Breaking: Solana price jumps above $50; here's where SOL will go next

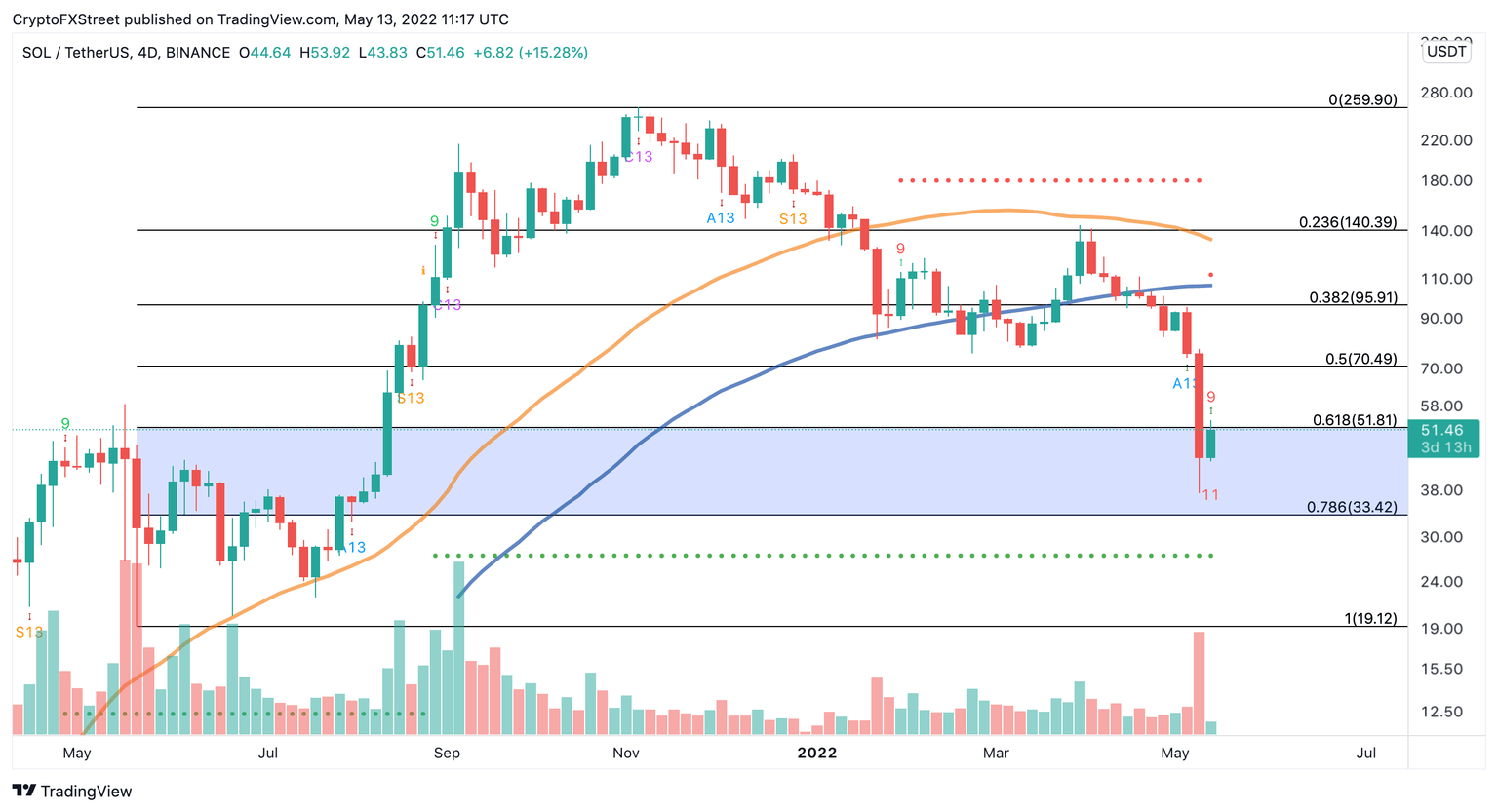

Solana has gained over 42% in market value in the past 24 hours after experiencing a brutal crash to $37. The sudden spike in interest helped SOL regain the psychological $50 level as support. Further buying pressure could push the Layer 1 token even higher as technical indicators turn bullish.

The Tom DeMark (TD) Sequential indicators flashed a buy signal on Solana's daily and four-day chart. The technical formation anticipates that SOL could enter a relief rally that lasts one to four daily candlesticks. The eighth-largest cryptocurrency by market cap would have to print a daily close above $52 to add credence to the optimistic outlook.

Overcoming such a critical resistance barrier could encourage sidelined investors to reenter the market, pushing Solana to $70 or even $80.

SOL 4-day chart

It is worth noting that failing to slice through the $52 level could be perceived as a sign of weakness. The rejection from this level could then accelerate the selling pressure seen behind Solana recently. Sweeping the recent low at $37 would likely see SOL dive to $25 or even $20.

Author

FXStreet Team

FXStreet