Bitcoin fundamentals are at all-time highs while prices are heading to $20,000

- Bitcoin is yet to fully price in the strong fundamentals as it gains more institutional attention.

- BTC price currently trades around $18,000, targeting new all-time highs.

As Bitcoin price approaches $20,000, it becomes more likely that the ongoing rally is yet to lose momentum. Volume continues to rise as several metrics begin to see new highs. The current market behavior suggests that the $2,000 price gap to new all-time highs will be closed in the upcoming weeks.

The fundamentals look healthier than ever

Bitcoin price continues to gain traction, as its fundamentals are looking strongly bullish, and it appears that the market is yet to price in these factors fully. It is expected that this narrative would ramp up the price to new highs.

The bullishness of the present market seen in Bitcoin is different from the last bullish cycle, but the current price rally is not coincidental.

Here are some fundamentals that are already hitting a new all-time high indicative of future price surge.

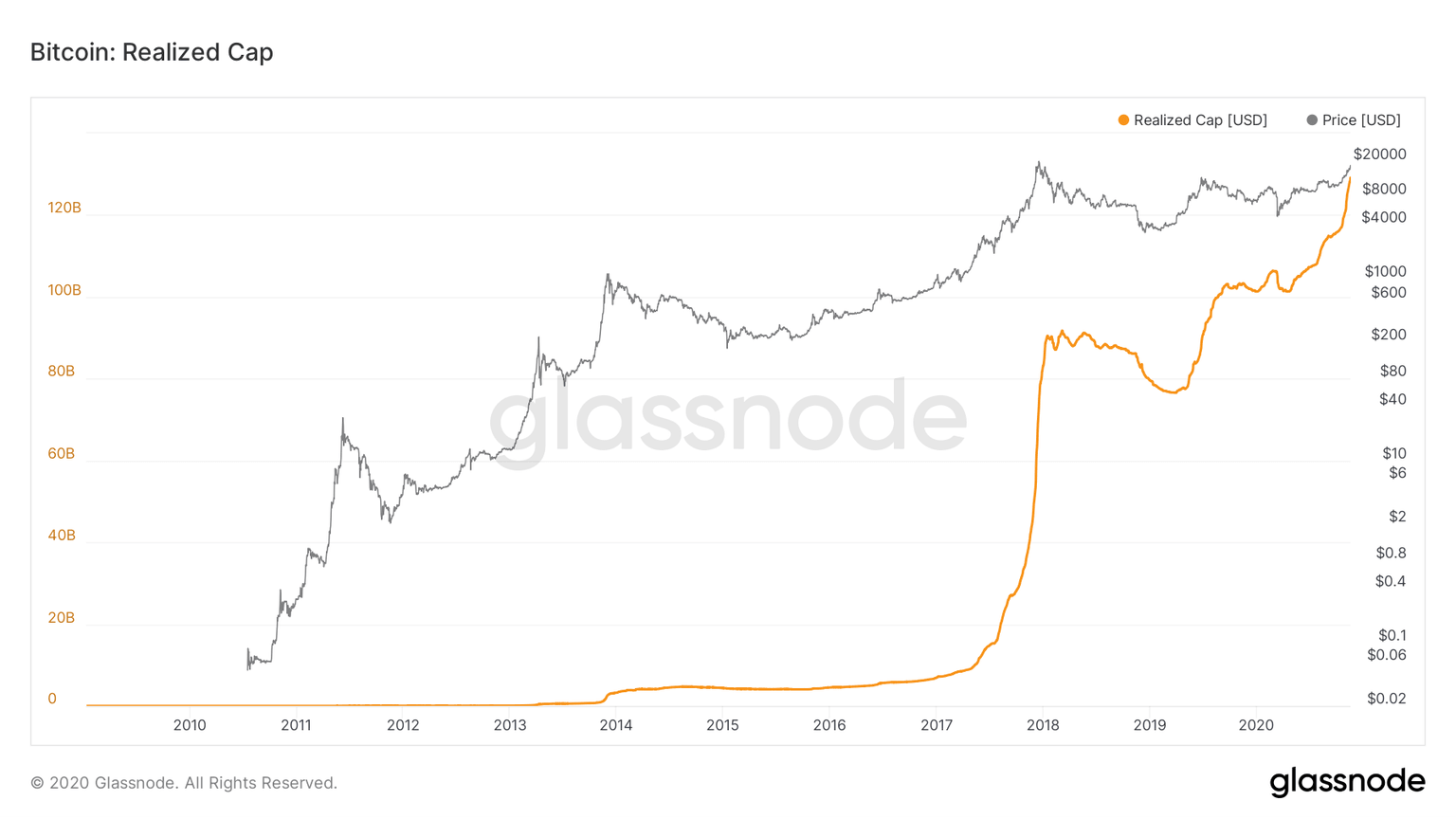

Realized capitalization: Instead of pricing, every outstanding unit of the Bitcoin in circulation at the last market price realized market cap values different parts of the supplies at different prices. This on-chain metric records the value of the digital asset at the price it was traded for.

Bitcoin Realized Capitalization

Bitcoin's liquid supply is taken into account, excluding those that haven't moved since 2009 as it did not have a market by then. The realized capitalization also confirms the bullish sentiment reflected in the market.

Addresses with a balance of $10 or more: A steady increase of this factor points to the increased adoption. It shows a growing demand for Bitcoin, especially in small portions that are consistent with retail investors. This is a good sign because it increases demand and will inevitably boost its intrinsic value.

Bitcoin Addresses With $10 or More

Sure, one address might not necessarily correspond to one person. On average, it satisfies the purpose of indicating an all-time high in the adoption of Bitcoin.

