Bitcoin recovery faces major challenges ahead

BTC holds its higher low, but heavy supply zones above signal a decisive battle ahead.

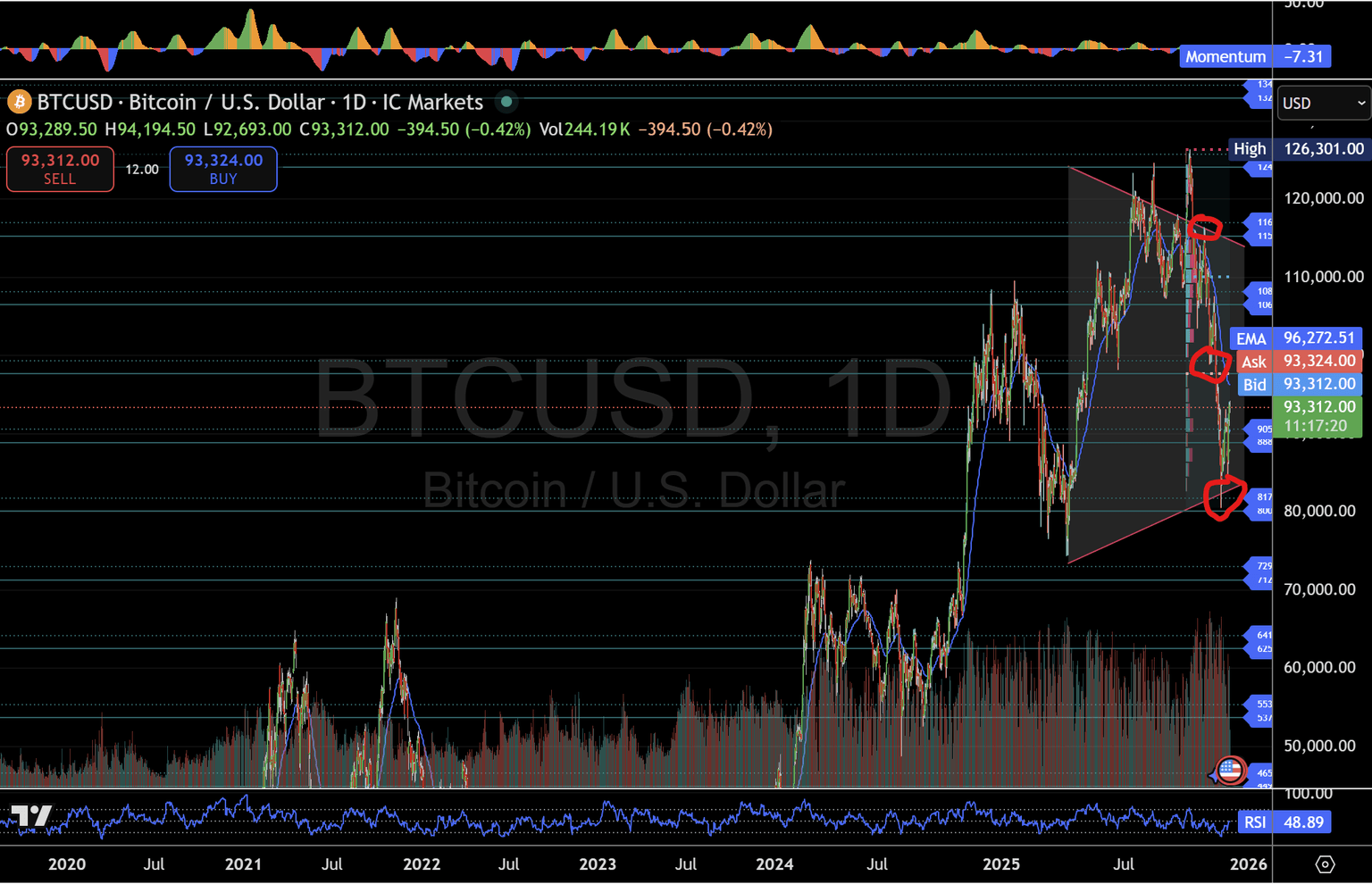

Bitcoin (BTC/USD) continues to stabilise after a 34% drawdown from the 125,755 – 124,075 Macro S&D High-Time-Frame (HTF) supply zone — a region that triggered one of the most violent unwinds in the crypto market this year.

