Bitcoin outflows from centralized exchanges surge to 100K BTC monthly

Bitcoin outflows from centralized exchanges have surged to their highest level year-to-date, with roughly 40,000 BTC being withdrawn over the past seven days.

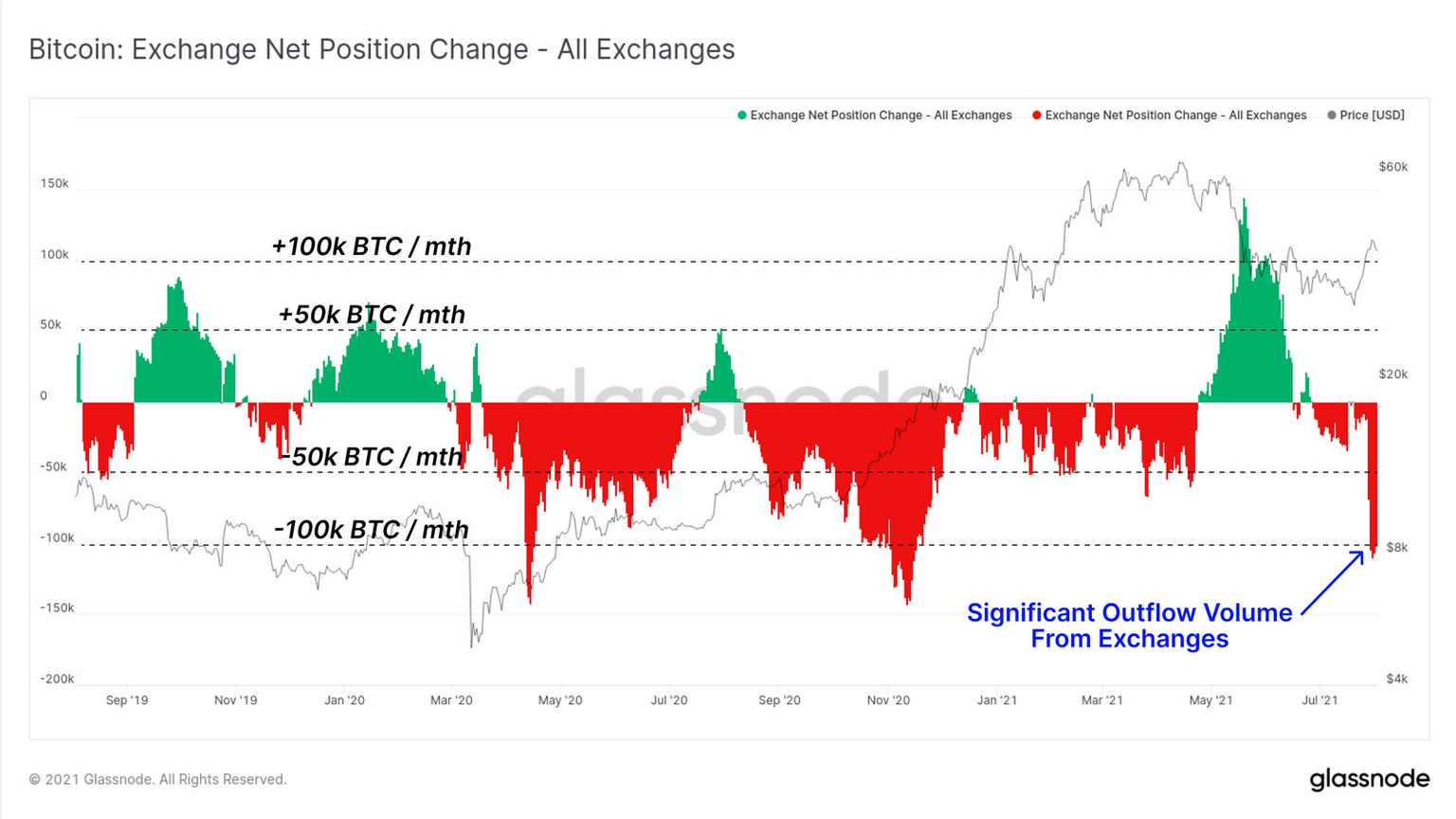

According to the Glassnode’s August 2 The Week On-Chain report, Bitcoin outflows have accelerated to a rate exceeding 100,000 BTC per month for just the third time since September 2019. The on-chain analytics provider estimates that just 13.2% of circulating BTC are currently held on exchanges — a new low for 2021.

“This represents a near full retracement of the significant inflow volume observed during the May sell-off,” the report noted.

BTC Exchange Net Position Change - Glassnode

Outflows surged to nearly 150,000 BTC monthly at the end of April 2020 following the violent “Black Thursday” crash that saw crypto prices tumble by more than 50% in less than two days after then-U.S. President Trump announced a travel ban between Europe and the U.S. in March as the coronavirus pandemic intensified. Despite the aggressive crash, Bitcoin had rebounded by 150% by the end of May 2020, driving heavy accumulation.

