Bitcoin Price: BTC/USD facing severe resistance at $11,047 – Confluence Detector

- Bitcoin is dancing at the edge of a cliff ($11,000) as recovery towards $11,400 becomes tougher.

- BTC/USD seems to have just enough energy to hold above $11,000 but upward action continues to be limited.

Bitcoin bulls seem to be spending all their energy defending support at $11,000 and are left with very little to actualize the bullish case to $11,400. On Thursday, BTC/USD recovered magnificently past $11,000 but hit a barrier at $11,200. Besides, Bitcoin and most of the assets in the market are in the red as we prepare to usher in the Asian session.

At the moment, the price is doddering at $11,014. Holding above $11,000 is key for the bull-run to $11,400. However, the RSI is threatening a retreat from the overbought region. In other words, the ongoing decline is likely to continue and even push Bitcoin lower.

On the other hand, the MACD is holding well within the positive region. This shows that in spite of the retreat, BTC/USD still has some buying support. In addition, the price is sitting significantly above the moving averages. In the daily range, the 50 SMA holds the position at $9,514 while the 200 SMA is at $8,695.

BTC/USD daily chart

%20(11)-637317674260077356.png&w=1536&q=95)

Bitcoin confluence levels

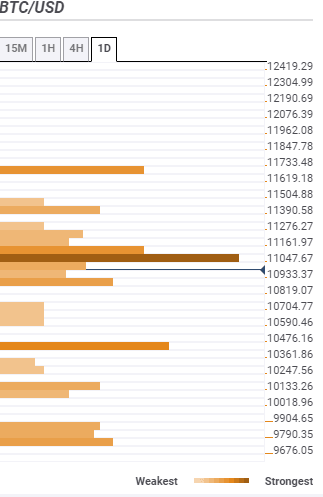

According to the confluence levels, Bitcoin is facing the sturdiest resistance at $11,047. Holding the ground within this zone is the previous high 15-minutes, the SMA ten 15-minutes, SMA 100 15-minutes, the Bollinger Band 1-hour middle curve and the previous high 1-hour among other indicators.

Glancing higher, a second resistance lies at $11,161 as highlighted by the Bollinger Band 1-day upper curve and the previous high 4-hour. The next key hurdle is the one at $11,733; its home to the pivot point one-day resistance three and the pivot point one-month resistance three.

It is essential that Bitcoin finds support preferably above $11,200, however, the selling pressure will continue to force a return under $11,000. Support is envisioned at $10,933 as shown by various indicators including the Bollinger Band 1-hour lower curve, the SMA 100 1-hour and the pivot point one-day support one. A break below this the initial support might not encounter any interruptions until it hits the buyer congestion at $10,476. Losses under $10,000 will seek refuge at $9,904, $9,790 and $9,676.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren