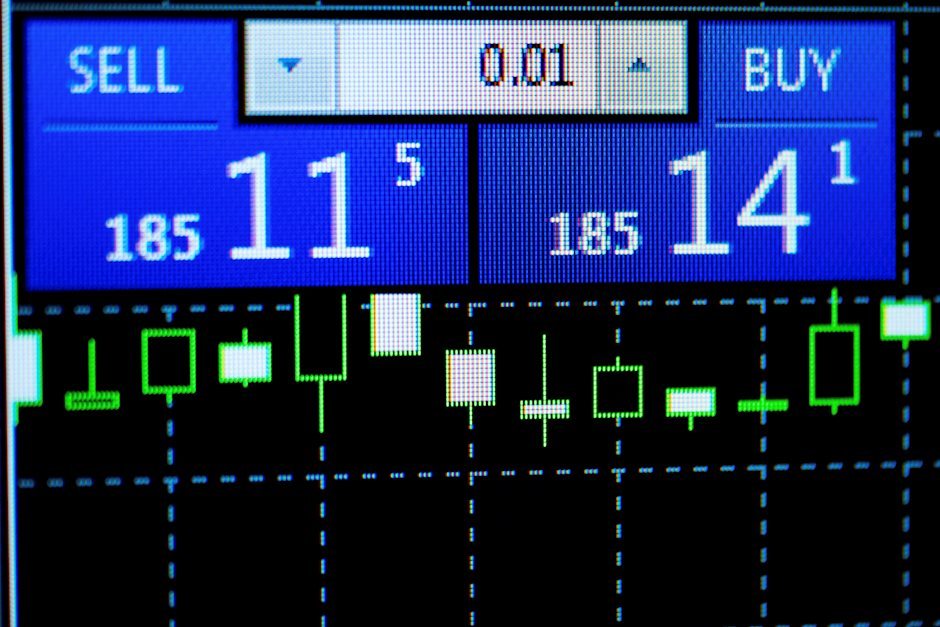

BTC/USD technical analysis: Hourly chart shows selling momentum is slowing

- Crypto sentument still remains weak on Tuesday with Bitcoin trading 0.93% lower.

- There is a divergence on the RSI which can be an indication of slowing momentum.

Bitcoin 1-Hour Chart

There has been some serious selling momentum in the BTC/USD pair and the hourly chart below shows it.

There has been an acceleration lower past the descending wedge pattern and the bottom of the pattern could provide some resistance.

With this extra downside momentum, the market reached an extremely oversold level and now the momentum is wearing thin.

The RSI divergence shows the market is making a lower low wave pattern but the RSI indicator made a few higher lows.

This is just an indication and a break to the upside would need more confirmation like a break back above the 8,220.63 consolidation high

Additional Levels

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.

-637097897213130650.png&w=1536&q=95)