Breaking: Cardano price surpasses $1 for the first time in over a month

Cardano price has gained enough bullish pressure to break through the psychological $1 resistance barrier. This is the first time in over a month that ADA is able to overcome such a significant hurdle, allowing it to gain a lot of attention from market participants. Still, the so-called "Ethereum killer" could be bound for a brief correction before it advances further.

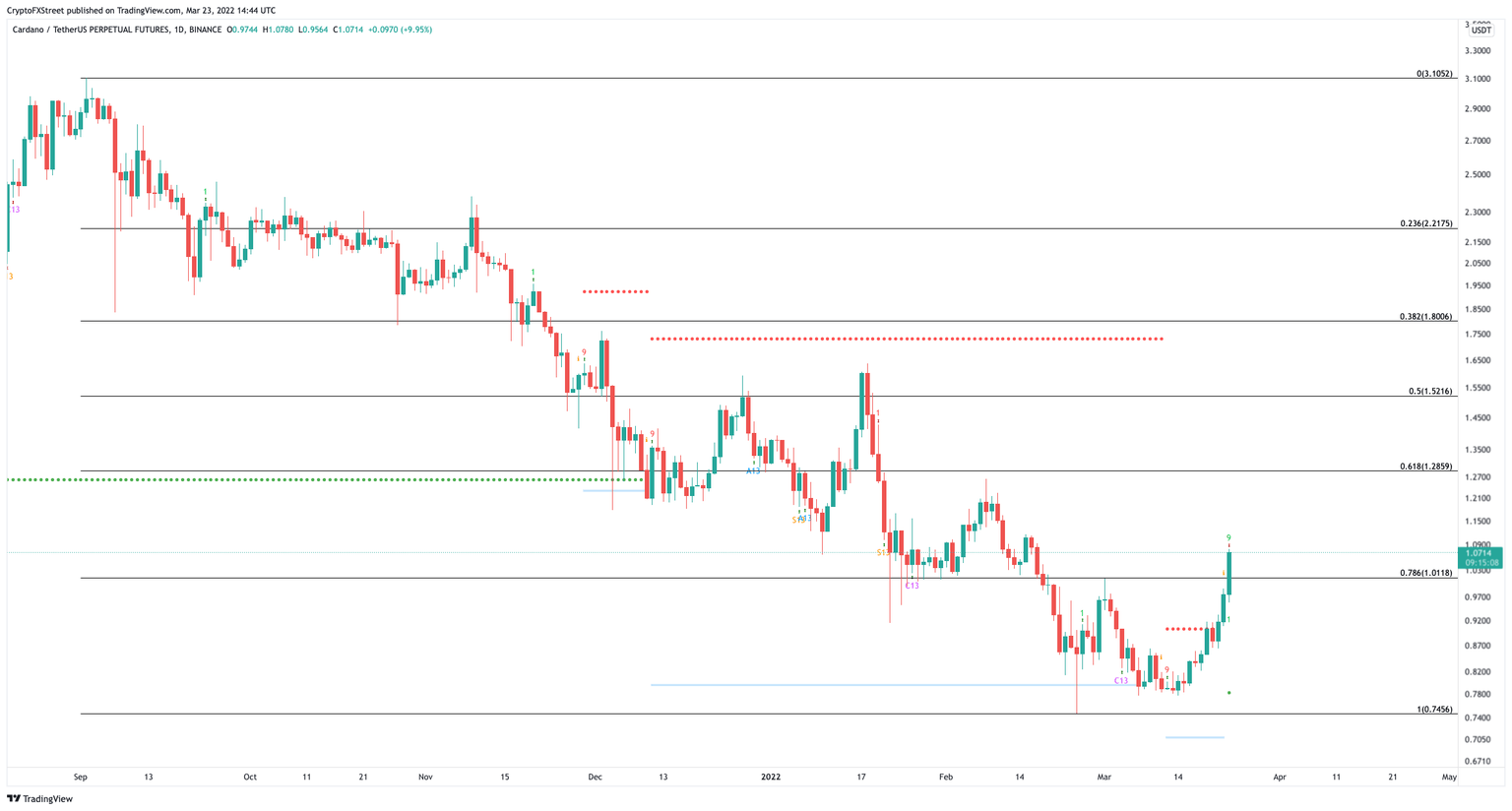

The Tom DeMark (TD) Sequential indicator currently presents a sell signal on ADA's daily chart. The bearish formation developed as a green nine candlestick, which is indicative of a one to four daily candlesticks retracement before the uptrend resumes. A spike in profit-taking could help validate the short-term pessimistic outlook, pushing Cardano price to $0.98 or even $0.96.

ADA/USD daily chart

Despite the short-term bearish thesis that the TD setup presents for Cardano price, there are a few indicators that point to further gains on the horizon. Watch the video below to understand what may invalidate the sell signal on ADA's daily chart and what could be the next bullish target.

Author

FXStreet Team

FXStreet