Bitcoin falls to 97k as Google’s Willow fuels concerns, where next for BTC?

-

Bitcoin remains below the 100k milestone.

-

Profit taking & liquidations.

-

Will Willow break BTC?

-

Bitcoin bullish momentum is fading.

Bitcoin has fallen away from the key 100K milestone reached last week, dropping to a low of 94K on Monday. At the time of writing, BTC trades at 97.7 K. The largest cryptocurrency by market cap has fallen amid profit-taking and security concerns following Google's quantum computing developments.

Bitcoin has struggled to move meaningfully past 100K amid high levels of profit taking at that key milestone. Long-term holders (LTH) have been selling as their profits have ballooned after the price surge. According to CryptoQuant, LTHs are sitting on an average profit of 326%.

With the recent move lower, total liquidations rose above $1.7 billion as 583,530 traders were wiped out over the past 24 hours. Of these, $1.552 billion were long positions, and $154.59 were short positions. Massive liquidation events can mark a floor for the price.

Will Willow break BTC?

News of Google unveiling its quantum computing chip, Willow, has added to weak market sentiment. The chip is the latest development in quantum computing, which claims to take minutes to solve a problem that would take the world's fastest supercomputers 10 septillion years to complete.

Unlike traditional computers and chips, which can’t crack cryptographic algorithms that safeguard Bitcoin networks and wallets, quantum computers could breach this security. This makes them potentially an existential threat to Bitcoin encryption. However, the technology is still in development, and while Willow is a huge step forward, experts say it is still far from being able to penetrate Bitcoin security. While the technology may still be some years away from doing this, its existence highlights the need to develop quantum-resistant BTC.

Caution could remain ahead of a busy week for data as the market continues to weigh up uncertainty surrounding the Fed’s outlook for interest rates next year.

Wednesday sees the release of US CPI, Thursday US PPI and jobless claims. These releases will be released next week before the FOMC rate decision. The market is pricing in an 85% chance of a 25 basis point rate cut. A lower interest rate environment is more beneficial for risk assets such as Bitcoin given the higher levels of liquidity.

Where next for Bitcoin?

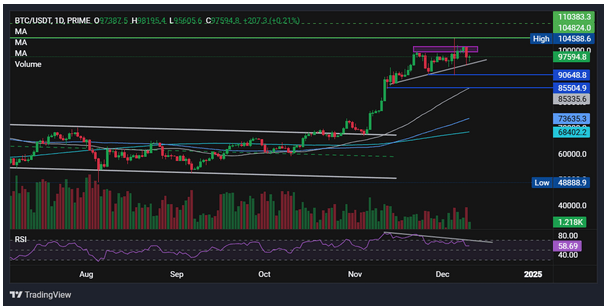

After breaking out of its 7-month falling channel, BTC/USD has continued to trend higher, trading above its rising trendline and 20 SMA.

However, the price has failed to hold above 100k, falling sharply lower. Buyers could be encouraged by the long, lower wicks on recent candles, suggesting selling pressure was weaker at the lower price levels. Buyers will look to make another attempt at 100k ahead of 103.6k and fresh ATHs.

However, the RSI bearish divergence suggests that the uptrend could be losing steam, and a down move could take place. Sellers are testing the 20 SMA. A break below here opens the door to 94k, the rising trendline support, and 92k, the November 26 low. A break below here creates a lower low and opens the door to 85k, the November 12 low.

Start trading with PrimeXBT

Start trading with PrimeXBT

Author

Matthew Hayward

PrimeXBT

Matthew Hayward is a Senior Market Analyst at PrimeXBT, a global cryptocurrency broker. He has over five years of expertise in both Fundamental and Technical Analysis, focusing on Cryptocurrency, Foreign Exchange, Indices, and Commodities.