Bitcoin whales selling to institutions as grayscale adds 7,188 BTC in 24 hours

A huge sell wall at $20,000 may see a major transfer of wealth from whales to institutions based on current data.

Bitcoin (BTC) whales appear to be selling to institutions as the supply squeeze heightens below $20,000.

Data from various sources shows that while more BTC returned to exchanges this week, largescale buyers are still creating more demand than supply can meet.

Exchange inflows and Grayscale buy-ins

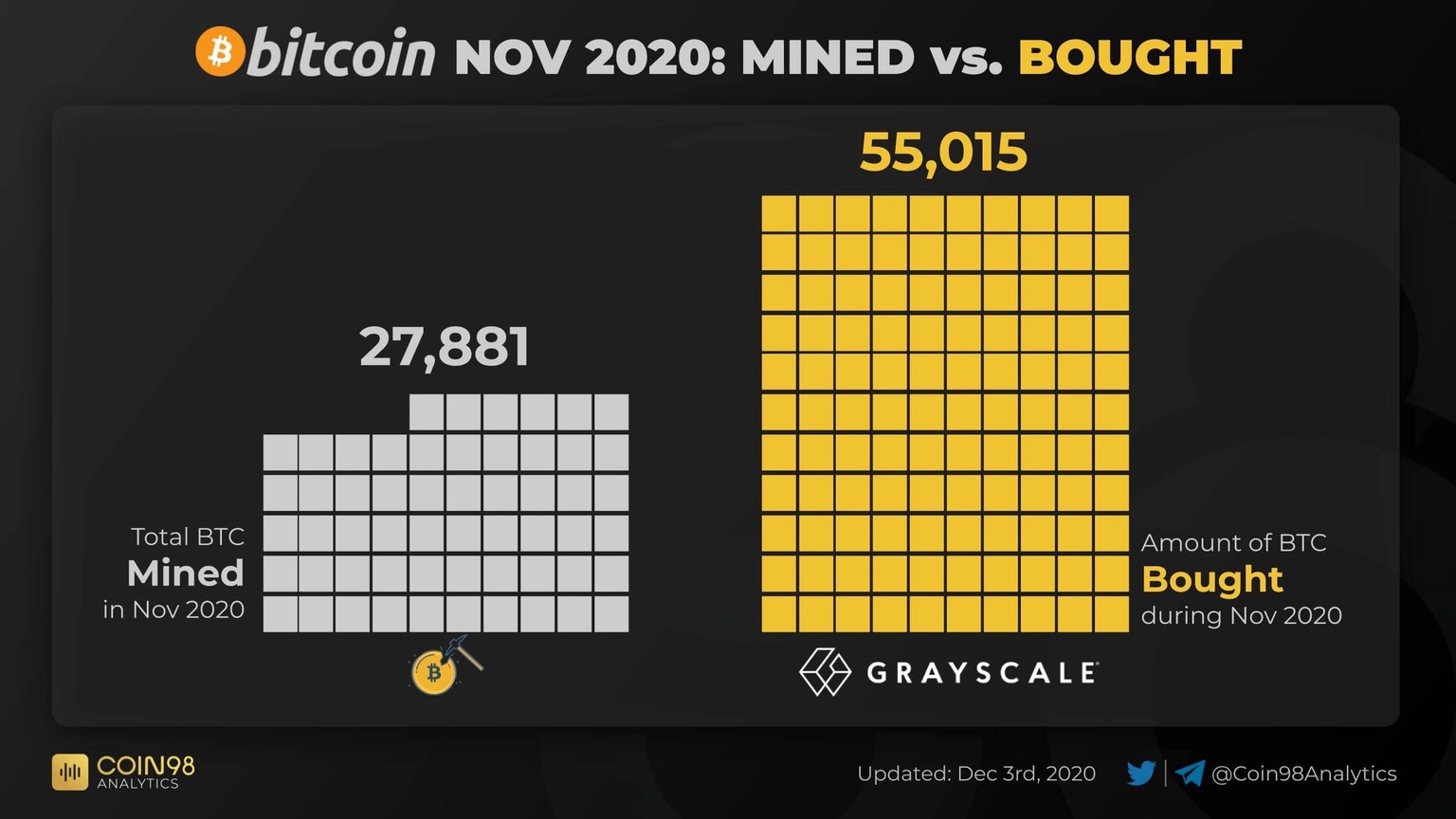

Statistics from on-chain analytics service Coin98 confirmed that investment giant Grayscale bought twice as much Bitcoin as miners could create in November.

Grayscale Bitcoin buys versus flow in November 2020. Source: Coin98/ Twitter

Together with Square and PayPal, the other major corporate actors requiring more and more BTC stocks, Grayscale is creating a supply imbalance to which price gains are the only logical outcome.

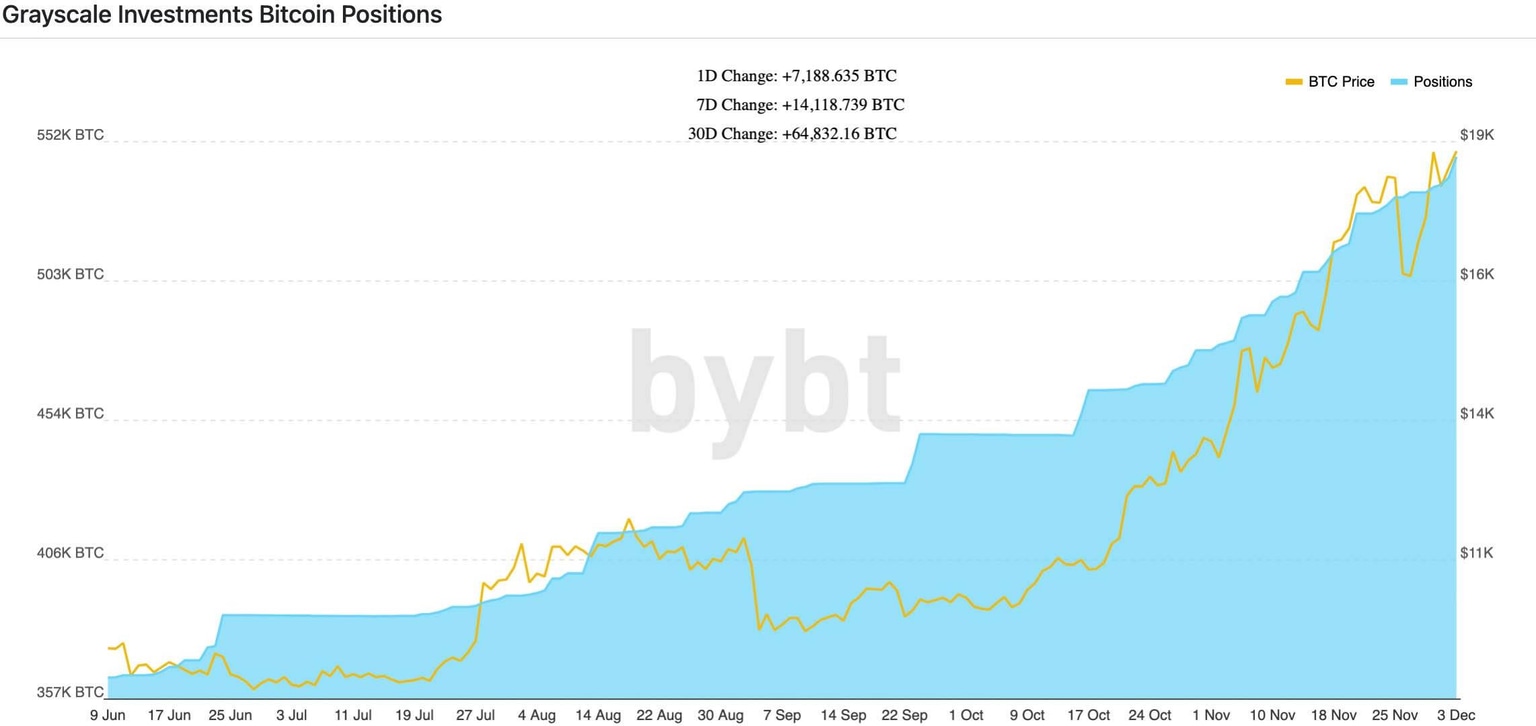

This scenario set the stage for December, with Grayscale buying continuing and totaling over 7,000 BTC in just 24 hours as its Bitcoin Assets Under Management now exceed 10.5 billion as of Dec. 4.

Grayscale Bitcoin buys 6-month chart. Source: Bybt

Simultaneously, this week saw Bitcoin break all-time highs and challenge $20,000, only to encounter massive selling pressure.

Having bounced off lows of $18,100 and returned to circle $19,000, BTC/USD looks primed for another test of the seminal level, but selling dynamics remain unusual. With sell walls at $20,000 still firmly in place, longtime hodlers and whales looking to exit have reliable buyers in the form of Grayscale and other institutions.

Bitcoin sell walls versus BTC/USD on Dec. 4. Source: TensorCharts

Evidence points to increasing inflows from whales to exchanges this week, something which coincided with the $20,000 attempt. Should selling already be keeping prices down, BTC should thus be finding its way from whales to the stronger hands of Grayscale and its clients.

Bitcoin exchange holdings 3-year chart. Source: CryptoQuant

CNBC: The wealthy are "loading up" on Bitcoin

The phenomenon has even caught the attention of mainstream media.

“Total accounts buying more than $1 million worth of Bitcoin and then moving it off of exchange has skyrocketed,” CNBC reported on Thursday.

“That’s up 180% from 2017 to this year. Analysts say that signals wealthy investors are loading up on Bitcoin and then storing it offline to store somewhere a little more secure.”

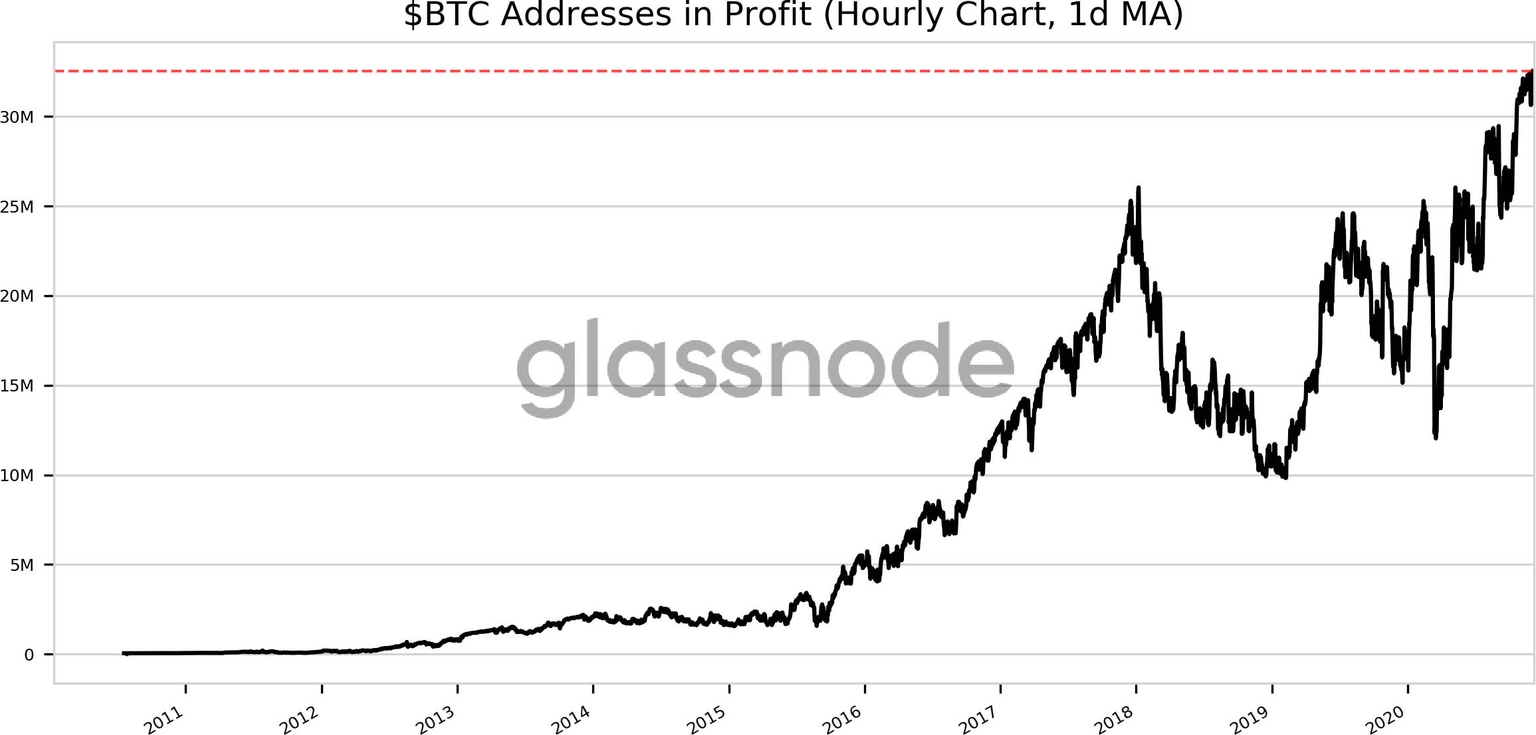

Bitcoin addresses in profit historical chart. Source: Glassnode/ Twitter

At the same time, total Bitcoin addresses in profit versus when coins were placed in them hit new record highs on Friday, according to the latest data from Glassnode.

On Wall Street, meanwhile, news on Thursday came that Bitcoin and hundreds of altcoins would compose new cryptocurrency indexes by S&P Dow Jones Indices from January 2021.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.