Outflows again came close to 150,000 BTC monthly in November 2020 as Bitcoin surged to test its then-record price high of $20,000, with BTC rallying into new all-time highs the following month.

Glassnode notes divergent trends between Coinbase and Binance throughout most of 2021, with Coinbase having experienced significant outflows while Binance has been the largest recipient of BTC.

However, Binance’s reserves are now beginning to dwindle, with 37,500 BTC (worth roughly $1.5 billion) exiting the exchange over the past week.

Coinbase balances remained steady in June. While the exchange received 30,000 BTC in mid-July, 31,000 BTC was withdrawn from the platform this past week.

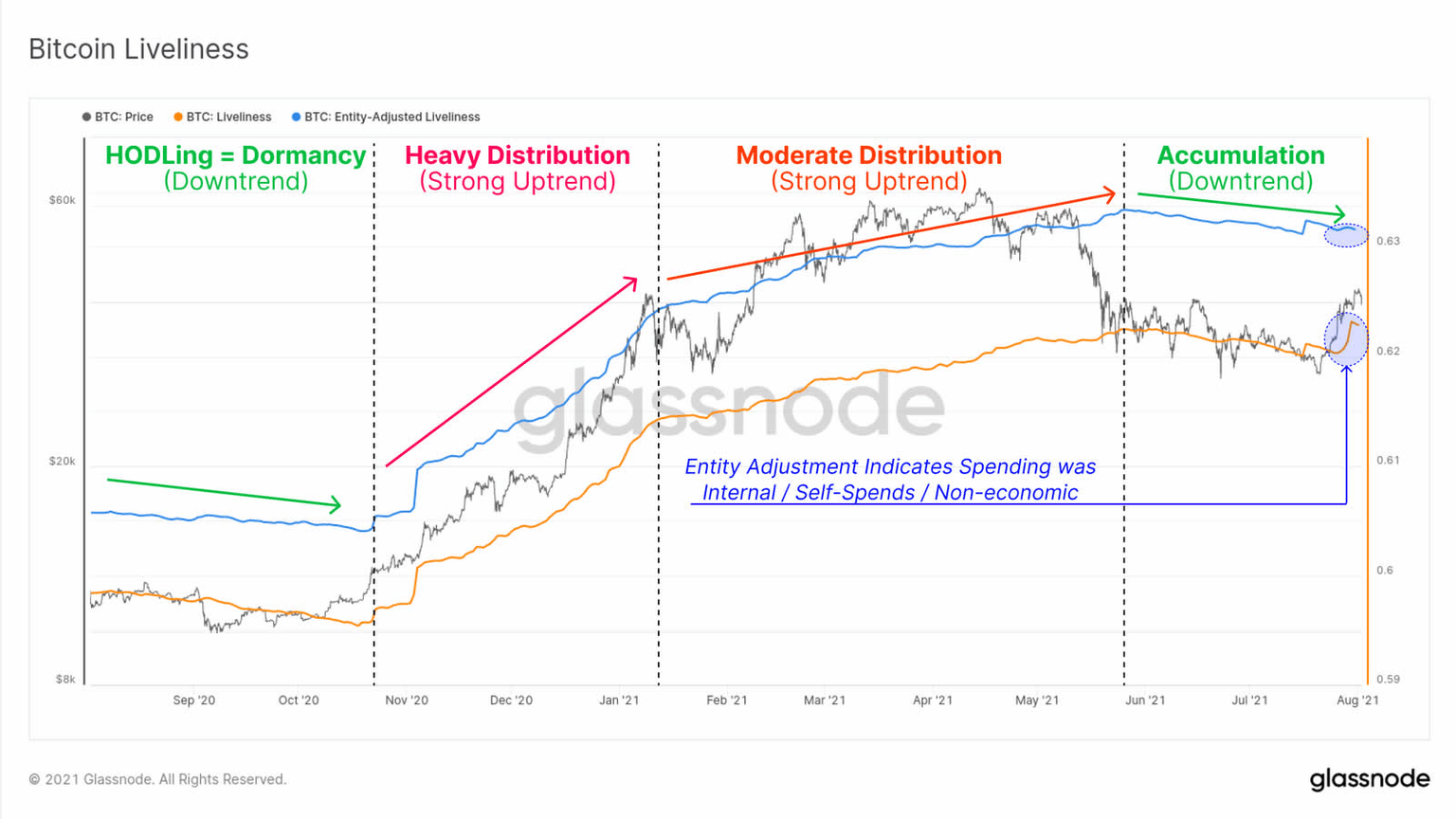

Looking at the macro sentiment, the on-chain analytics provider referred to its “Liveliness metric” to identify trends in accumulation.

The metric, which measures the ratio of the sum of coin days destroyed and the sum of all coin days ever created, indicates a broad trend of accumulation following May’s immediate sell-off.

“It seems that HODLing and accumulation is the most likely dominant trend in the on-chain market,” the report concluded.

BTC Liveliness chart: Glassnode

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.