Bitcoin traders play waiting game ahead of CPI data and the Merge

- Bitcoin briefly hit the $22,000 level before retreating to the $21,700 level in the recent correction.

- Bloomberg analysts believe traders are awaiting US inflation data and a successful completion of the Ethereum Merge, before making a move.

- Analysts predict a comeback in Bitcoin price, identified a bullish engulfing candle in the BTC price chart.

Bitcoin price witnessed a slow recovery from its slump as investors waited for the release of CPI data. Analysts believe Bitcoin price could witness a reversal of its downtrend once there is a successful completion of the Merge.

Also read: Ethereum Merge could break the internet according to Preston Van Loon

Bitcoin price rally cools off ahead of CPI data

Bitcoin’s price scaled $22,000 briefly before retracing the $21,700 level. Analysts at Bloomberg believe Bitcon’s price trend can be explained by the anticipation surrounding the release of CPI data and the upcoming Merge.

Ethereum’s Merge and the transition to proof-of-stake is a milestone event in the crypto ecosystem. The community is likely to witness a change in the way Ethereum is created and a massive scale up in the ETH blockchain’s adoption. A hard fork is likely, according to Proof-of-Work supporters, this could result in an airdrop of PoW tokens for PoS holders.

The Merge and resulting consequences could therefore shift trader’s perspective in the crypto ecosystem. The release of CPI data and the Merge could therefore influence Bitcoin’s price. Inflation figures and the upgrade in the Ethereum ecosystem could result in volatility in Bitcoin price trend.

Higher than expected US inflation could harden traders’ expectations and result in a decline in Bitcoin price. Similarly, any roadblock or challenge faced by the Ethereum blockchain could hurt trader sentiment and result in decrease in capital inflow to the crypto ecosystem.

Analysts identifies bullish signal in BTC price chart

Phoenix Ashes, a pseudonymous crypto analyst evaluated the Bitcoin price chart and noted that there is no bullish divergence in sight. The analyst commented on Bitcoin’s price chart in a recent tweet:

We didn't get that bullish divergence, tho we came close

— Phoenix (@Phoenix_Ash3s) September 11, 2022

Just like we did in 2019

What we do get is a bullish engulfing weekly candle

Just like we did in 2019

History still rhymes a whole damn lot $BTC #Bitcoin pic.twitter.com/PZvtzJNqYZ

BraveNewCoin liquid index for Bitcoin

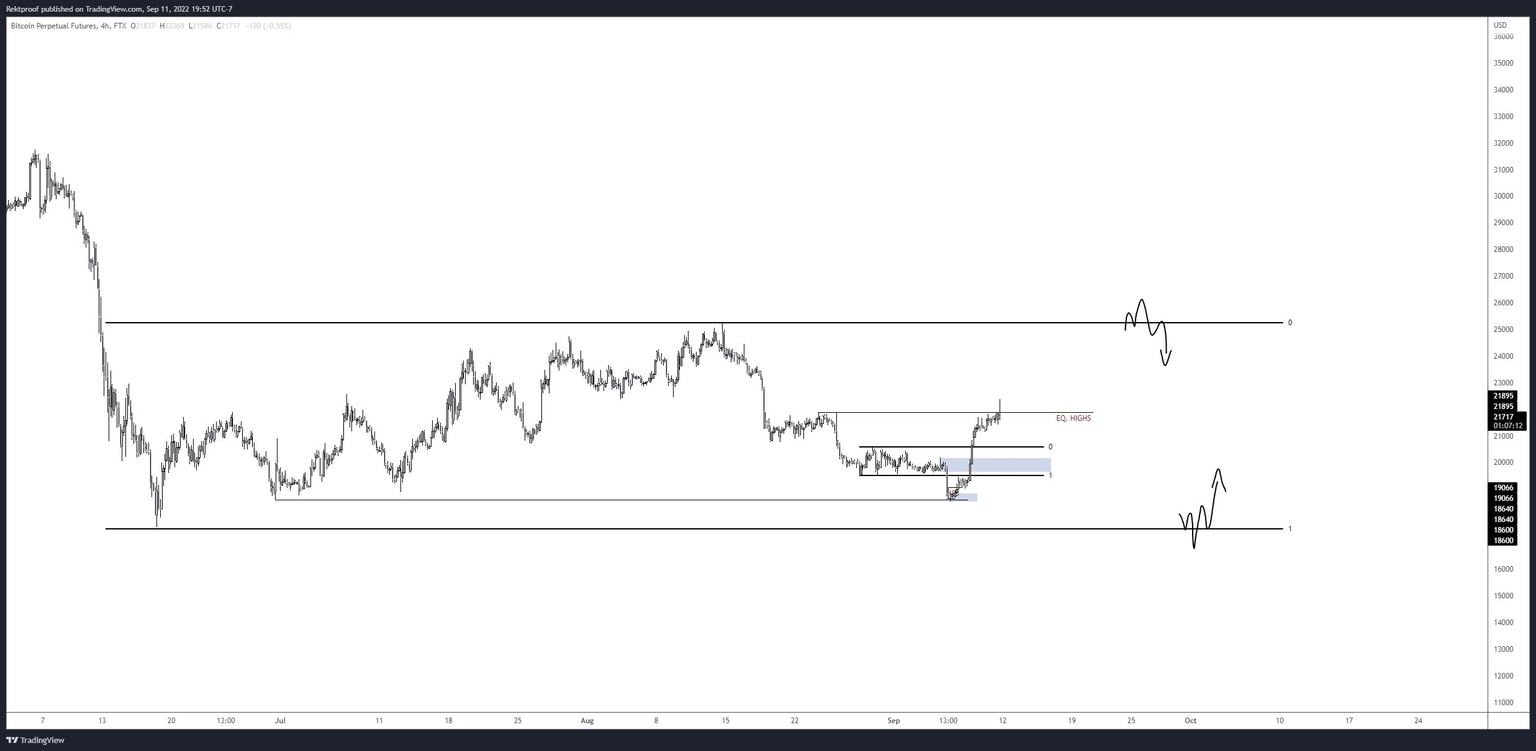

RektProof, a crypto trader argues that Bitcoin price could retrace lower, to the $18,600 level before its rally. The analyst has therefore identified two key areas of interest to open shorts. The $20,000 level and the $26,000 level are the two key points on Bitcoin’s price trend where the analyst expects a correction, therefore an opportunity for a short.

Bitcoin Perpetual Futures

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.