Bitcoin Price Prediction: BTC/USD zooms above $8,900, can the bulls break above $9,000? – Confluence Detector

- Bitcoin nears the $9,000 psychological level amid renewed bullish action.

- Fundamentals and technical levels seem ripe for a cross above $9,000.

Bitcoin is likely to close the week in a bullish phase after an incredible few days. BTC/USD is up 2.81% on the day after pushing from $8,714 (opening value) to $8,991.39 (intraday high). Most analysts are convinced that the dynamics are positive for BTC to make a comeback above the psychological $9,000 level.

The world’s largest and most traded cryptocurrency has a market cap of $162 billion according to the data on CoinMarketCap. The last 24 hours have posted $31.9 billion in trading volume across the listed exchanges. BTC’s dominance is falling slightly below the levels recorded in December. In other words, altcoins seem to be gaining traction against Bitcoin in 2020.

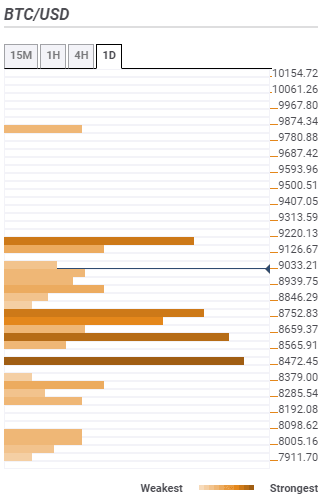

Bitcoin confluence levels

Bitcoin confluence detector clearly shows that the worst is in the rearview. What the bulls need is to gather strength and push above $9,000 in the short-term, preferably in the next sessions on Friday.

Meanwhile, a minor resistance zone at $9,033 seems to be holding BTC back. The previous high 15-minutes and the 161.8% one-day meet here to highlight the resistance. The only other prominent resistance is the area at $9,220 and hosts the pivot point one-week resistance two and the pivot point one-month resistance three.

Although, resistance has greatly been suppressed on the upside, support has been strengthened. It shows that Bitcoin is fundamentally ready to trade above $9,000. In the event that bears forge a strong reversal mission, traders should be on the lookout for support areas starting from $8,752, $8,659, and $8,472.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren