Bitcoin has support at $23K, but analysts warn of a dire drop to $8K as global debt unwinds

BTC’s sell-off is easing slightly, but traders are afraid that negative newsflow and future U.S. interest rate hikes could push the price lower.

Bitcoin's month-long (BTC) choppy price action came to an end on June 13 after a deep market sell-off pressed the top cryptocurrency under the $29,000 support. The move took place as equities markets also sold-off sharply, hitting their lowest levels of the year.

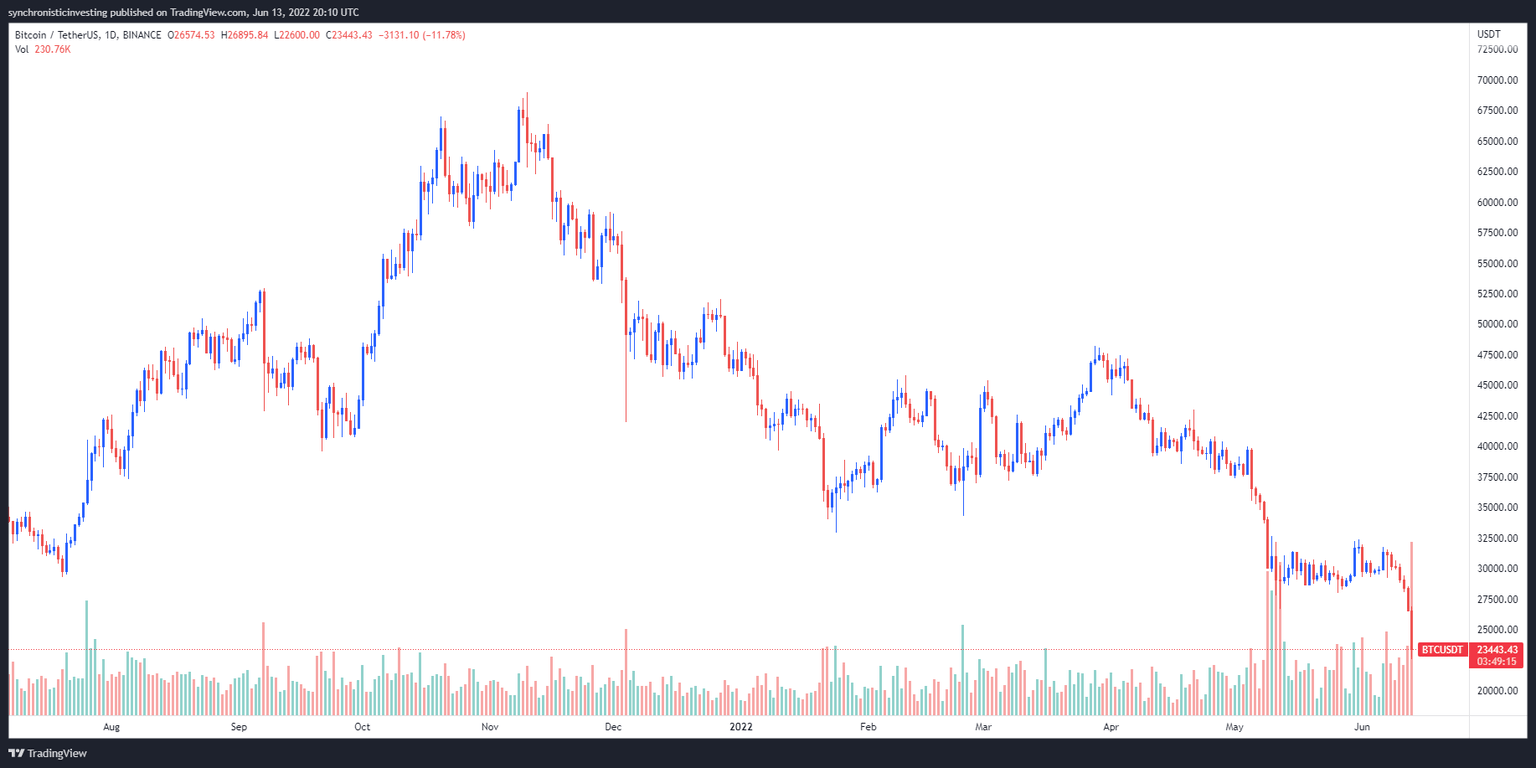

Data from Cointelegraph Markets Pro and TradingView shows that the Bitcoin sell-off began late in the day on June 12 and escalated into midday on June 13 when BTC hit a low of $22,592.

BTC/USDT 1-day chart. Source: TradingView

Here’s a look at what several market analysts are saying about Bitcoin's move lower and whether this is the final capitulation event before the long-awaited price bottom.

Is there solid support at $23,000?

