Bitcoin price holds 200-day trend line as trader predicts low is in

Bitcoin (BTC $27,222) is retaining this week’s gains, with some traders doubling down on their bullish BTC price bets.

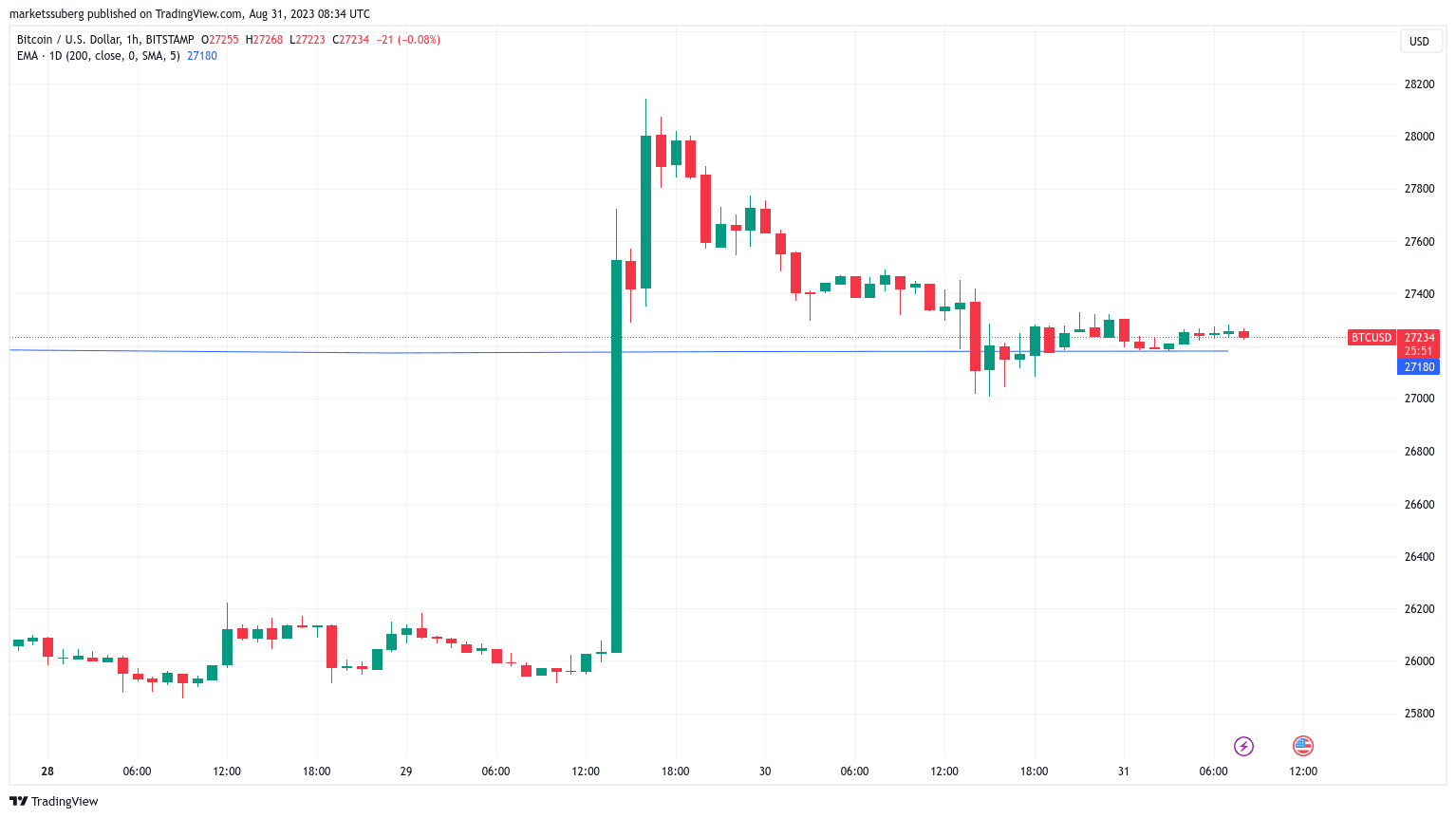

BTC/USD 1-hour chart with 200-day EMA. Source: TradingView

Trader: Bitcoin price may have bottomed

A key moving average is buoying low-timeframe BTC price action, which continues to preserve $27,000, data from Cointelegraph Markets Pro and TradingView shows.

Bitcoin may have retraced from its local highs above $28,000, but bears have not yet sparked a full retrace of the move.

For some, this is increasingly positive news, as BTC/USD is now successfully holding a long-term trend line lost as support earlier in August.

This comes in the form of the 200-day exponential moving average (EMA), currently at $27,180.

Some hourly candles closing below into Aug. 31 were not enough to spark a more significant breakdown, and Bitcoin is tightly hugging the 200-day EMA into the August monthly close.

“Bitcoin is back above the daily EMA 200-Line,” popular trader Moustache told X subscribers.

A lot of people are waiting for a better entry, but I don't think it's going to happen.

BTC/USD annotated chart with 200-day EMA. Source: Moustache/X

That perspective contrasts strongly with the slew of more bearish market takes from various well-known sources, many of which call for a return to $25,000 or lower.

Still optimistic, however, is fellow trader Jelle, who likewise placed significance on Bitcoin holding above $27,000.

“This is exactly what I want to see after an impulse. Spike up, shallow retrace, hold at key HTF level. Send it higher,” he summarized on Aug. 30.

A subsequent update revealed plans for longs in preparation for BTC/USD “taking out” local highs.

BTC price outlooks diverge

As Cointelegraph reported, BTC price action has yet to reclaim some other bull market moving averages from earlier in the month.

Trader and analyst Rekt Capital, cautious in the current climate, noted overnight that some of these are now acting as resistance.

BTC/USD annotated chart. Source: Rekt Capital/X

Continuing on the day, monitoring resource Material Indicators likewise warned that Bitcoin could come full circle, and that a “resurgence in bullish sentiment” was required for a higher local high.

Based on signals from its proprietary trading tools, Material Indicators flagged $27,760 and $24,750 as the upside and downside levels to watch, respectively.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.