Bitcoin price quickly rebounds to reach $41,000 as market cap passes Tencent

Bitcoin even goes beyond Tesla's market cap for a short time as bulls suggest the upwards momentum is not done even at $40,000.

Bitcoin (BTC) returned to $40,000 on Jan. 8 as another price consolidation period ended characteristically briefly.

Cryptocurrency market overview. Source: Coin360

Data from Cointelegraph Markets, Coin360 and TradingView showed BTC/USD quickly rise to recapture the psycholigically significant price level during trading on Friday.

After a 9% fall following runs to all-time highs the day before, Bitcoin managed to stay lower only for a matter of hours before bullish momentum returned. Thereafter, the largest cryptocurrency not only matched its all-time highs, but delivered a new one — $40,087.

BTC/USD 1-minute candle chart (Bitstamp). Source: TradingView

"Seems we only dump to shake out the weak hands these days," a popular social media trader summarized on the day.

Big player market caps topple to BTC

Bitcoin also beat the market cap of Chinese giant Tencent and briefly passed "darling" tech firm Tesla as it rose to $41,000 per coin.

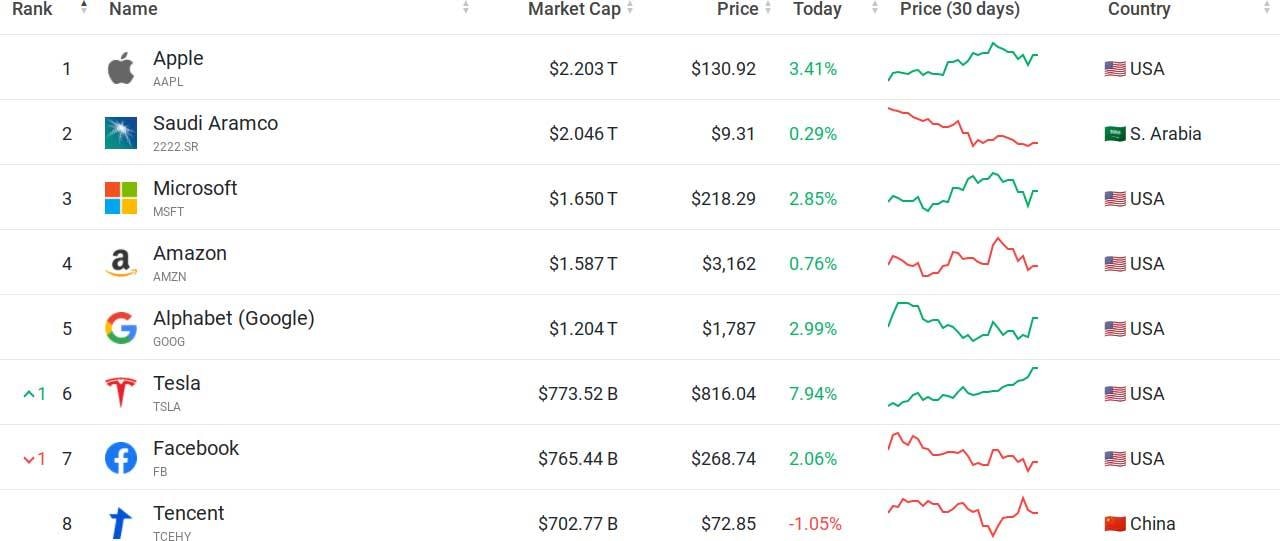

Data from CoinMarketCap and Companies Market Cap confirmed that on Jan. 7 Bitcoin almost entered the top five companies by market cap.

Top companies by market cap as of Jan. 8, 2021. Source: Companies Market Cap.

As BTC/USD crossed the $40,000 mark, Bitcoin's market cap grew to unprecedented levels, topping out at $745 billion. A day later, following a correction, the figure retreated to $737 billion before regaining its earlier record.

At the same time, Tesla delivered a swift 7.3% daily gain, allowing it to outpace Bitcoin once again after losing its market cap prowess to the cryptocurrency for a short period. On Friday, the company was on $773 billion as Bitcoin once again sailed through $40,000.

Tencent stock (orange) vs. BTC/USD chart. Source: TradingView

A more decisive victory came over Chinese tech giant Tencent, however, which at $716 billion firmly bowed to Bitcoin's momentum. Previously, Tencent was also worth more than Tesla.

As Cointelegraph reported, Tesla had likewise outperformed against stocks and cryptocurrency in 2020, beating even Bitcoin's performance versus its March lows. A look at Tencent stock growth meanwhile underscores the slow pace of gains which characterized other stocks compared to cryptocurrency.

"There are still companies in the world that are worth more than #Bitcoin. Crazy," Tyler Winklevoss, co-founder of Gemini exchange, commented on the phenomenon.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.