Bitcoin Falls to Fresh Lows Amid Google Push into Financial Services

Bitcoin sank to its lowest levels since October 25th in Tuesday trading, dipping below the $8,000 level. The world’s leading cryptocurrency may have been rattled by news of Google’s entry into the financial services business with its new project, code-named Cache. Last Wednesday, the search giant announced plans to offer ‘smart’ checking accounts to customers as soon as next year. Google has partnered with Citigroup to develop the checking accounts which will be linked to the Google Pay app.

Google Cache aims to provide useful insights and budgeting tools to customers, while keeping their money in an FDIC or NCUA-insured account. Google executive Caesar Sengupta told the Wall Street Journal;

“If we can help more people do more stuff in a digital way online, it’s good for the internet and good for us.”

He added that the company is not planning on selling the financial data of its checking account users.

Meanwhile, Bitcoin evangelists dismiss Google Cache as a threat, insisting that the project will not undermine the need for a decentralized global currency. Digital asset strategist Gabor Gurbacs at VanEck expressed his doubts over the threat to Bitcoin on Twitter:

“When big banks, big tech and big governments join forces on controlling money, then only one realizes the true need for sound money. #Bitcoin and #gold have never been more important in monetary history.”

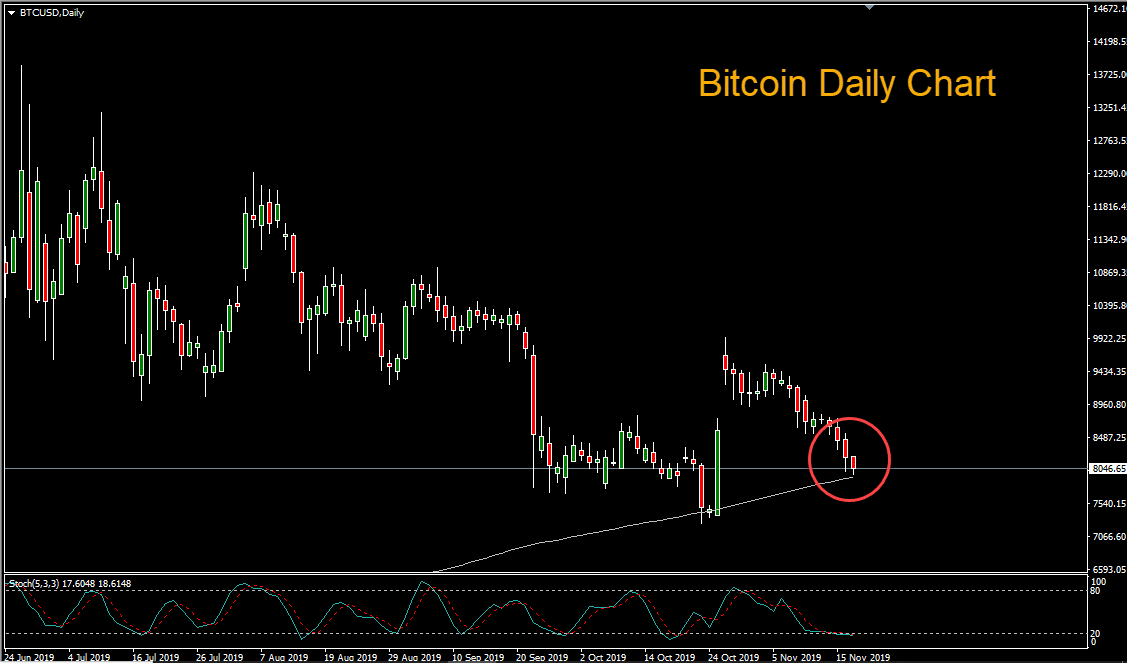

Looking at the Bitcoin daily chart we can see price has fallen to the ‘line in the sand’ 200 period simple moving average. The next level of potential support stands at the prior low of 7,731.

Author

Dan Blystone

TradersLog.com

Experience Dan Blystone began his career in the trading industry in 1998. He worked as an arb clerk on the floor of the Chicago Mercantile Exchange (CME), flashing orders into the currency futures pits.