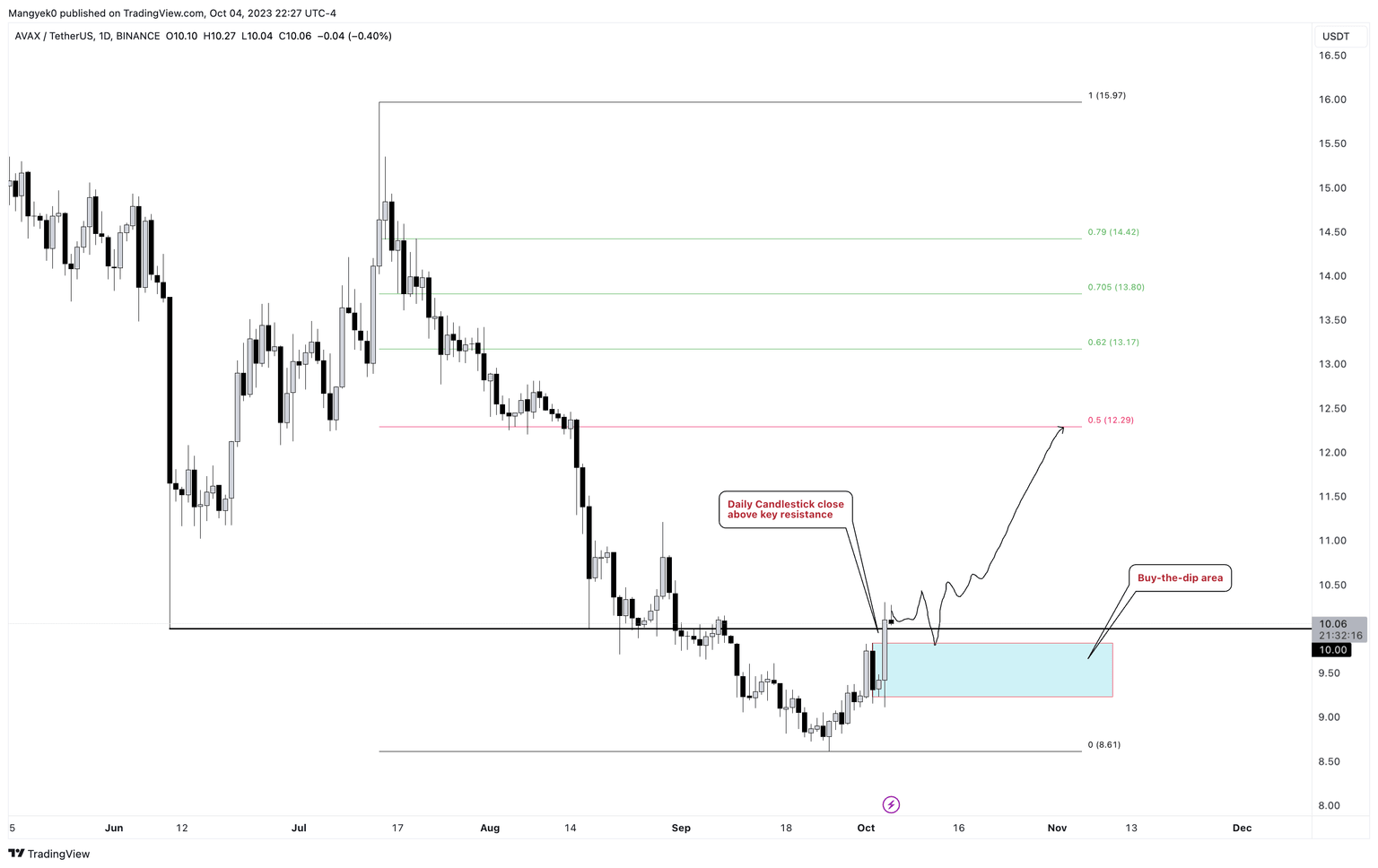

AVAX price clears key hurdle

AVAX price has cleared the $10 psychological level by producing a daily candlestick close above it. This move has created an accumulation zone, extending from $9.23 to $9.84. A pullback into this area will be an opportunity for sidelined buyers that could trigger a 15% bounce to the intermediate hurdle of $11.38.

But the target where traders can book profits is $12.29, which is the midpoint of the 46% crash that AVAX price witnessed between July 14 and September 25.

In a highly bullish case, AVAX price could tag $13.17 and $13.80, which are key take profit levels as well.

AVAX/USDT 1-day chart

On the other hand, if AVAX price fumbles the flip of the $10 psychological level as a support floor, it would signal that bulls are hesitant. A daily candlestick close below the accumulation zone’s lower limit of $9.23, will invalidate the bullish thesis.

In such a case, AVAX price could crash nearly 7% and revisit the September 25 swing low at $8.61.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B10.22.56%2C%252005%2520Oct%2C%25202023%5D-638320815884505451.png&w=1536&q=95)