Bitcoin Price Prediction: BTC/USD resilient at $6,800 as oil and stocks topple – Confluence Detector

- Bitcoin investors are worrisome of the impact of COVID-19 on the oil market and the extended damage to the stock market.

- Bitcoin price minor recovery from $6,748 loses its mojo short of $6,900; investors fear the correlation with the stocks.

Bitcoin price has found balance following a brief free-fall from last week’s highs around $7,341. Moreover, the crypto is staying above the 50-day SMA as a show of strength in the market where bears are threatening to bring the bulls to their knees.

The oil market in the United States suffered the biggest blow in history following a drop into the negative on Monday. The drop is also having a ripple effect on the stock market; a situation that is becoming worrisome to Bitcoin and crypto enthusiasts due to the recently established correlation of BTC price action to the stocks’ price movements.

Equity market in the US closed the trading on Tuesday in the red despite a three week’s steady recovery. The West Texas Intermediate (WTI), which functions as the US index for oil closed at $9.06 after a significant recovery from -$37. Moreover, June 2020 futures also suffered under the impact of the oil drop closing at $13.12 from $22.58.

Due to the Coronavirus pandemic, industrial, travel and business activities have been brought to a halt around the world as countries wrestle to stop the spread of the disease by imposing lockdowns and restricted movements. Demand for oil has been reduced to the bare minimum while supply continues to surge.

What is worrying to investors in the cryptocurrency industry is how far COVID-19 will dampen the oil market. The main question is, will the stock and futures markets withstand the pressure?

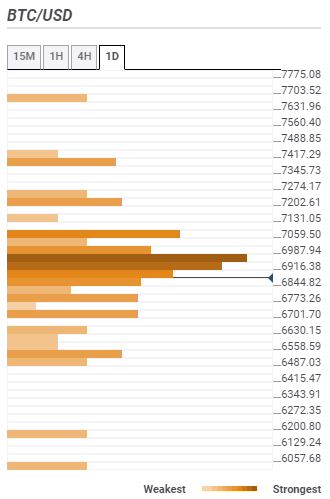

Bitcoin price confluence levels

BTC/USD is slightly in the green at the time of writing. The coin has been able to contain the losses in the last 48 hours above $6,800. However, recovery beyond $6,900 has not been forthcoming, which raises questions whether a breakout above $7,000 is sustainable prior to the May 2020 halving. On the other hand, as long as support at $6,800 remains intact, Bitcoin bulls will have the opportunity to focus on achieving levels above $7,000.

Resistance one: $6,916 – The seller congestion zone is home to the SMA 10 1-hour, Fibo 38.2% one-day, the previous high 15-mins and the Bollinger Band 15-mins upper.

Resistance two: $6,987 – Hurdle highlighted by the previous high 4-hour, BB 1-hour upper, SMA 200 15-mins and the pivot point one-day resistance one.

Support one: $6,844 – The buyer congestion zone highlights the Bollinger Band 15-mins lower, the SMA 50 one-day, the Fibo 61.8% one-day and the previous low 4-hour.

Support two: $6,701 – This zone converged the Fibo 161.8% one-day, the pivot point one-day support two and the Bollinger Band 4-hour lower curve.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren