Bitcoin price prediction: CME Bitcoin futures volume soars as BTC/USD price drifts at $8,200 – Confluence Detector

- Data from Skew show that Bitcoin futures volume has been growing on CME in the last one month.

- Bitcoin must clear the prominent resistance at $8,248 to higher levels around $9,000.

CME Bitcoin futures contracts have been key players in the cryptocurrency market since their launch in December 2017. The contracts which are settled at the end of every month provide an insight into the involvement of institutional investors with the crypto market.

The rising volume of Bitcoin futures volume on CME in the last month is a key indicator of the positive sentiments from institutional investors. The number of investors going long on Bitcoin futures is rising according to data provided by Skew, a crypto analytical company. Bitcoin longs position on CME has stepped above 1,100 after grinding to almost zero.

Long positions held by institutional accounts at the CME have been rising again in October.

— skew (@skew_markets) October 20, 2019

For reference, institutions include pension funds, endowments, insurance companies, mutual funds & portfolio/investment managers whose clients are predominantly institutional. pic.twitter.com/96N2XZwo9e

Bitcoin confluence levels

Bitcoin price is slightly in the green on the second day of this week’s trading. The crypto stepped briefly above $8,300 on Monday but failed to sustain gains towards the key $8,400. At the time of writing, Bitcoin is trading at $8,224 after recovery from a weekly low formed at $8,154.

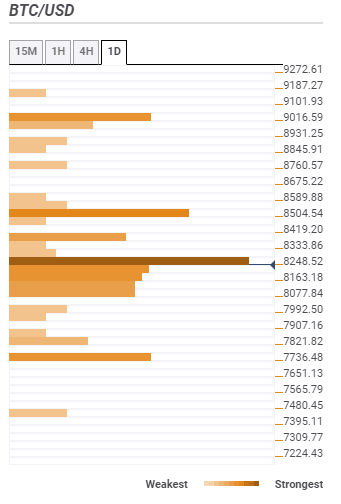

According to the confluence detector tool, Bitcoin is staring into the most prominent resistance at $8,248. The numerous indicators making this zone almost impenetrable include the Bollinger Band one-day middle, BB one-hour middle, previous high 15-minutes, the Simple Moving Average 100 15-mins, Fibonacci 61.8% one-week, previous high one-hour and previous high four-hour among others.

The other hurdle that is in line to hinder growth towards $9,000 is $8,500. Some of the indicators at this range are the 161.8% one-day, previous week high and the Fibo 23.6% one-month.

On the downside, the region between $8,077 and $8,163 is a wide support range that continues to prevent price dips below $8,000. Movement below $8,000 will find support at $7,736 according to the confluence detector.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren