Breaking: Bitcoin price crashes 14% sending cryptocurrency market into tailspin

- Bitcoin price shows massive sell-off as it slid from $60,900 to $51,541.

- This crash comes after rumors of the US treasury charging several financial institutions for money laundering using cryptocurrency emerge.

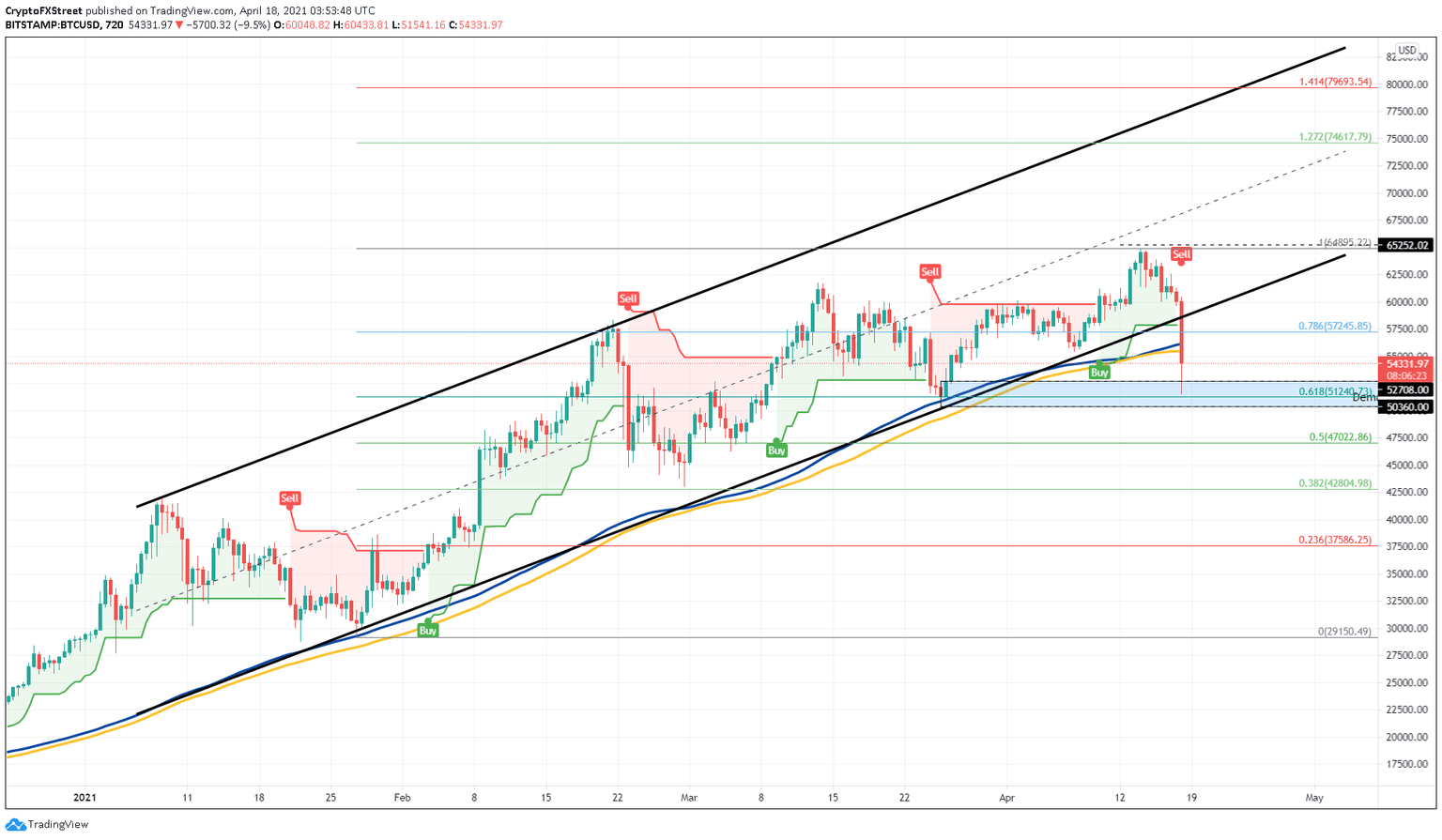

- BTC could bounce around the 61.8% Fibonacci retracement level at $51,240.

Bitcoin price is experiencing a massive sell-off, resulting in a breakout of a technical formation that contained it for more than three months.

Coinbase direct and Bitcoin price crash

On the 12-hour chart, Bitcoin price has shed nearly $9,000, bringing it down to $51,541. Although unconfirmed, this crash seems to coincide with tweets stating that the U.S. treasuries will be cracking down on financial institutions for money laundering using cryptocurrencies.

U.S. TREASURY TO CHARGE SEVERAL FINANCIAL INSTITUTIONS FOR MONEY LAUNDERING USING CRYPTOCURRENCIES -SOURCES

— FXHedge (@Fxhedgers) April 18, 2021

While this crash may be unrelated to Coinbase’s direct listing, Peter Schiff, an avid critic of cryptocurrencies, stated,

Rather than being a watershed moment in the life of Bitcoin, the CoinbaseIPO may have marked the beginning of its death.

The market-wide crash has resulted in $1.72 billion worth of long positions liquidated in the last hour alone. Expanding this range to 24-hours shows that 927,000 traders’ positions worth nearly $10 billion were wiped off, with $68.73 million being the largest liquidation so far.

Bitcoin price witnesses first significant crash February

Bitcoin price has dropped 19% over the last three days and 14% in the past 12 hours. This move has triggered a sell-signal from the SuperTrend indicator as BTC sliced through the 50 and 100 Simple Moving Averages (SMA) on the 12-hour chart/

Areas of interest include the 61.8% and 50% Fibonacci retracement levels at $51,240 and $47,022, respectively.

BTC/USD 12-hour chart

On the flip side, if investors begin to buy the dips, Bitcoin price could turn around and retest the 78.6% Fibonacci retracement level at $57,245.

Due to massive institutional demand, investors could quickly scoop up BTC, which is now selling at a discount.

Author

FXStreet Team

FXStreet