Bitcoin Price Prediction: BTC/USD likely to print a $16,000 – Analyst

- Bitcoin is likely to enter into a period of consolidation above $9,800 before a breakout.

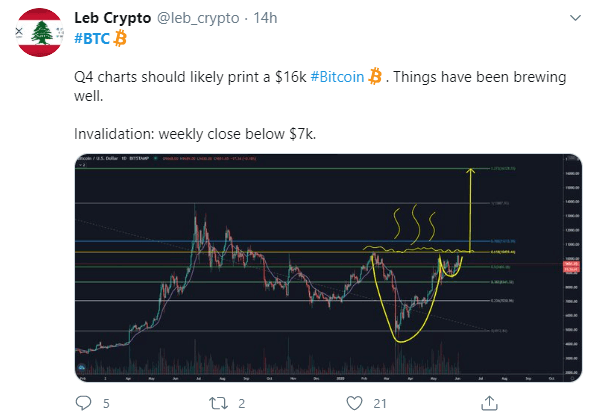

- Leb Crypto, an analyst on Twitter believes that Bitcoin’s next stop is $16,000.

Bitcoin dipped to $9,300 earlier this week following a failed attempt on sustaining recovery above $10,000. However, the dump was nothing but a volatility stint because there was no follow up. Recovery in the last 48 hours has been lethargic but steady. For Bitcoin bulls, the fight for gains above $10,000 is the only goal, at least for now.

In the meantime, BTC/USD is trading above $9,800. On the upside, Bitcoin hit a wall at $9,848 (intraday high). A minor adjustment has since forced Bitcoin to $9,830 (prevailing market value). The trend at the time of writing is bullish but due to the shrinking volatility, rapid price movements are unlikely in the Asian session.

Related content: Cryptocurrency Market Update: Bitcoin unrelenting in the fight for $10,000

Bitcoin price technical picture

BTC/USD is holding above the ascending trendline amid the bulls’ desire to pull above $10,000. The technical indicators applied hint towards consolidation taking place above $9,800. This sideways trading is key for the next run above $10,000, probably during the weekend session. RSI is leveling its motion at 60 after recovering from May lows at 44. A gradual slope upwards means that the price is inclined more to the north. The MACD puts emphasis on the consolidation as it flirts with the mean line (0.0).

BTC/USD daily chart

-637269248795313930.png&w=1536&q=95)

On the other hand, Bitcoin price is above all the moving averages; the 50-day SMA and the 200-day SMA. Therefore, it is very hard for sellers to enact an extremely bearish move. Besides, an analyst on Twitter Leb Crypto, reckons that Bitcoin is ready to “print a $16k” because “things have been brewing well.”

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren