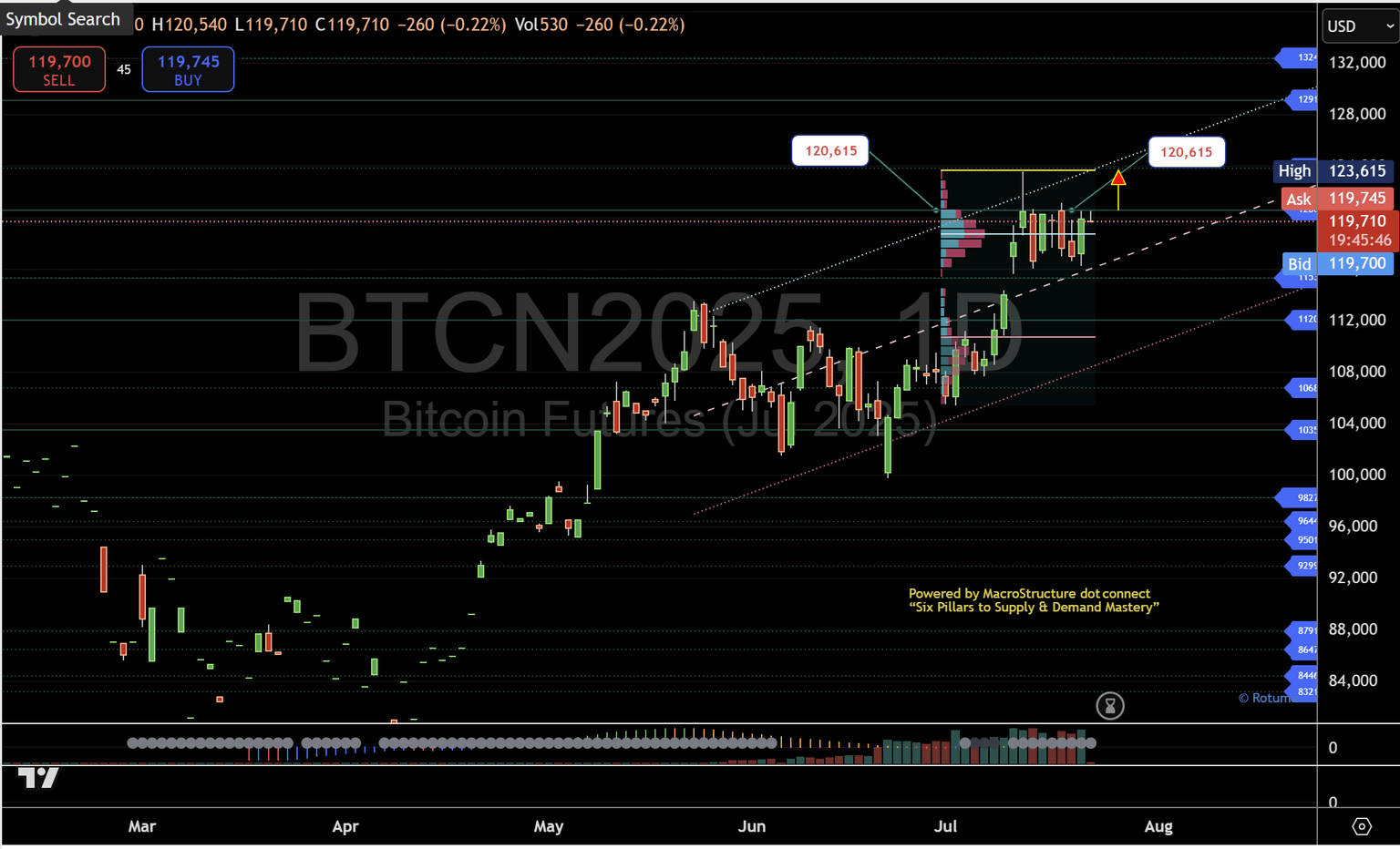

Bitcoin July futures stalemate at central pivot as bulls eye 120,615 breakout

BTCN2025 contract trapped between 123,875 and 115,340 pivots, with the 120,615 central point rejection guiding the next directional bias.

Key takeaways

- Range bound: July futures have been oscillating for the past week between the 123,875 high‑range pivot and the 115,340 lower‑range pivot.

- Central point rejection: Price action stalled at 120,615, the midpoint of the range, signalling hesitation among both bulls and bears.

- Next guides: Three critical levels will determine the bias:

- Bullish trigger: A clear break and hold above 126,015 (upper channel trendline) could propel a retest of 123,875 and pave the way to 129,000–132,000 zones.

- Bearish guard: Failure to reclaim 120,615 risks a slide back toward 115,340, with the next support level near 112,000.

- Consolidation phase: Continued congestion around 120,000–121,000 will likely result in diminished volatility and tight trading ranges into month-end.

Bitcoin Futures price chart courtesy of TradingView. Analysis by MacroStructure dot connect

Analysis

1. Price structure intact

Since early May, Bitcoin's July contract has been respecting an ascending channel (dashed trendlines), confirming higher lows off the 115,340 pivot. The overall bullish framework remains intact, provided 115,340 holds.

2. Volume profile confluence

Volume‑at‑price shows a value area concentrated between 118,000 and 122,000, underscoring the importance of this zone. The rejection at 120,615—where daily volume spiked—indicates strong supply on rallies above that level.

3. Bullish scenario

- Upside breakout: A decisive close above 120,615 (upper trendline and recent swing high) would invalidate the central‑pivot ceiling and open the door to 129,000 and the 132,000 cluster.

- Catalysts: Positive on‑chain flows, macro risk‑on triggers (e.g., BTC ETF inflows), or a broader crypto rally could fuel this move.

4. Bearish scenario

- Downside risk: If BTC fails to recapture 120,615, expect renewed selling pressure toward 115,340. A breach would target the rising trendline support around 112,000 and the low-vol POC at 108,000.

- Headwinds: Profit‑taking, regulatory concerns, or weakness in equity markets may intensify selling pressure.

5. What’s next?

Traders should watch for a sustained break and retest of 120,615 or a breakdown below 120,615. Position sizing and stop‑loss management around these pivots will be crucial as volatility tightens into the month's close.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.