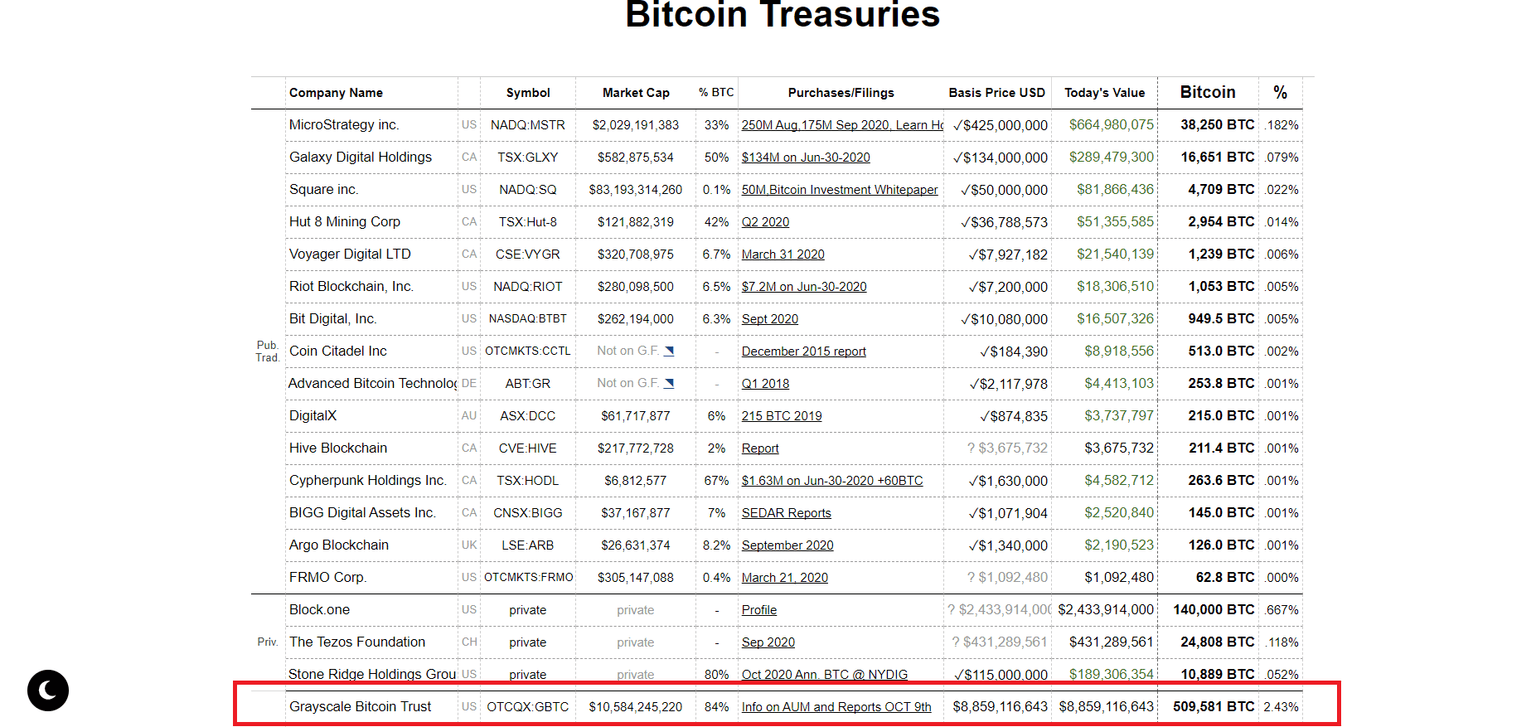

Bitcoin exposure to institutional investors: It appears the bullishness behind Bitcoin is different from the last bull market because there seems to be a more organic demand for digital assets. Institutional investors' interest will undoubtedly go a long way to drive up demand leading to further price rallies as we see the Bitcoin treasuries.

Bitcoin Treasuries

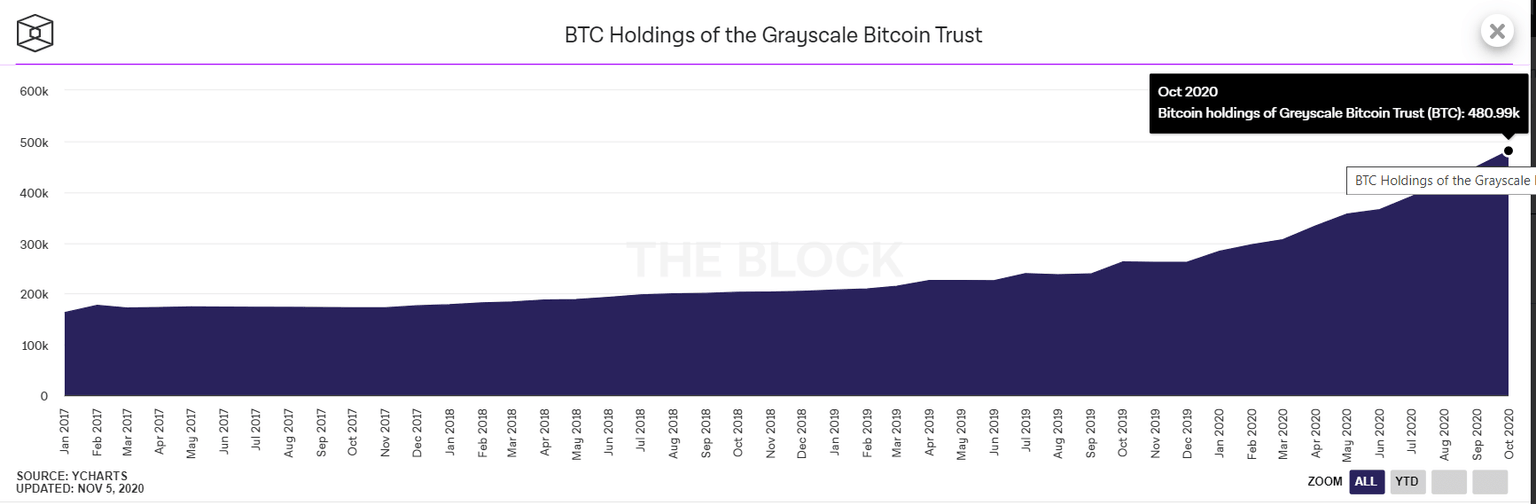

One major chart that reflects hype around Bitcoin is the number of tokens held by asset managers like Grayscale, which currently has over 500,000 BTC, worth over $9 billion. This sum amounts to 84% of the BTC publicly declared on the treasuries.

Grayscale Bitcoin Trust

Having this increase in exposure strengthens the bullish outlook. This proves that an older and less crypto-native group of investors retains a significant appetite for it.

