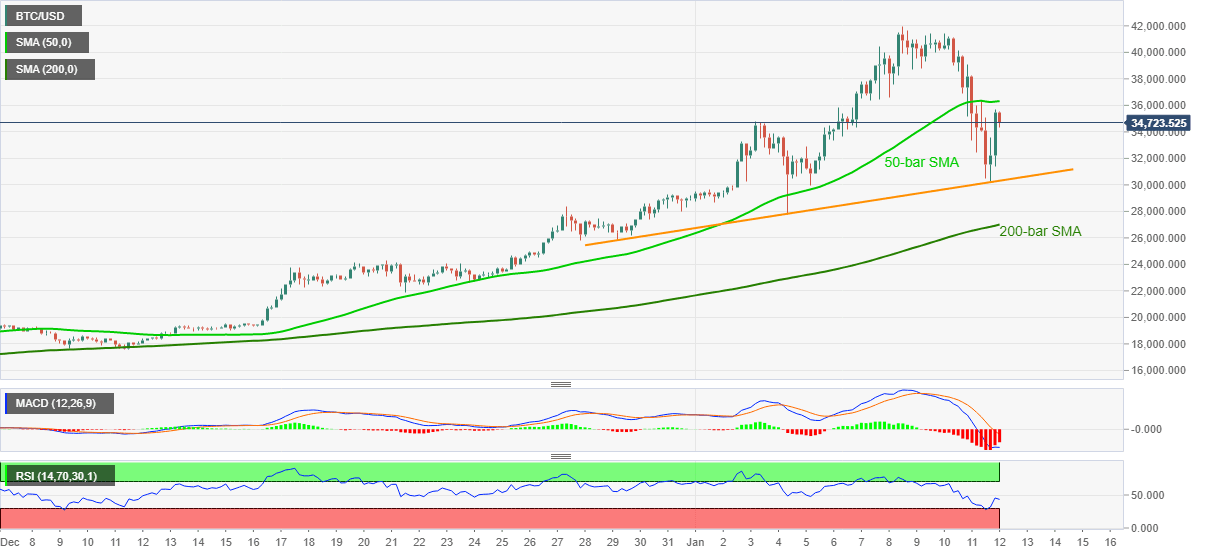

Bitcoin Price Analysis: BTC fades bounce off short-term support line below 35,000

- BTC/USD struggles to keep bounce off two-week-old support line.

- Bearish MACD probes Bitcoin buyers below 50-bar SMA.

- 200-bar SMA, upbeat RSI conditions restrict major downside.

BTC/USD fades the latest recoveries while easing to 34,800 during early Tuesday. In doing so, the crypto major battles with bearish MACD below 50-bar SMA.

Although pullback to an ascending trend line from December 29, at 30,320 now, seems imminent, any further weakness will be challenged by strong RSI conditions and a 200-bar SMA level of 27,006.

It should, however, be noted that a sustained downside past-27,000 will make BTC/USD vulnerable to revisit the December 20 top surrounding 24,300.

Meanwhile, an upside clearance of 50-bar SMA, at 36,326 now, will attack the 40,000 psychological magnet while also likely to take a break near Friday’s low of 38,733.

During the quote’s upside past-40,000 the recent record high near 42,000 and the 50,000 threshold will be in focus.

To sum up, BTC/USD is in an uptrend but short-term pullbacks can’t be ruled out.

BTC/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.