Despite the sharp selloff, the long-term trend structure remains intact. Bitcoin has so far defended the 81,774–80,094 MacroStructure demand zone with precision, forming a higher low on the daily and maintaining the internal structure needed for the MacroStructure demand zone with precision, forming a higher low on the daily broader cyclical continuation.

But the path higher is now littered with thick supply blocks, micro-resistances, and HTF VAL checkpoints that the bulls must reclaim if they aim to resume control.

MacroStructure S&D: What the system is projecting ahead of price

The Macro S&D system identifies the following critical zones ahead of price — and these zones are already dictating market behaviour before any narrative catches up:

1. Immediate headwind: 97,686 – 99,366 (daily supply zone + VAL retest)

Circled on the chart, this zone is the first major challenge for the recovery.

It combines:

- HTF Value Area Low (VAL).

- MacroStructure Daily Supply block.

- Confluence with EMA cluster near 96,285.

This is the battlefield where trend continuation or trend failure will be determined.

2. Secondary barrier: 108,162 – 108,482 (daily supply)

This zone is unavoidable if BTC breaches $100k.

It also aligns with the macro down trendline price drawn from the all-time high, adding confluence from both diagonal structure and horizontal supply.

3. Major HTF supply cap: 115,278 – 116,699

Even if Bitcoin clears the first two obstacles, this supply block acts as the upper ceiling of the current triangle structure.

Breaking this would flip long-term momentum back into bullish expansion.

Price action context: Structure is tightening, not breaking

Higher lows hold (for now)

BTC’s bounce from 81,774 was clean and structurally significant:

- RSI shows no sign of breakdown.

- Volume remains consistent, not capitulative.

- Buyers stepped in at the trendline support.

This confirms the system’s strength:

Structure projected the low before the downtrendline ever touched it.

But momentum is still bear-tilted

The momentum indicator (-7.29) shows the recovery is not driven by strength — it’s a relief leg inside a larger correction.

For the bullish case to gain traction:

- Momentum must turn positive

- Price must reclaim 97,686 – 99,366

- Volume must increase above the 30-day average

Where Bitcoin goes next (scenarios)

Bullish continuation scenario

Triggered only if BTC closes above 99,366 (upper bound of first supply).

Targets:

- 100,000 psychological + order-flow magnet

- 108,162 – 108,482 (Daily Supply test)

- 115,278 – 116,699 (HTF supply; the ultimate resistance)

Break above 116k = retest of the All-Time High supply block near 125k.

Bearish rejection scenario

If BTC is rejected at 97,686–99,366, the price may unwind sharply.

Downside targets:

- 88,890 – 90,570 (Intermediate demand zone)

- 81,774 – 80,094 (Primary MacroStructure demand)

- Structural breakdown below 80k risks opening:

- 72,978 – 71,298

- 64,182 – 62,502

Breaking 72k would mark a macro shift, invalidating the higher-low structure.

Market reality: Fundamentals are now aligning with the structure

The system is projecting levels ahead of the fundamentals, but the macro narrative is now starting to catch up:

1. Liquidity contraction continues into Q1 2026

ETF flows have slowed dramatically.

Treasury yields remain elevated.

Risk assets are struggling across the board.

2. Crypto leverage reset but not fully flushed

Funding rates normalised, but large accounts remain defensive.

3. BTC dominance resilience

Despite the selloff, BTC dominance barely retreated — a sign institutional flows haven’t exited the asset class, only repositioned.

These factors support the point that:

MacroStructure S&D reveals divergence and market turning points before they happen.

Price is now reacting exactly where the system projected months in advance.

Summary: BTC recovery faces its toughest test yet

Bitcoin is attempting to rebound, but it now approaches the most important supply cluster of Q4 2025.

Until BTC reclaims 99,366, this remains a relief rally, not a confirmed trend reversal.

The system makes the structure clear:

- Higher low is intact.

- Major supply zones above.

- Momentum still neutral-to-bearish.

- Decision point = 97,686 – 99,366.

This is where Bitcoin’s next multi-week direction will be decided.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.