Bitcoin miners are on fire [Video]

![Bitcoin miners are on fire [Video]](https://editorial.fxsstatic.com/images/i/BTC-bearish-animal_XtraLarge.png)

Bitcoin miners are on fire because Bitcoin’s price has surged, boosting mining revenues, while investors bet on higher profitability despite the recent halving. Some miners are also pivoting into AI and high-performance computing, attracting extra excitement and capital.

Cipher Mining with ticker CIFR is breaking strongly bullish within a higher degree wave C or 3, and there’s space for more gains, as we see an unfinished lower-degree five-wave bullish impulse. Currently it keeps rising within wave (3), so after the next wave (4) pullback, be aware of more upside for wave (5), as long as the price is above 7 invalidation level.

CIFR Daily Chart

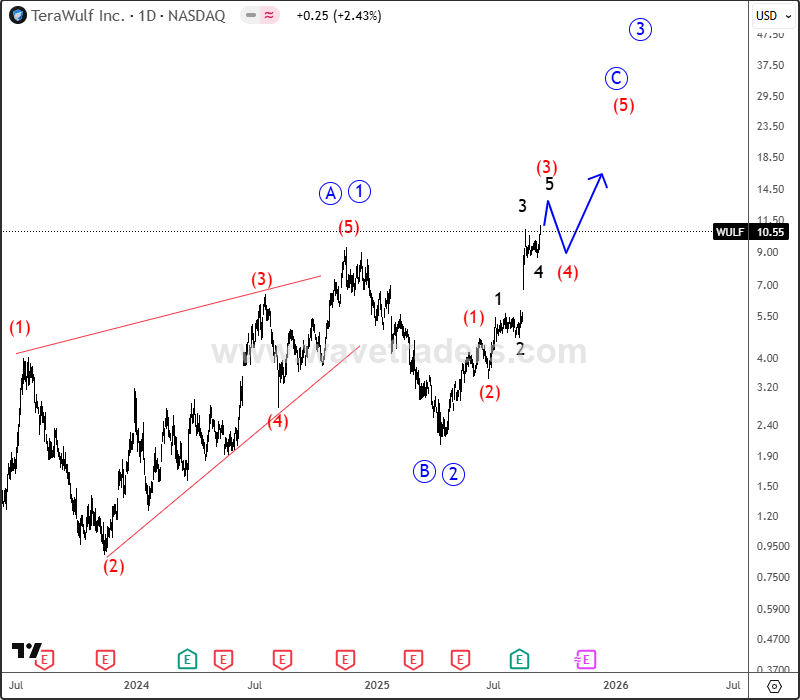

Terawulf with ticker WULF is also trading within a five-wave bullish impulse for a higher degree wave C/3, where we are currently tracking subwave 5 of (3), so even this one has room for more upside, just watch out on wave (4) pullback before a bullish continuation within wave (5) of C/3.

WULF Daily Chart

What we want to point out is that with the bullish Bitcoin miners, Bitcoin and the whole Crypto market could see more gains, just keep in mind that we might be in final stages of a bullish cycle this year.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.