Bitcoin speculators hit all-time lows as Grayscale says BTC like 2016

Bitcoin (BTC) hodlers are beating out speculators in a sign that the cryptocurrency’s bull run is “just beginning,” data suggests.

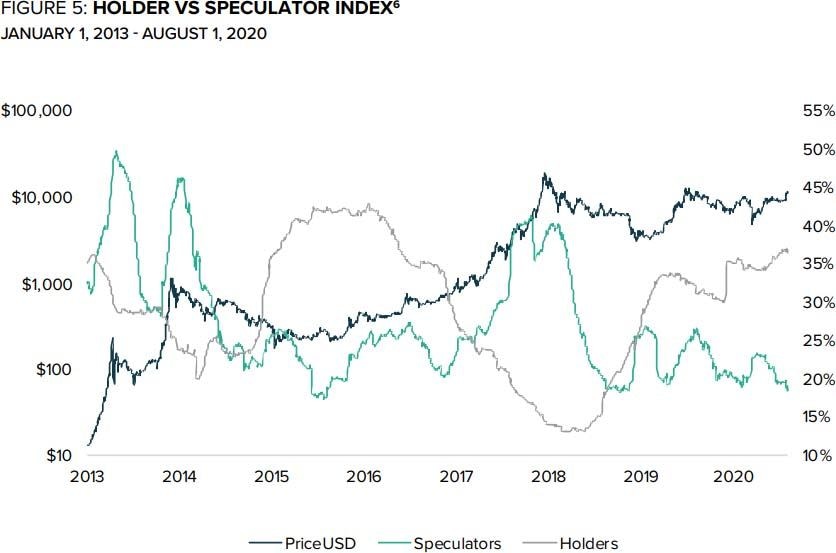

Part of asset manager Grayscale’s Valuing Bitcoin report issued this month, the Hodler vs. Speculator Index (HSI) is showing highly bullish divergence.

Grayscale notes “similar structure to early 2016”

HSI measures Bitcoin activity from wallets in order to give an impression of how network participants are using BTC — and market sentiment as a result.

The data, compiled from on-chain analytics resource Coin Metrics, labels coins which have not moved in one to three years as “hodler” coins. “Speculator” coins are those which have moved at some point in the past 90 days.

The resulting comparison shows that, as of August, speculator coins were disappearing, while hodler coin numbers were spiking.

“This chart looks potentially promising for Bitcoin, as there are a growing number of Holders relative to a small number of Speculators in the market,” author Phil Bonello commented.

“Notice the similar structure to that of early 2016.”

Bitcoin Hodler vs. Speculator Index historical chart. Source: Grayscale/ Coin Metrics

As Cointelegraph reported, analysts have already argued that the current state of Bitcoin echoes 2016, roughly 18 months before its all-time highs of $20,000.

With a raft of technical indicators all flashing green, the bullish potential has not gone unnoticed by many.

“Percent of Bitcoin ‘Holders’ peaking and ‘Speculators’ bottoming, another great indicator that the Bull run is just beginning,” Charles Edwards, founder of fellow asset manager Capriole, added on Twitter about HSI.

1-year dormant BTC beats record

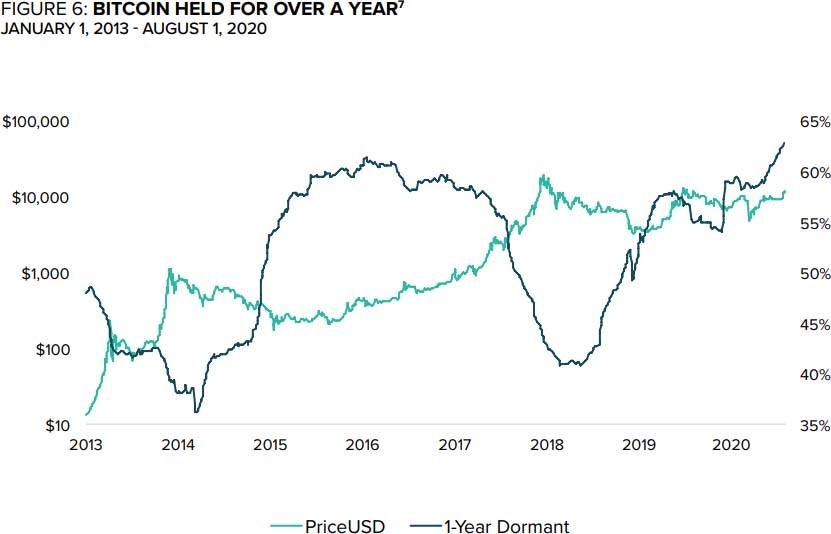

The Grayscale report meanwhile delivers further insights into the strength of Bitcoin investor resolve in 2020.

Despite highly varied price action over the past twelve months, there is a keen desire to keep BTC as an investment and not trade or sell it at any price up to the current yearly high of $12,000.

“It’s also worth noting that the Bitcoin blockchain reveals that there has never been a higher level of Bitcoin owned for more than one year,” Bonello notes.

“This metric indicates a strong conviction in Bitcoin by its current investor base. While this is a supply-side metric, it also demonstrates the demand for Bitcoin’s use case as a store of value — rather than trading, it appears investors are interested in holding Bitcoin despite its volatility.”

Bitcoin 1-year dormant supply historical chart. Source: Grayscale

The store-of-value proposition continues to gain publicity this month as MicroStrategy, which purchased over 21,000 BTC in mid August, confirmed it had upped its holdings to the equivalent of over $400 million.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.