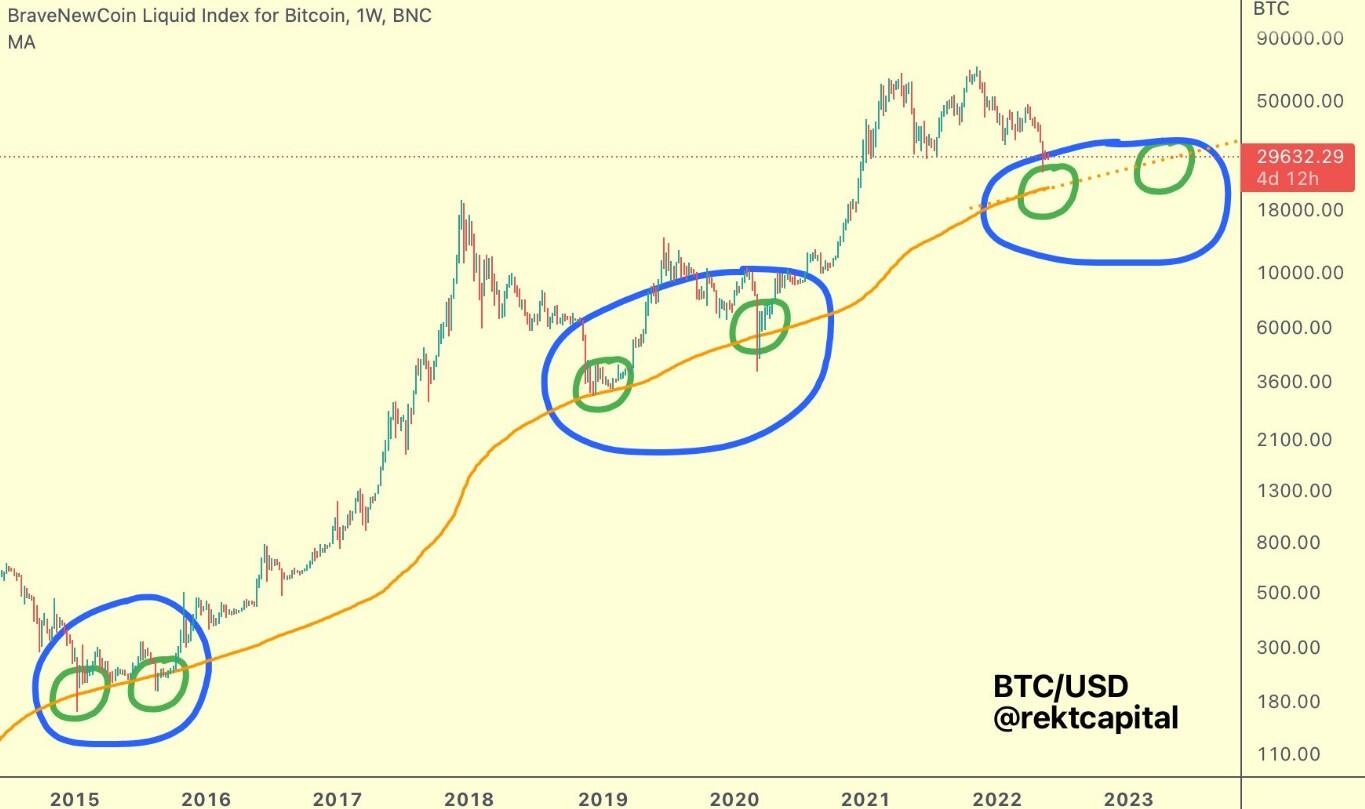

Previous instances of bear market capitulation have seen a solid level of support at Bitcoin’s 200-week moving average as shown in the following chart posted by market analyst and pseudonymous Twitter user Rekt Capital.

BTC/USD 1-week chart. Source: Twitter

Based on the trend from the last two cycles, Rekt Capital suggested that it's possible that BTC could see a “macro double bottom at the 200-week moving average” moving forward if the price action plays out in a similar fashion.

Rekt Capital said,

If so, then $BTC is very close to forming its first Macro Bottom at the 200-week MA at ~$23,000. The second Macro Bottom could form in about two years' time at a price point of ~$41,000.

Analysts say "max pain" is at $13,330

Insight into where Bitcoin could potentially be headed should it continue to break below the established support levels was provided by data from Whalemap, who posted the following chart highlighting the previously established support levels that could now flip to resistance.

Bitcoin realized price by address. Source: Twitter

Whalemap said,

#Bitcoin has broken through key realized price supports where they will likely become our new resistances. $13,331 is the ultimate max pain bottom.

In an extreme, Bitcoin could pullback to $8,000

According to Francis Hunt, a market analyst at The Market Sniper, Bitcoin price could drop to as low at $8,000 before hitting a real bottom.

BTC/USD 1-day chart. Source: Twitter

Hunt said,

The accumulation points would be $17,000 to $18,000. This $15,000 comes out of the blue head and shoulders there, that would be a pretty nasty downturn, and there is a bear flag target, a little less strong on the bear flag target at $12,000, and a full round trip will take you back to our funnel at $8,000 to $10,000.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.