Bitcoin Price Prediction: Will BTC/USD surge above $7,000 confirm trajectory to $8,000? – Confluence Detector

- Bitcoin price buyers keen on nurturing the uptrend towards $7,000 after finding support above $6,400.

- The IMF remains optimistic about a global economic turnaround in 2021.

- Bitcoin price step above $7,000 is likely to cement the bulls’ position on the market.

Bitcoin price bulls are concentrating on one key resistance; $7,000. The surge on Friday last week pulled BTC/USD from lows under $5,500 to highs touching the coveted $7,000. However, the weekend action remained drab as the buyers lost traction amid increased bearish action. Various support areas were confirmed including $6,000, and $5,800. Bitcoin price commenced this week’s trading battling tooth and nail to force a reversal targeting $7,000.

At the time of writing BTC/USD is doddering at $6,558 after a 1% growth on the day. The current trend is bullish but the volatility is low, which means that rapid movement north is unlikely in the short term.

IMF envisions global economic turnaround in 2021

The cryptocurrency market led by Bitcoin is nurturing a recovery following the recent Coronavirus induced crash. Global economies are on the verge of recession due to the pandemic. Consequently, a report regarding the meeting of the G20 finance ministers and central bank governors on COVID-19, the International Monetary Fund (IMF) Managing Director Kristalina Georgieva, global economies are likely to face a recession far worse than the one between 2007 and 2008. However, Georgieva remains optimistic that economic recovery will take place in 2021 as long as countries continue to prioritize health systems to curb the spread of the virus.

Read more: Bitcoin Price Analysis: BTC/USD averts Coronavirus hostility, focuses on $7,000 psychological level

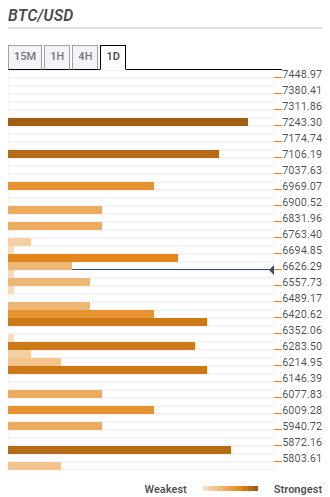

Bitcoin price confluence support and resistance

Resistance one: $6,694 – Highlights the previous high one-day, the Bollinger Band 15-mins upper and the previous high 1-hour.

Resistance two: $6,969 – Hosts the previous week high.

Resistance three: $7,106 – Highlights the pivot point one-month support two.

Support one: $6,420 – Home to the previous low 4-hour, the Fibonacci 23.6% one-day and the SMA 100 4-hour.

Support two: $6,214 – Highlights SMA ten 4-hour, the BB 4-hour middle curve, the SMA 200 15-mins, and the SMA 50 1-hour.

Support three: $5,872 – The SMA 200 1-hour and the SMA 50 4-hour.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren