Bitcoin price aiming for $20,000 by the end of November as it hits a market capitalization all-time high

- Bitcoin price is currently $17,677 after another massive 8% price explosion in the past 24 hours.

- The flagship cryptocurrency is aiming for a new all-time high as it is facing very little resistance to the upside.

The current bull rally of Bitcoin seems unstoppable as most indicators remain bullish and on-chain metrics show virtually no opposition towards $20,000. At this pace, reaching a new all-time high by the end of November is realistic.

Bitcoin hits a market capitalization of $328 billion for the first time ever

Due to the increase in the supply of Bitcoin, the flagship cryptocurrency has just set a new all-time high when it comes to market capitalization at $328 billion compared to the last high at $324 billion in December 2017.

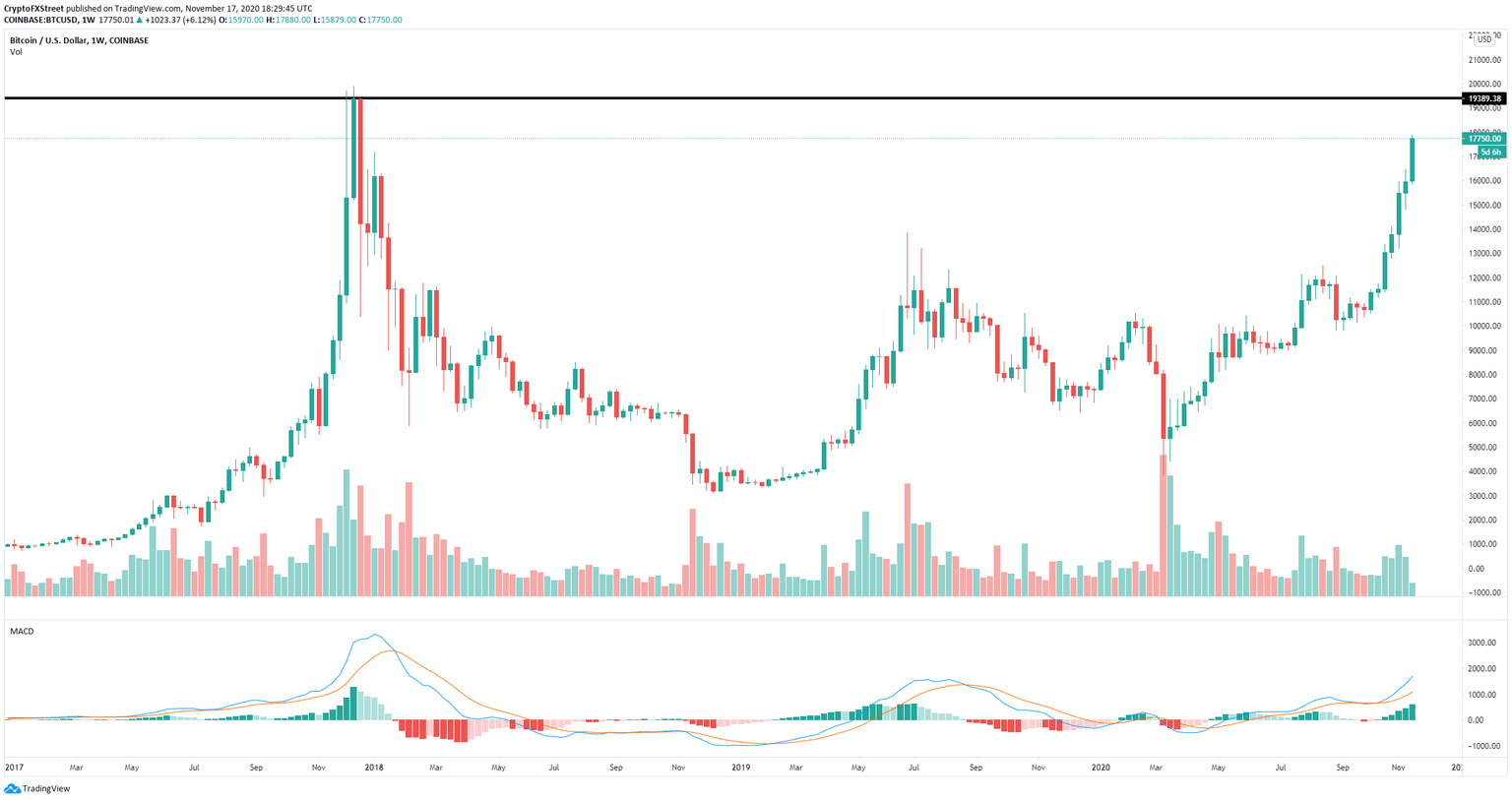

BTC/USD weekly chart

The weekly chart shows basically no resistance levels until perhaps $19,400. The MACD remains bullish and gaining momentum just like it did back in December 2017. The interest in the digital asset is also growing significantly over the past few months.

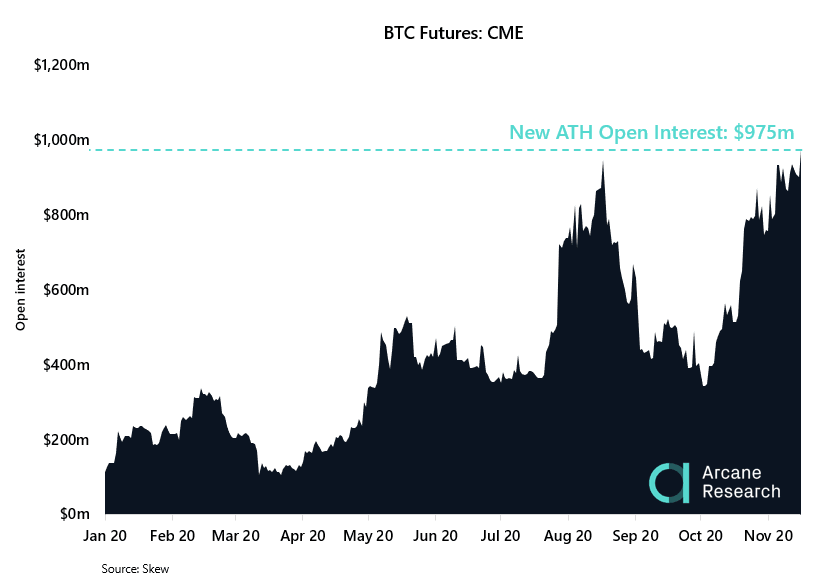

BTC Futures CME chart

The open interest for CME’s Bitcoin futures has just hit a new all-time high at $975 million, on the verge of surpassing $1 billion this week. This metric shows institutional interest in the flagship cryptocurrency despite the price being so high.

#Bitcoin is still small when you compare it to the M1 money supply of major currencies.

— ecoinometrics (@ecoinometrics) November 16, 2020

But it might only take #BTC a couple more halving cycles to rise towards the top and compete at least with gold.

More on that here https://t.co/LNpOiA6aDU pic.twitter.com/GUUW7Yw2Ro

A tweet posted by Ecoinometrics shows how Bitcoin is still undervalued despite the massive increase in market capitalization. The post compares BTC to other currencies and it states that the flagship cryptocurrency doesn’t pose any threat to other major global currencies with its current size.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.