Bittensor, NEAR and other AI tokens extend gains as OpenAI, Oracle and NVIDIA announce Stargate UAE AI campus

- OpenAI, Oracle and NVIDIA are joining forces to build an Artificial Intelligence campus in the UAE.

- Nvidia CEO Jensen Huang said that Stargate UAE is a bold move that reflects the country's commitment to shaping the future of AI.

- Bittensor approaches $500 as cryptocurrencies broadly recover, led by Bitcoin's surge to new all-time highs near $111,880.

- NEAR is on the cusp of a major breakout above a descending trendline, with short-term and mid-term targets at $3.50 and $6.00, respectively.

Technology titans OpenAI, Oracle, Nvidia and Cisco have announced a groundbreaking collaboration that will see them establish a Stargate Artificial Intelligence (AI) campus in the United Arab Emirates (UAE).

The news comes amid strong sentiment in the AI sector, with tokens like Bittensor (TAO) and Near Protocol (NEAR) extending gains on Thursday.

AI giants join forces to build a Stargate AI campus in the UAE

The Stargate AI campus project in the UAE, announced on Thursday, could mark a significant milestone in the global AI race, bringing together four technology heavyweights, including OpenAI, Oracle, Nvidia and Cisco.

This massive development, which will feature a 5-gigawatt AI campus, spanning 10 square miles in Abu Dhabi, underscores the UAE's ambition to position itself as a global hub for artificial intelligence.

The project's first phase includes a 200-megawatt AI cluster likely to go live in 2026, with plans already in place for further expansion to meet the growing demand for AI compute power.

As highlighted by Tech and investment analyst Amit on X, Nvidia's role in this project is particularly notable, as the company continues to dominate the AI hardware space with its GPUs.

BREAKING: OPENAI & NVIDIA ANNOUNCE "UAE STARGATE"

— amit (@amitisinvesting) May 22, 2025

- 5 Gigawatt UAE-US AI campus in Abu Dhabi

- 200 megawatt AI cluster expected to go live in 2026

- Oracle, Softbank, and Cisco will be participating to build datacenters

I cannot explain how bullish this is for $NVDA.

OpenAI… pic.twitter.com/CLrer2N4Tl

The announcement drew attention from high-profile figures, with Nvidia CEO Jensen Huang, OpenAI CEO Sam Altman, SoftBank CEO Masayoshi Son, and Cisco President Jeetu Patel present in the UAE during the unveiling ceremony.

Their presence, alongside a state visit from United States (US) President Donald Trump, signals this collaboration's geopolitical and economic significance.

"AI is the most transformative force of our time," Nvidia CEO Jensen Huang said in a press release on Thursday. "With Stargate UAE, we are building the AI infrastructure to power the country's bold vision – to empower its people, grow its economy, and shape its future," he added.

Bittensor, NEAR surge amid positive sentiment

The AI sector in the cryptocurrency space has continued to gain traction, with tokens like Bittensor, Near Protocol, Internet Computer (ICP) and Render (RNDR) reaching for higher highs.

Sentiment in the AI space remains strong with developments like the Stargate UAE campus, signaling immense potential in shaping the future of AI.

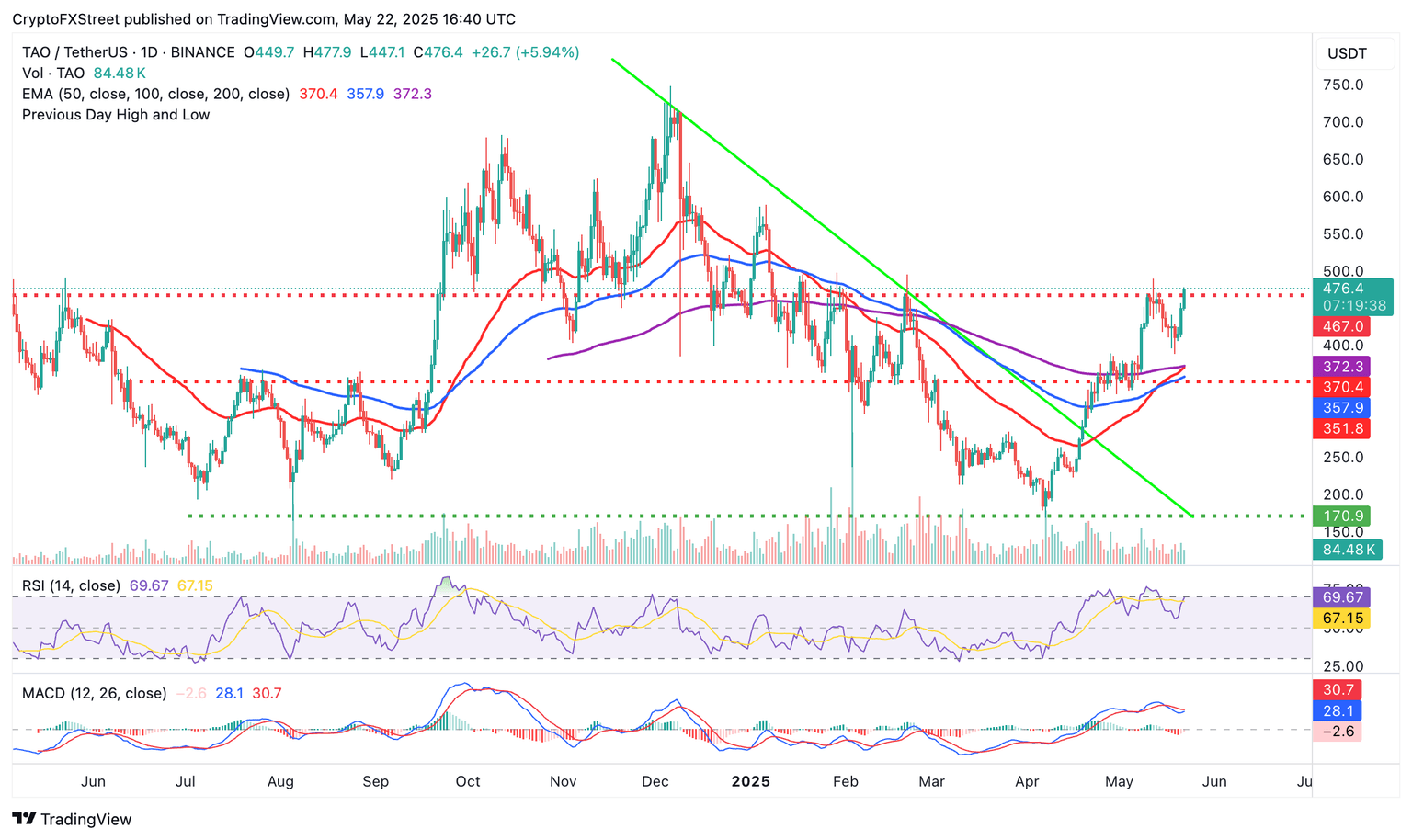

For instance, Bittensor is up over 5% on the day, trading at around $474 at the time of writing. A breakout toward the critical $500 level seems imminent, with a potential golden cross pattern likely to encourage traders to buy TAO, effectively increasing demand and bullish momentum.

A golden cross occurs when a shorter-term moving average crosses above a longer-term one. The daily chart below shows that the 50-day Exponential Moving Average (EMA) is about to flip the 200-day EMA at around $372.

TAO/USD daily chart

Technical indicators like the Moving Average Convergence Divergence (MACD) support the bullish structure above the center line. A bullish crossover in the MACD could boost the bullish momentum in the short term.

On the other hand, NEAR's price shows strong bullish potential as it approaches a potential breakout above the descending trendline at approximately $3.00.

The MACD indicator confirms steady bullish momentum with a positive crossover of the MACD line (blue flipping above the signal red line).

The RSI, at 59.61, is above the 50 midline and moving toward the overbought threshold of 70, which affirms the uptrend's strength and room for bulls to wiggle.

NEAR/USD daily chart

A breakout above the descending trendline could target $3.50 (200-day EMA) in the short term, with $6.00 as the mid-term goal, provided momentum holds.

Key support areas lie at the 100-day EMA ($2.96) and 50-day EMA ($2.70) if a reversal occurs, potentially trimming the gains accrued since the April 7 crash to $1.84.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren