Bitcoin investors sit on sidelines ‘licking their wounds’ despite 15% bounce on weekend

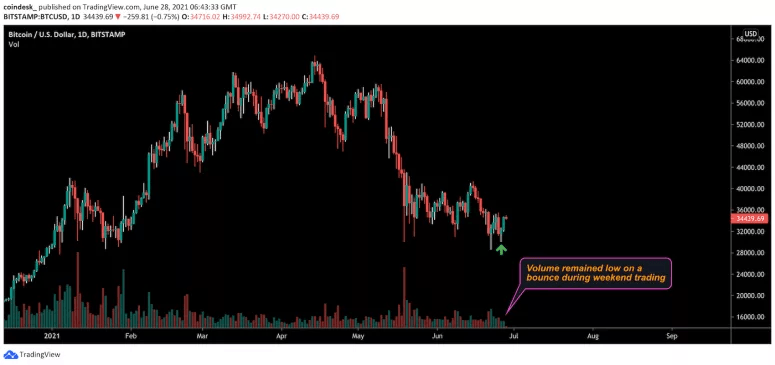

Bitcoin climbed more than 15% over the weekend as prices bounced from four-day lows after a sharp sell-off last week.

Prices Monday were slightly higher, with one bitcoin (BTC, +5.02%) fetching around $35,000 at press time, CoinDesk 20 data show. One expert said more is needed to continue driving gains in the current climate of fear, uncertainty, and doubt (FUD).

On Friday, the world’s first cryptocurrency fell more than 8% despite rallying 5% during the Asian trading session, bolstered by news of El Salvador’s confirmed date of its bitcoin law and a $30 bitcoin e-wallet airdrop.

“An unprecedented stream of FUD has resulted in bitcoin struggling to keep above water,” Jehan Chu, managing partner at Hong Kong-based crypto-investment firm Kenetic Capital told CoinDesk via Whatsapp on Monday.

Chu also said the short-term outlook remains “choppy and uncertain,” despite the recent bounce back above $34,000. “With retail investors on the sidelines licking their wounds, volumes will struggle until the next price catalyst.”

Bitcoin daily chart

Source: TradingView

Indeed, daily trading volume for bitcoin has remained low, particularly during the weekend. That’s been the trend for most of the month.

The absence of strong trading volumes points to a lack of institutional and retail interest, Chu said, citing undisclosed trading teams he has had conversations with.

Meanwhile, other notable cryptos are coasting in bitcoin’s slipstream, with ether (ETH, +10.77%) and internet computer both advancing over a 24-hour period.

In traditional markets, Asian equities were posting mainly green, with the exception of Japan’s Nikkei 225 Index Hong Kong’s Hang Seng Index and the Australian All Ordinaries Index, down by less than half a percent.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.