Bitcoin price prediction: Bearish wave befalls BTC/USD as $8,000 is tested – Confluence Detector

- Bitwise Bitcoin ETF called back for review by the SEC.

- Bitcoin refreshes the support at $8,000 vital level amid looming danger of a return to $7,300.

Bitcoin, alongside other major assets, was caught up in yet another selloff on Monday. Bitcoin’s renewed bearish momentum broke the weekend’s consolidation below $8,350. Moreover, the lower leg extended below the support at $8,250 and tested the key level at $8,000. However, a low formed at $8,025 paved the way for gains above $8,100. BTC/USD is trading at $8,133 while attempting to establish support above $8,100 in a bid to push for recovery.

FXStreet reported in other news that the United States Securities and Exchange (SEC) has recalled the Bitwise rejected BTC exchange-traded fund for review. The review will look into why the product was rejected.

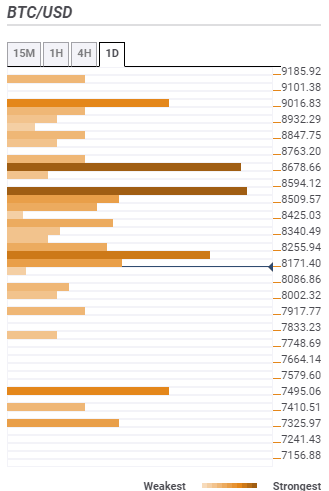

Bitcoin confluence levels

According to the confluence detector tool, Bitcoin is in for a bumpy ride. The first resistance is seen at $8,177 and cemented by the previous low 4-hour, previous high 15-minutes, Fibonacci 23.6% daily, SMA 10 15-mins, Bollinger Band 15-mins middle and the previous high one-hour.

Glancing high to the north, $8,255 is the next hurdle. Highlighted in this zone include indicators such as the pivot point one-week support one, SMA 50 15-mins, previous high 4-hour and Bollinger Band 4-hour lower. In addition to that, additional significant hurdles will be faced at $8,594 and $8,678 respectively.

As far as support is concerned, Bitcoin is facing a shortage of anchor levels. The only relatively strong resistance is placed at $7,495. However, mild support can be found at $8,086, $7,917 and $7,833.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren