Bitcoin whales 'bought the dip' as orders for $100K or more hit all-time highs

Bitcoin (BTC) whales and institutions alike have made the most of the recent BTC price "dip" by buying big, data suggests.

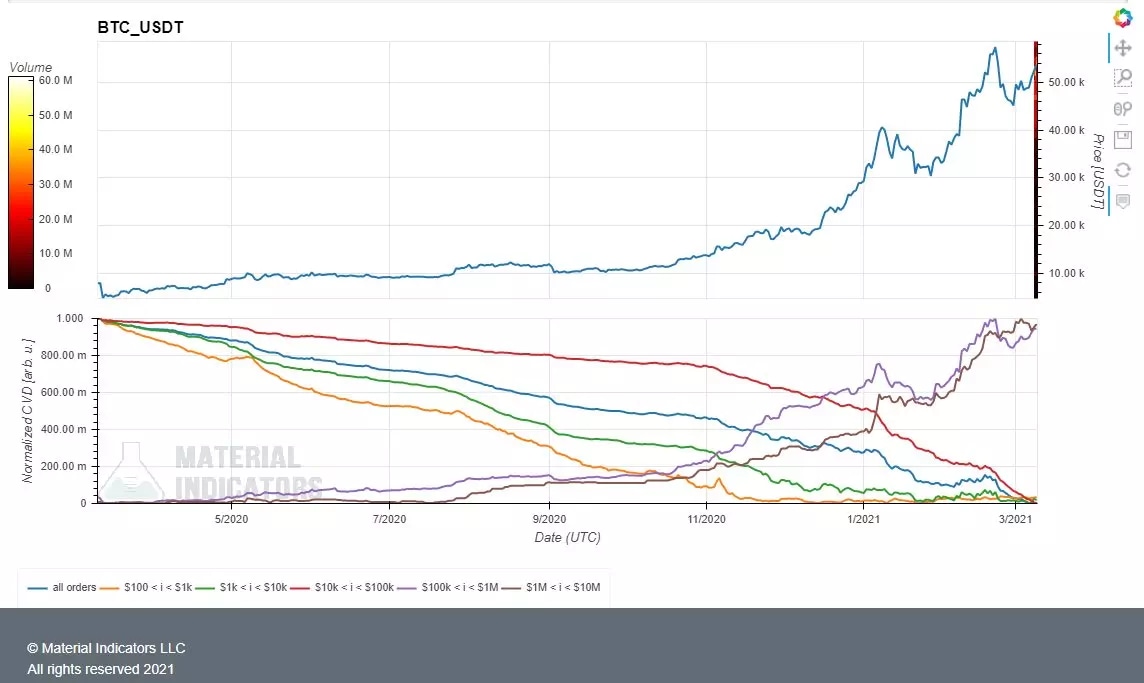

In an update on March 9, on-chain analytics service Material Indicators noted that buy orders of $100,000 and higher on Binance — the biggest cryptocurrency exchange by volume worldwide — are reaching all-time highs.

Big Bitcoin buyers don't hesitate

In stark contrast to orders worth less than $100,000, larger buys are more frequent than ever before in Bitcoin's history.

Smaller allocations have plummeted in 2021, matching an existing narrative that institutions are scooping up liquidity on exchanges which surfaced during the recent bull run.

"The $100k - $1M class is now also about to make a new ATH," Material Indicators commented on Twitter alongside a chart.

"Meaning, they bought the dip."

BTC/USD vs. order volume chart. Source: Material Indicators/ Twitter

Material Indicators previously voiced concerns about this week's price rise, arguing that whales could "sell into" the surge, producing a repeat of the run to $58,000 all-time highs and subsequent 25% correction.

While this has so far not come to pass, analysts also noted that macroeconomic factors were also having a different impact to that which was expected.

Whale orders declined after news that the United States' $1.9 trillion stimulus package had passed the Senate, while China providing support to tech stocks had the opposite effect. As Cointelegraph reported, tech had led a dramatic change of fortunes on equities markets.

$54,500 surge followed major Coinbase buy

Later, meanwhile, another batch of nearly 12,000 BTC left professional trading platform Coinbase Pro as an example of major BTC allocations continuing at current prices.

"That happened just before the recent surge in price. Nice coincidence," quant analyst Lex Moskovski commented on data from fellow on-chain analytics resource Glassnode.

BTC/USD hit two-week highs of $54,500 earlier on Tuesday.

BTC/USD vs. Coinbase outflows chart. Source: Glassnode/ Twitter

Zooming out, the increasing institutional involvement around Bitcoin could fuel its entry as a standard for investors alongside traditional plays.

"We do think it will behave, actually, I would say more like the fixed income markets, believe it or not," Cathie Wood, founder and CEO of ARK Investment Management, told CNBC this week.

Binance orderbooks show the next major BTC/USDT resistances for the bulls are around $58,000 — the all-time high — and $59,500.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.