Technicals show Bitcoin on the brink of take-off

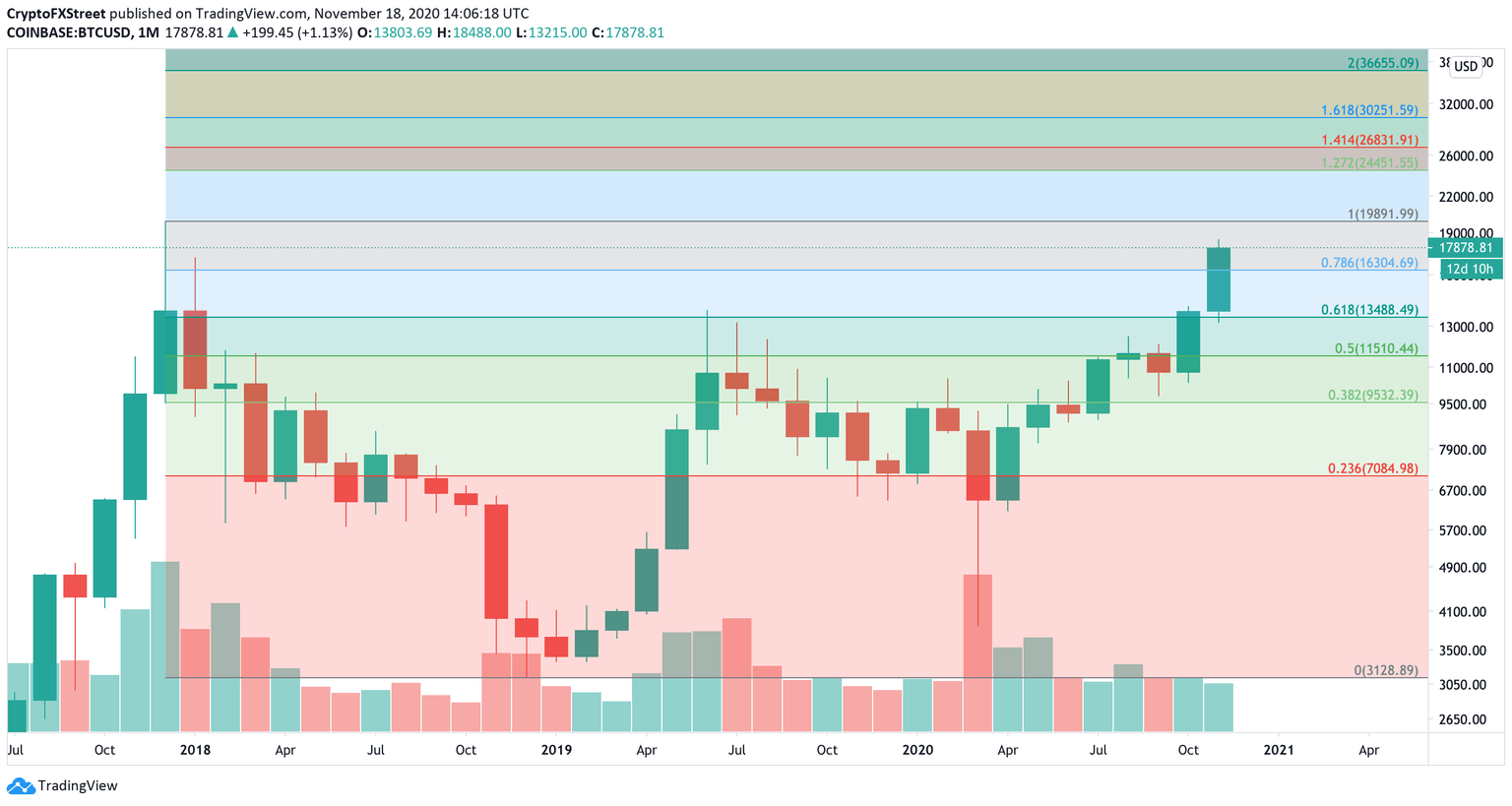

Given that the backdrop to the recent strong price performance is fundamentally strong, Bitcoin may soon slice through the $18,500 resistance and retest the previous all-time highs.

Smashing the $19,892 price hurdle will clear the path for a jump towards the 127.2% or 141.4% Fibonacci retracement levels. These important potential price targets sit at $24,500 and $26,830, respectively.

BTC/USD Monthly cChart

Failing to break through the overhead resistance may lead to a correction to the 78.6% or 61.8% Fibonacci retracement levels. These support zones are hovering around $16,300 and $13,500, respectively.

Author

FXStreet Team

FXStreet