Bitcoin Price Prediction: BTC/USD looming breakdown to $8,500 – Confluence Detector

- Bitcoin price recovery from the dip on Thursday is in for a rough ride with strong barriers at $9,169 and $9,264.

- Bitcoin bulls must hold Bitcoin above $9,000 to avert possible extreme losses to $8,500.

Following a period of consolidation above $9,200, Bitcoin price plunged towards $9,000 on Thursday. The volatility, although minimal happened after some top Twitter accounts including Elon Musk’s were hacked. A recovery ensued following the widespread drop that mainly affected altcoins such as Ripple (XRP), Stellar (XLM) and Tezos (XTZ). Bitcoin stepped above $9,100 but gains towards $9,200 are yet to materialize as we will see with the analysis of the confluence resistance and support areas.

Bitcoin confluence resistance and support levels

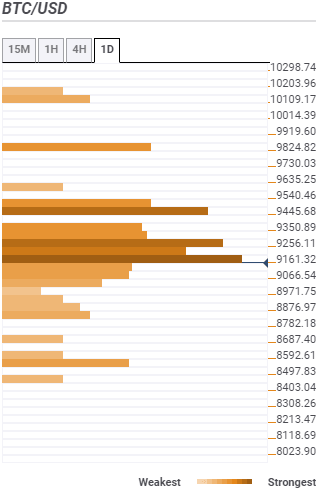

Bitcoin bulls must brace for a rough ride in the coming sessions. Note that, the confluence tool highlights the first resistance at $9,169.50. The same zone holds various technical indicators like the SMA five 1-hour, the SMA 100 15-minutes, the Fibonacci 61.8% weekly, the previous high 1-hour and the Bollinger Band 15-minutes upper curve among others.

This resistance is likely to extend towards the second hurdle at $9,264 making it an uphill task to sustain gains. Some of the indicators in the second resistance zones are the pivot point one-day resistance one, the SMA 200 1-hour, SMA 50 4-hour and the Fibonacci 38.2% weekly.

On the downside, support levels are scarce and also not strong enough. For this reason, Bitcoin not holding above $9,000 would open the Pandora box, with renewed bearish forces pushing it to $8,500 or even $8,000. For now, we can look forward to the mild support at $9,074 as highlighted by the pivot point one-day resistance one, the Bollinger Band 1-hour lower curve and the Fibonacci 23.6% one-day.

Other weaker support areas include $8,979.77, $8,884.90, $8,600.29 and $8,505. Therefore, it is essential that buyers hold Bitcoin above $9,000 as if their lives depend on it. Losses towards $8,500 could gain momentum below $8,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren