Bitcoin Price Forecast: BTC recovers above $90,000 as Trump backs off Greenland tariffs threat

- Bitcoin price recovers above $90,000 on Thursday after retesting the midpoint of a horizontal parallel channel.

- Trump’s Davos speech on Wednesday ended the imposition of new tariffs on European nations against the US purchase of Greenland, improving risk sentiment.

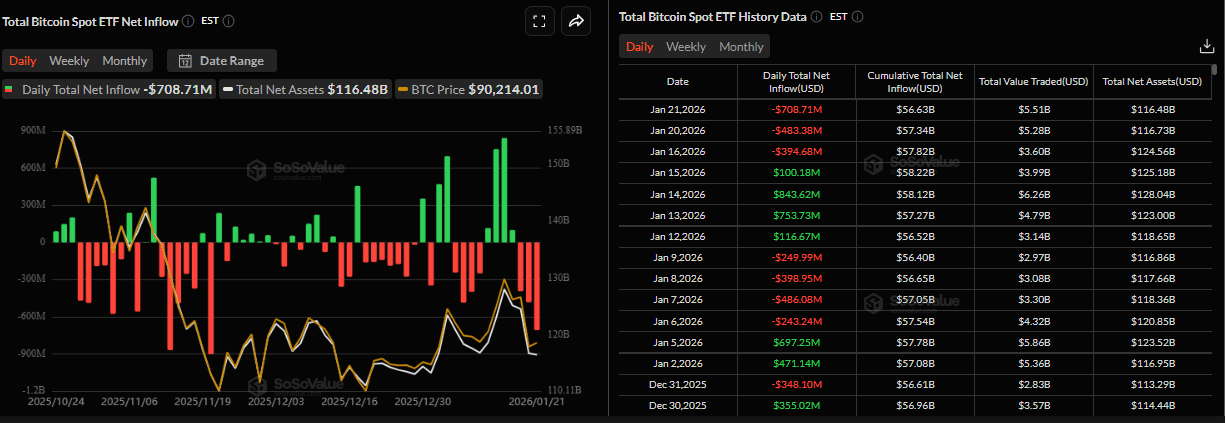

- ETF outflows persist, recording over $700 million on Wednesday, the largest single-day withdrawals since November 20.

Bitcoin (BTC) price extends recovery above $90,000 at the time of writing on Thursday after finding support around a key level the previous day. Risk appetite improved after US President Donald Trump’s speech at Davos on Wednesday, which ended the imposition of new tariffs on European nations, supporting risky assets such as BTC. However, traders should be cautious, as Bitcoin Spot Exchange Traded Funds (ETFs) are showing fading institutional demand, with over $700 million in outflows on Wednesday, capping a strong recovery in the Crypto King.

Easing geopolitical tension fuels Bitcoin recovery

Bitcoin price recovered slightly on Wednesday after six consecutive days of decline. This price recovery is strengthening as global risk sentiment gets a strong boost in response to US President Trump’s U-turn on Greenland at the World Economic Forum in Davos.

Trump mentioned in his speech that he had reached an agreement with the North Atlantic Treaty Organization (NATO) on a framework for a future deal on Greenland, ending the need to impose new tariffs on European nations.

Apart from easing geopolitical tension, Trump also said he “Hope to sign bill on crypto soon,” as the US Congress continues to work on a crypto market structure bill that was postponed last week by the Senate Banking Committee.

These developments have triggered a mild risk-on sentiment in the market, which supports riskier assets, such as Bitcoin, as it extends its recovery, trading above $90,000 when writing on Thursday.

In an exclusive interview, Charles Edwards, founder of Capriole Investments, told FXStreet that geopolitical and tariff-related tensions have eased significantly over the past 24 hours, noting that the US has fully walked back the tariffs tied to the Greenland issue.

Edwards explained that there are likely two reasons for this:

Firstly, Trump can’t afford the negative economic impact they were triggering, coming into the US midterm elections (which is also why significant tariff tensions from here are unlikely going forward). Secondly, a possible deal is being struck between the US and Greenland for shared resources. It’s also worth remembering that Trump often makes outlandish statements and economic threats, which are more often than not wound back and simply used as a negotiation tool.

“Should tensions escalate more significantly over global tariffs or conquering Greenland, that would likely be very bad for risk assets like Bitcoin, at least in the near term. Time will tell, and it is possible that this issue could resurge in an ugly way again, but for now it looks very promising,” Edward concluded.

Some signs of concern

Despite the market’s positive sentiment, as discussed above, institutional demand for Bitcoin continues to fade. SoSoValue data shows that spot Bitcoin ETFs recorded an outflow of $708.71 million on Wednesday, the third consecutive day of withdrawals and the highest single-day outflow since November 20. If these outflows continue and intensify, BTC could see further correction.

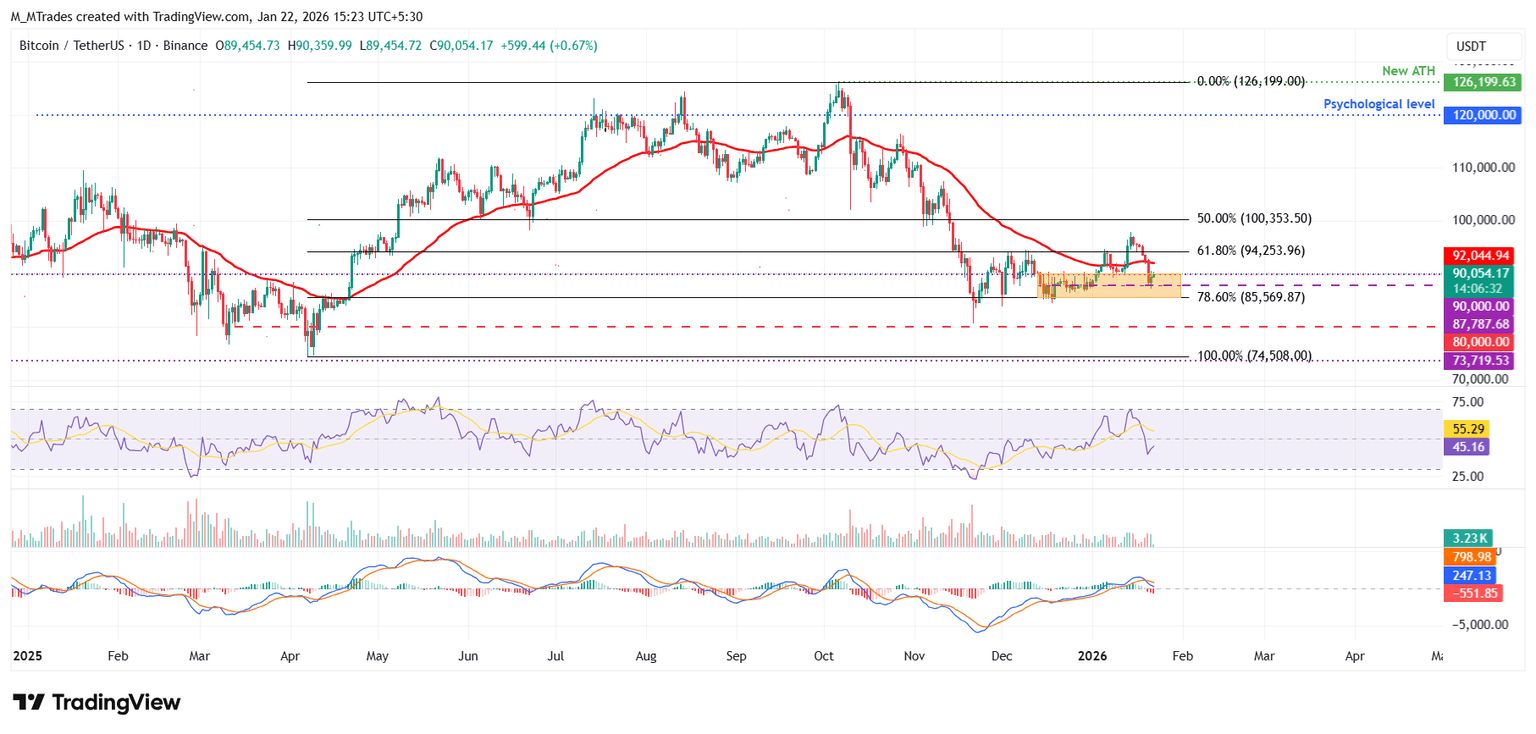

Bitcoin Price Forecast: BTC rebounds from key support

Bitcoin price started the week on a negative note, closing below key support levels: the 50-day Exponential Moving Average (EMA) at $92,044 and the previously broken upper consolidation boundary at $90,000. On Wednesday, BTC rebounded slightly after retesting the midpoint of a horizontal parallel channel at $87,787. As of writing on Thursday, it continues trading higher at $90,000.

If BTC continues its ongoing recovery, it could extend the advance toward the 50-day EMA at $92,044.

The Relative Strength Index (RSI) on the daily chart is 45, pointing upward toward the neutral 50 level, indicating fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. However, traders should be cautious, as the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on Tuesday, suggesting a mild downward pressure.

On the other hand, if BTC closes below the $87,787 support on a daily basis, it could extend the fall toward the lower consolidation boundary at $85,569, which coincides with the 78.6% Fibonacci retracement level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.