Bitcoin Price Forecast: BTC cooling off but an explosive move comes soon

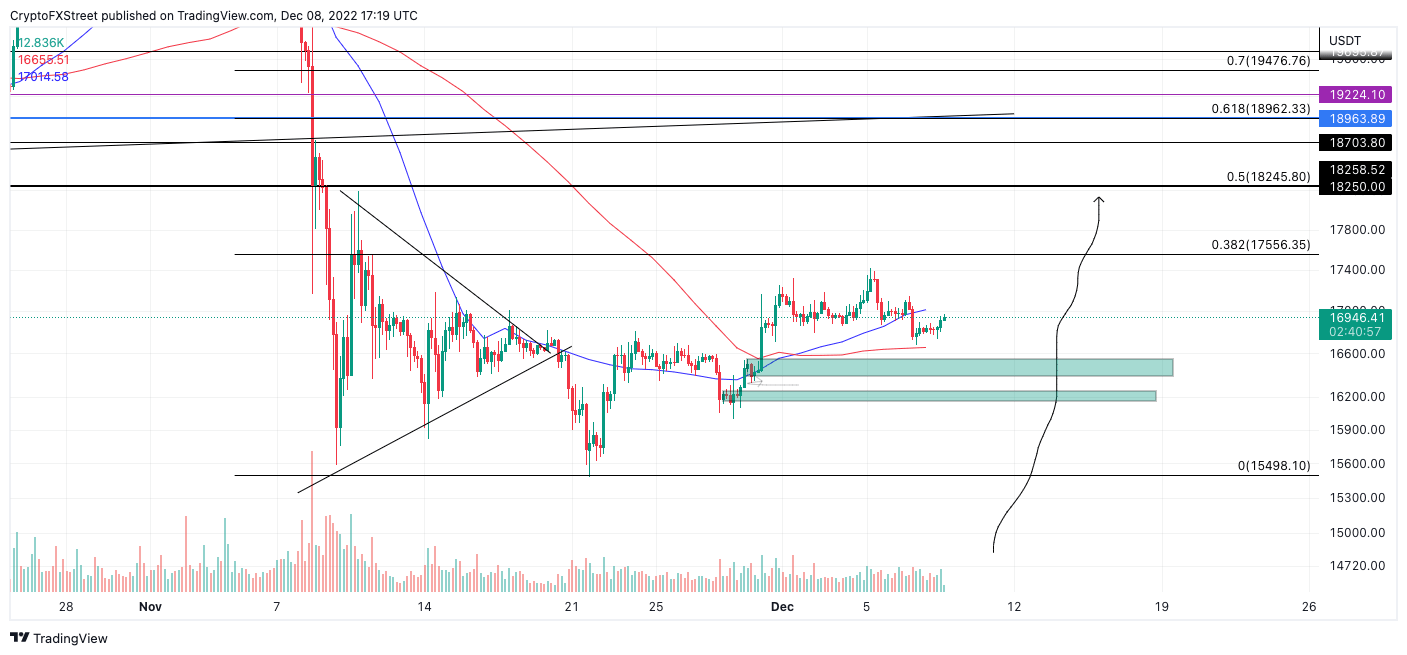

- Bitcoin price faces rejection from the $17,000 zone.

- BTC coils between two key moving averages which will likely result in an explosive move.

- A 4-hour candlestick close on either side of the moving averages can be an early landmark of the future trend.

Bitcoin price is enduring congestive market conditions during the second trading week of December. Traders may want to remain sidelined until a definitive move is made from the consolidation to avoid unnecessary losses from being on the wrong side of the trade.

Bitcoin price still in limbo

Bitcoin is struggling to sustain support above the $17,000 price zone. Following November’s 16% market decline, the bulls have shown spars retaliation signals. Because November closed bearish,, staying with a bearish bias would be the safest approach. Countertrend traders may want to apply caution as a breach of the newfound yearly lows at $15,476 could occur in the coming days.

BTC/USDT 4-Hour Chart

If the market is genuinely bullish, a surge above the 8-day EMA could catalyze an uptrend swing targeting the $17,500 and $18,250 levels. These target zones are extracted using a Fibonacci retracement tool which surrounds the entirety of November’s downtrend.

On the contrary, a 4-hour candlestick close beneath the 21-day SMA could be the signal sidelined bears are waiting for. Under the bearish scenario, a decline targeting the $16,000 congestion zone, as well as November’s low at $15,476, would stand a fair chance of occurring.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.