Bitcoin Price Prediction: Day traders unfazed by the macro

- Bitcoin price briefly tagged the $17,000 barrier this week.

- BTC has crossed over two significant short-term indicators.

- The current uptrend will be void if the $16,750 price level loses support.

Bitcoin price has day traders eyeing close as the sludging market may finally see an influx of volatility. Key levels have been defined to gauge BTC’s next potential move.

Bitcoin price to present trader's an opportunity

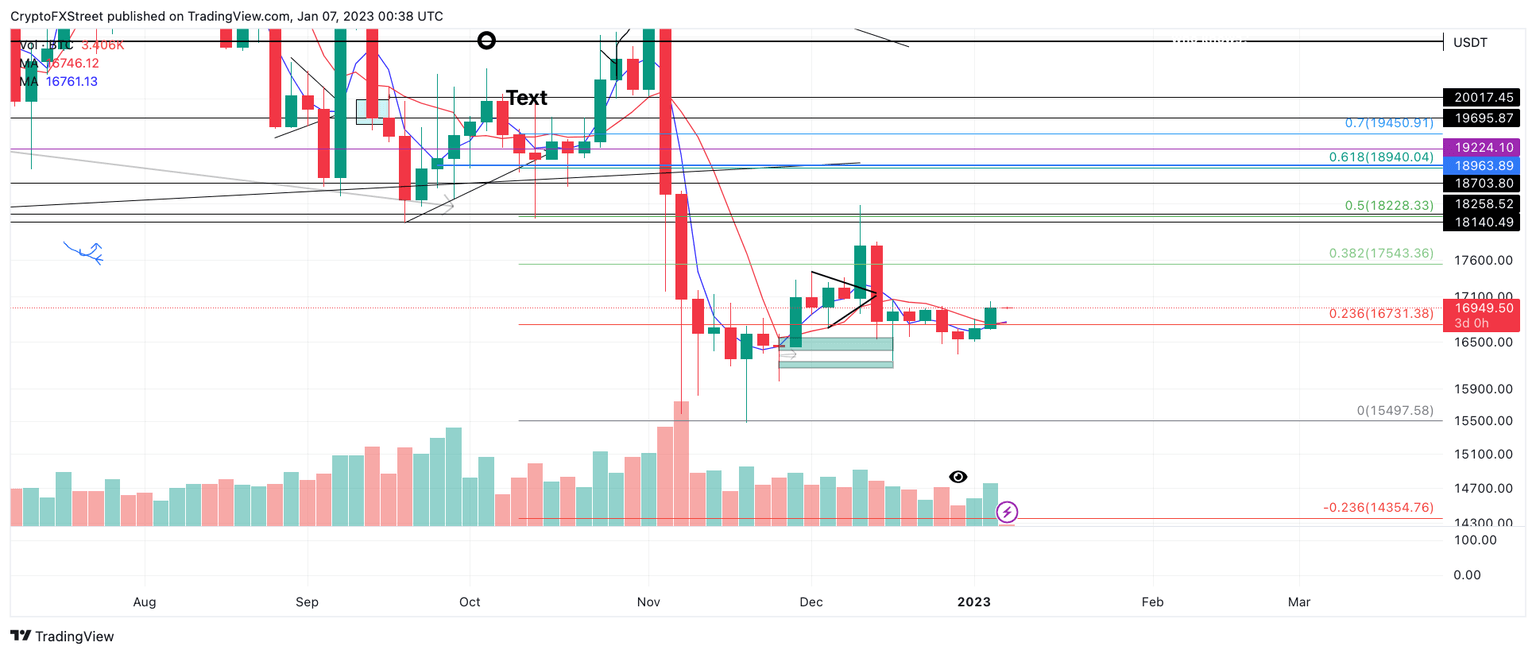

Bitcoin price has risen in stair-step fashion during the first week of the year, bolstering a 4% increase in market value since January 1’s opening price. The progressing uptrend ricocheted back and forth between the $16,500 and $16,990 zone. On Friday, January 6, the bulls pressed on further, expanding the uptrend into the $17,000 zone.

Bitcoin price currently auctions at $16,937 as day traders were quick to book profits at the psychological $17,000 marker. During the hike, the bulls successfully breached the 8-day exponential and 21-day simple moving averages, suggesting more uptrend gains could be had in the coming days.

If the market is genuinely bullish, the next target for bulls to aim for would be the December high of $18,387. The key monthly level lies parallel with the 50.% Fib level, extracted from a Fibonacci retracement tool surrounding November swing high at $21,480 and the 2022 low at $15,476. The target level creates possibility of a 9% rally from the current BTC price today.

BTC/USDT 3-Day Chart

Traders participating in the countertrend idea should remember that the larger trend is still pointing south based on December’s auction settling in the red at $16,256. If the bears breach the 8-day exponential moving average of $16,750, the shorter uptrend potential would be void. As a result, the bears could induce a challenge of the 2022 low at $15,476, resulting in a nine percent decrease from Bitcoin's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.