Bitcoin Price Forecast: BTC hunts for support above $60,000 while declines teas

- Bitcoin spiked to new all-time highs above $60,000, suggesting a potential move to $70,000.

- A correction is putting pressure on the tentative support at $60,000.

- The SuperTrend indicator reveals that the uptrend is still intact, and traders can keep long positions.

Bitcoin sprung above the previous all-time high on Saturday, opening the door to new record highs. The bellwether cryptocurrency hit highs above $60,000 for the first time in history. Bitcoin achieved a new record high at $61,745 before the ongoing correction came into the picture. If BTC does not hold the ground above $60,000, massive selling orders may come into the picture.

The battle for higher support begins

At the time of writing, Bitcoin is trading marginally below $60,500, following a correction from the new all-time highs. Holding above $60,000 remains key to the uptrend. However, massive selling orders are likely to come into the picture, culminating in losses as investors cash out for profit.

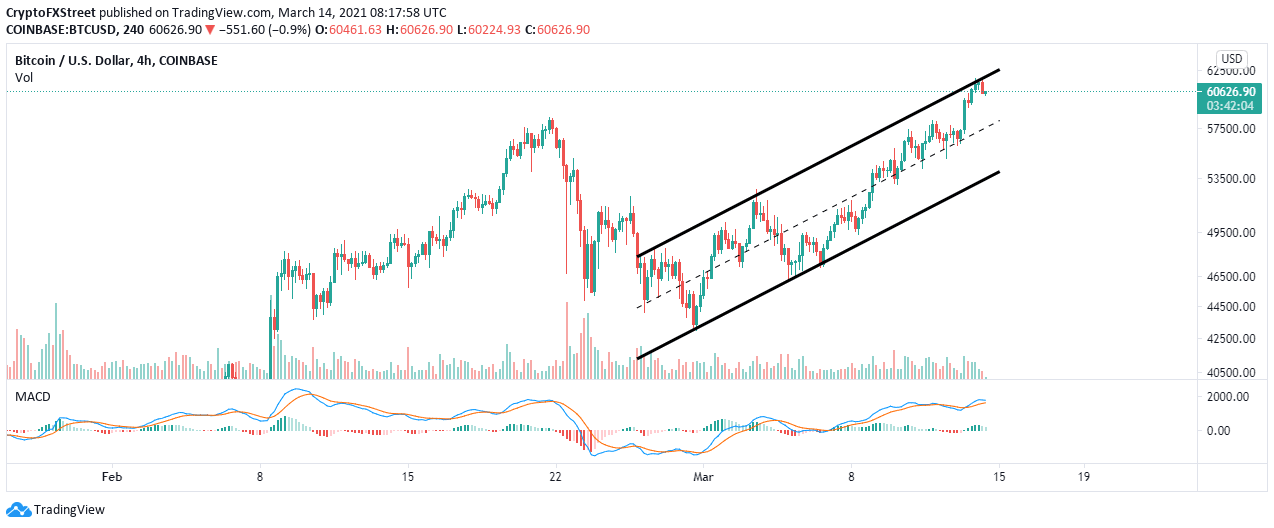

The 4-hour chart brings to light the formation of an ascending triangle channel. Resistance at the upper boundary of the channel is contributing to the overhead pressure. If the middle boundary doesn’t hold, Bitcoin may begin to explore losses toward other lower support levels at $56,000 and $54,000.

The Moving Average Convergence Divergence (MACD) is moving close to flipping bearish. A bearish impulse will come into the picture if the MACD line (blue) crosses under the signal line and the indicator generally drops toward the midline.

BTC/USD 4-hour chart

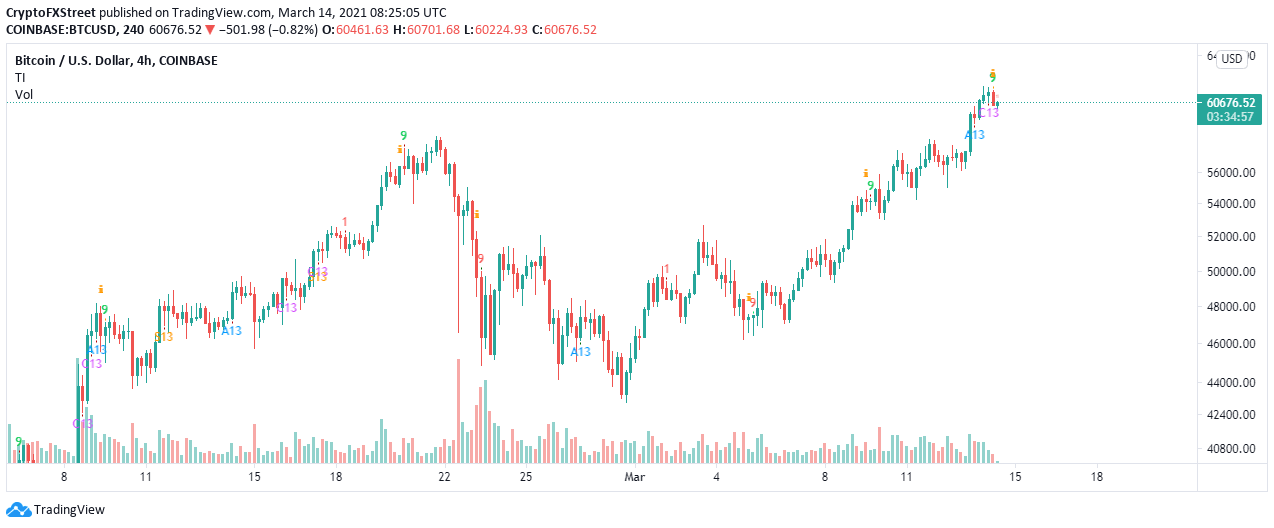

The TD Sequential indicator has flashed a sell signal on the 4-hour chart. The call to sell manifested in green a green nine candlestick. If validated, Bitcoin will commence the correction under $60,000.

BTC/USD 4-hour chart

Looking at the other side of the fence

Support above $60,000 and preferably $60,500 would be a bullish move. More investors will be attracted to buy in if Bitcoin pushes above $62,000. The fear of missing out (FOMO) might also contribute immensely to the tailwind, pushing Bitcoin to $70,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren