Bovada adds support for Litecoin, bracing LTC price for gigantic liftoff

- Litecoin lands support on Bovada, one of the leading online sports platforms.

- Bovada praises Litecoin for its algorithm that ensures faster deposits and withdrawals.

- LTC has resumed recovery eyeing an upswing to $250.

Bovada, a leading online sportsbook, has added support for Litecoin. The company sent information to its users on March 16, praising LTC for its algorithm that ensures faster deposits and withdrawals.

According to the company, many firms start by accepting Bitcoin (BTC) only to realize Litecoin is better for use in payments, especially due to the lower transaction fees. However, Bovada still clarified the biggest bonuses on the sports platform are in Bitcoin.

Litecoin rebounds from recent support

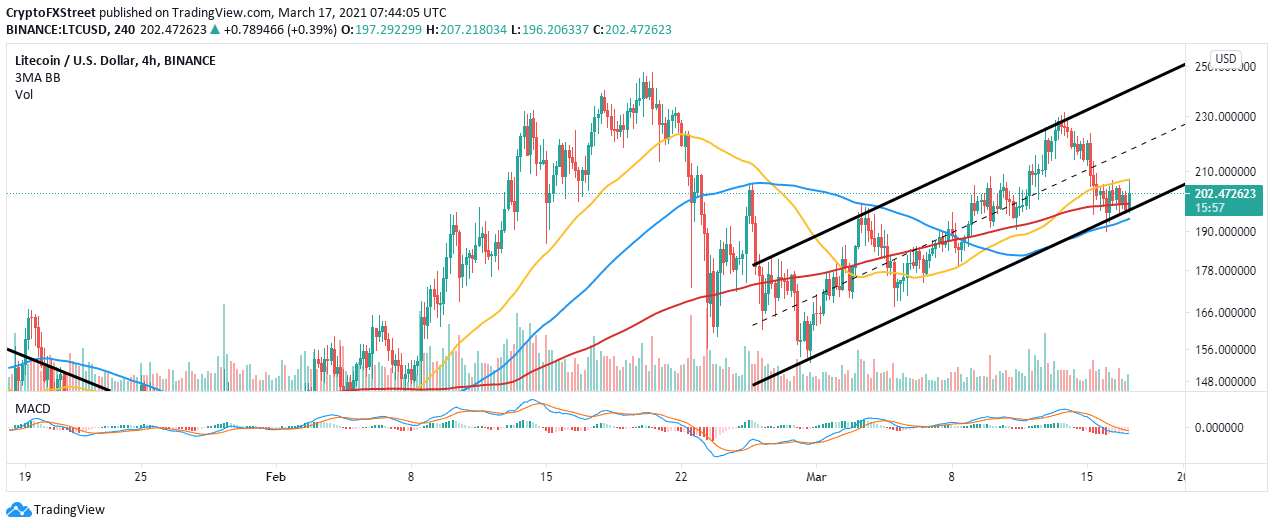

Litecoin is trading within an ascending channel. The channel’s support has been instrumental in providing LTC with the much-needed support, especially after the recent freefall from highs above $230.

At the time of writing, LTC is teetering at $206 as bulls battle the 50 Simple Moving Average resistance. If the price overcomes the hurdle at this level, Litecoin may swing further up for gains eyeing price levels past $230. A break above the middle layer of the channel will validate the upswing.

The Moving Average Convergence Divergence (MACD), although currently in the negative region, is likely to give a bullish signal in the near-term. Traders can look out for the MACD line (blue) cross above the signal line to reinforce the upswing.

LTC/USD 4-hour chart

Looking at the other side of the fence

Litecoin must close the day above the 50 Simple Moving Average (SMA) to ascertain the uptrend. If the resistance remains intact, LTC will trigger losses toward the channel’s lower boundary. If push comes to shove and Litecoin slides under the channel, we will likely encounter a downswing toward $150.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren