Bitcoin Price Prediction: BTC/USD defends $8,900, where are the resistance levels? – Confluence Detector

- Selling pressure continues to mount for Bitcoin.

- BTC/USD briefly slipped below $9,000 but has recovered and it’s trading at $9,300 at the time of writing.

Bitcoin had another leg down today on June 15, however, bulls have managed to push Bitcoin back up from a low of $8,910. The current daily candlestick is a bullish reversal candlestick and indicates that bulls are still interested in buying Bitcoin.

Of course, Bitcoin will encounter more resistance levels towards $10,000 now. Let’s check out some of the closest resistance points Bitcoin is facing.

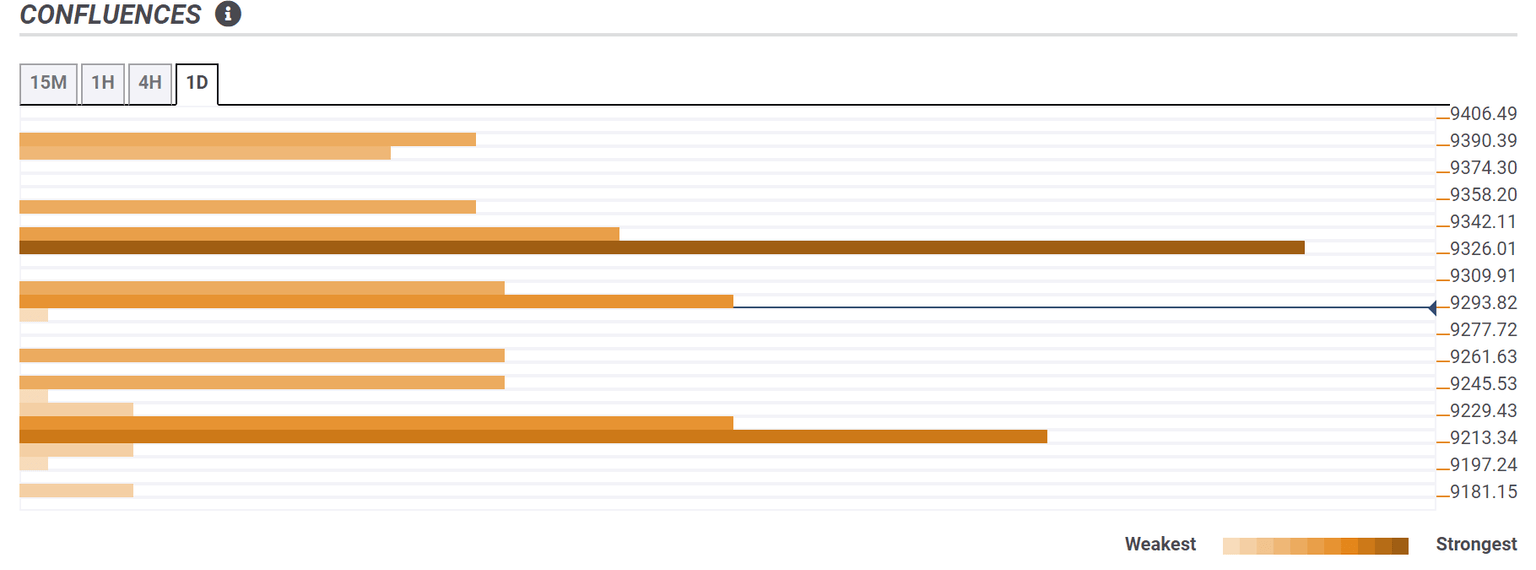

At $9,326, there is a strong resistance level formed by the 4-hour SMA10 and the monthly Fibonacci 38.2%. Nearby at $9,342, another resistance point formed by the 15-minute SMA200, the hourly SMA50, and the daily Fibonacci 38.2% will try to stop the bulls.

Bitcoin will also face the $9,500 psychological resistance level and both daily EMAs. Support can be found at $9,229 and $9,213 where the 4-hour SMA5, the daily pivot point, and the middle Bollinger Band on the hourly are converging.

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacent price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.